More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Small business health insurance provides vital coverage for your employees while helping your company attract and retain top talent. A quality small business plan offers comprehensive healthcare benefits that protect your team’s wellbeing, improve workplace productivity, and may provide tax advantages for your business.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right small business health insurance requires understanding your company’s specific needs and navigating various coverage options. Our local expertise helps business owners discover coverage that balances quality care with affordability while meeting employer requirements.

Why Choose Us for Your Small Business Health Coverage

Selecting health insurance for your business involves considering multiple factors including budget constraints, employee needs, and compliance requirements. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service for small business owners.

1. Business-Focused Guidance

We understand that every small business has unique healthcare needs and budget considerations. Our team helps you evaluate plans based on your company's specific situation, including workforce demographics, industry requirements, and business goals. We explain options clearly without insurance jargon, ensuring you understand exactly what coverage your business will receive.

2. Local Business Healthcare Knowledge

As small business supporters ourselves in Queen Creek and San Tan Valley, we know the local healthcare landscape for employers. We can tell you which plans work well with preferred provider networks in our area and what other local businesses similar to yours typically choose. This local insight helps your company offer healthcare options that truly work for your Arizona-based team.

3. Continuous Business Support

Our service relationship extends well beyond enrollment. As your business grows and changes, your insurance needs evolve too. We provide ongoing support for adding new employees, managing plan renewals, answering claims questions, and helping you maximize your business benefits year-round.

4. Customized Business Coverage

Small business health insurance through our agency gives you the flexibility to select coverage that accommodates your company's needs. Whether you're a startup with just a few employees or an established business with several dozen team members, we help you find plans that address your specific business profile and employee requirements.

5. Streamlined Business Enrollment

Our efficient application process reduces paperwork and confusion, especially important for busy business owners. We guide you through enrollment step-by-step, ensuring your company and employees gain coverage without delays or complications that could impact your operations.

6. Round-the-Clock Business Assistance

Small business owners need support at all hours. Our support team remains available whenever you need help understanding coverage options, addressing employee benefits questions, or managing urgent insurance issues that affect your business.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Small Business Health Insurance

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Small Business Plans

- Group purchasing power: Access to group rates often unavailable to individuals

- Comprehensive coverage options: Plans ranging from basic to premium coverage

- Tax advantages: Potential tax benefits for businesses offering health coverage

- Employee retention tool: Valuable benefit that helps attract and retain talent

- Contribution flexibility: Options for how much the business contributes toward premiums

- Administrative support: Assistance with enrollment and plan management

Types of Small Business Health Insurance Plans

Different plan structures offer various advantages for small businesses:

Group Health Insurance Plans

- Traditional employer-sponsored coverage

- Available to businesses with at least one employee (not including the owner or spouse)

- Various plan types available (HMO, PPO, EPO, POS)

- Employer typically contributes toward employee premiums

- May offer significant tax advantages for businesses

- Provides consistent coverage across your workforce

Qualified Small Employer Health Reimbursement Arrangement (QSEHRA)

- Available to businesses with fewer than 50 full-time employees

- Allows employers to reimburse employees for individual health insurance

- Tax-free benefit for employees

- Gives employees freedom to choose their own coverage

- Predictable costs for employers

- No minimum contribution requirements

Small Group Health Options Program (SHOP)

- Marketplace plans specifically for small businesses

- Available to employers with 1-50 full-time equivalent employees

- Possible tax credits for eligible employers

- Employee choice models available

- Side-by-side comparison of plan options

- Standardized benefits within coverage levels

Association Health Plans (AHPs)

- Allows small businesses to band together to purchase insurance

- Creates larger risk pools potentially lowering costs

- Available to small employers in similar industries or geographic areas

- Multiple plan options typically available

- May provide coverage across state lines in some cases

- Offers small businesses some of the advantages of larger group plans

Arizona Small Business Health Insurance Marketplace

Small businesses in Arizona have multiple options for providing health coverage to employees.

Business Enrollment Periods

Small Business Enrollment

Unlike individual health insurance, small businesses can typically enroll in group health plans at any time during the year. This flexibility allows you to:

- Start coverage based on your business needs

- Align health benefits with your fiscal year

- Add new coverage when your business is ready

- Make changes during your annual renewal period

Employee Waiting Periods

Most small business plans allow you to establish a waiting period before new employees become eligible for benefits:

- Typical waiting periods range from 0-90 days

- Must be applied consistently to all employees

- Cannot exceed 90 days under ACA regulations

- Can align with your probationary periods

Small Business Plan Categories

Small business health insurance follows similar metal category systems as individual plans:

Bronze Business Plans

- Lowest monthly premiums

- Highest employee deductibles and out-of-pocket costs

- Insurance covers a smaller portion of healthcare costs

- Employees pay more when services are used

- Suitable for businesses with tight budgets seeking basic coverage

Silver Business Plans

- Moderate monthly premiums

- Moderate employee deductibles and out-of-pocket costs

- Balanced cost-sharing between insurance and employees

- Popular choice for small businesses

- Good balance of coverage and affordability

Gold Business Plans

- Higher monthly premiums

- Lower employee deductibles and out-of-pocket costs

- Insurance covers a larger portion of healthcare costs

- Employees pay less when services are used

- Attractive offering for employee recruitment and retention

Platinum Business Plans

- Highest monthly premiums

- Lowest employee deductibles and out-of-pocket costs

- Insurance covers the largest portion of healthcare costs

- Employees pay minimal amounts when services are used

- Premium offering for businesses competing for top talent

Understanding Small Business Health Insurance Costs

Small business health insurance involves several types of costs that affect your company budget:

Business Premiums

Premiums are the monthly amount paid to maintain coverage for your business. These costs are typically shared between the employer and employees according to the contribution strategy you choose. Premium costs vary based on:

- Plan type and coverage level

- Industry classification

- Employee demographics

- Location

- Number of employees enrolled

- Coverage tier selection (employee-only, employee-plus-spouse, family coverage)

Employer Contribution Strategies

Small businesses have flexibility in how they contribute toward employee premiums:

- Percentage-based contributions (paying a percentage of each employee’s premium)

- Flat dollar amounts (contributing the same amount toward each employee’s coverage)

- Tiered contributions (varying amounts based on employment status or position)

- Salary-based contributions (contributions proportional to employee compensation)

Employee Cost-Sharing

Employees typically share in the costs of healthcare through:

- Premium contributions (payroll deductions for their portion of monthly premiums)

- Deductibles (amount paid before insurance begins covering services)

- Copayments (fixed amounts paid for specific services)

- Coinsurance (percentage of costs paid after meeting deductibles)

- Out-of-pocket maximums (limit on total employee spending for covered services)

Business Deductibles

Group plans include deductibles that employees must meet before insurance coverage begins. Plans with lower premiums typically have higher deductibles, while plans with higher premiums usually offer lower deductibles.

Annual Out-of-Pocket Maximums

These caps limit the total amount employees will pay for covered services during the plan year, providing financial protection against catastrophic medical expenses.

Tax Advantages for Small Businesses

Offering health insurance can provide significant tax benefits for small businesses.

Business Premium Tax Deductions

Small businesses can typically deduct health insurance premiums paid for employees as a business expense, reducing overall taxable income for the company.

Small Business Health Care Tax Credits

Some small businesses may qualify for tax credits to help offset the cost of providing health insurance. Eligibility factors include:

- Number of full-time equivalent employees

- Average employee salary

- Employer premium contributions

- Coverage purchased through the SHOP Marketplace

Pre-Tax Employee Contributions

When employees pay their portion of premiums with pre-tax dollars, both the business and employees can save on payroll taxes, creating a win-win situation.

Health Savings Account (HSA) Benefits

Pairing high-deductible health plans with HSAs can provide tax advantages for both employers and employees, including:

- Tax-deductible contributions for employees

- Tax-free growth of HSA funds

- Tax-free withdrawals for qualified medical expenses

- Potential employer contribution tax advantages

Small Business Health Insurance Requirements

Understanding the legal requirements for small business health insurance helps ensure compliance:

Affordable Care Act (ACA) Requirements

- Businesses with fewer than 50 full-time equivalent employees are not required to offer health insurance

- Businesses with 50+ full-time equivalent employees must provide affordable, minimum value coverage or face potential penalties

- All plans must cover essential health benefits if offering coverage

- No discrimination based on health status or pre-existing conditions

- Coverage must be offered to all eligible full-time employees

Annual Reporting Requirements

Depending on your business size and plan type, you may need to:

- Provide employees with Form 1095-B or 1095-C

- File Forms 1094 and 1095 with the IRS

- Report health coverage values on W-2 forms

- Submit other plan-specific reporting

Essential Health Benefits for Small Business Plans

All small group health plans must cover ten essential health benefits:

- Ambulatory patient services (outpatient care)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Laboratory services

- Preventive services and chronic disease management

- Pediatric services, including dental and vision care

These benefits ensure your employees receive comprehensive coverage for their healthcare needs.

Choosing the Right Small Business Plan

Selecting appropriate health insurance for your small business requires careful consideration:

Assess Your Business Needs

- Company size and budget

- Employee demographics and healthcare needs

- Industry-specific requirements

- Competitive landscape for talent attraction

- Geographic distribution of workforce

- Business growth projections

Evaluate Total Business Costs

Consider both immediate and long-term expenses:

- Monthly premium expenses

- Administrative costs

- Potential tax benefits

- Employee turnover costs without benefits

- Productivity impacts of healthcare access

- Future rate increase projections

Check Provider Networks

Verify that provider networks work for your employee base:

- Geographic coverage in employee residential areas

- Key hospitals and medical facilities

- Specialist availability for specific health concerns

- Pharmacy networks for convenience

- Telehealth and virtual care options

Compare Business-Specific Benefits

Look beyond basic coverage to understand:

- Wellness program availability

- Employee assistance programs

- Disease management services

- Family-friendly benefits

- Retirement plan integration possibilities

Implementing Your Small Business Health Plan

Successfully launching and managing your small business health plan involves several key steps:

Plan Introduction

Properly introducing your health plan to employees:

- Host informational meetings explaining coverage details

- Provide clear enrollment instructions and deadlines

- Explain the value of benefits you’re offering

- Create accessible resources for ongoing questions

- Consider bringing in insurance professionals to explain benefits

Enrollment Management

Effectively managing the enrollment process:

- Collect necessary employee information

- Assist with application completion

- Verify dependent eligibility documentation

- Track enrollment status

- Address employee questions and concerns

Ongoing Administration

Managing your plan throughout the year:

- Process employee changes (new hires, terminations, life events)

- Manage premium payments

- Distribute required notices

- Assist with claims questions

- Coordinate with insurance carriers

Annual Renewal

Preparing for yearly plan renewals:

- Review plan performance and usage

- Analyze any premium changes

- Evaluate alternative options if needed

- Communicate changes to employees

- Process renewal paperwork

Ready to Find the Right Coverage?

Don’t navigate health insurance alone. Our experienced agents can help you find the perfect plan for your needs and budget.

- Get a free personalized quote today

- Schedule a no-pressure consultation with our experts

- Have questions? Call us at +123456789

Our help comes at no extra cost to you. Let us make health insurance simple!

FAQS

Frequently asked questions

Most insurance carriers offer small group health insurance to businesses with at least one W-2 employee who isn't the owner or owner's spouse. Some states or insurance carriers may have different minimum requirements. Our team can help determine your eligibility based on your specific business structure.

Generally, you must offer coverage consistently to all employees in similar situations. You can establish eligibility criteria based on objective factors like full-time/part-time status or length of employment, but you cannot discriminate based on health status, age, or other protected characteristics. All criteria must be applied uniformly.

Small group health insurance typically applies to businesses with 1-50 employees (though some states extend this to 100). Small group plans must cover essential health benefits and follow community rating rules that limit how much premiums can vary. Large group plans (for businesses with 51+ employees) have different pricing structures and more flexibility in benefit design.

Small business health insurance costs vary widely based on location, employee demographics, coverage level, and contribution strategy. Rather than focusing on average costs (which may not apply to your situation), we recommend requesting a personalized quote based on your specific business details. Our team can help you explore options at different price points.

Yes, many small businesses offer employee choice models where employees can select from multiple plan options. This allows employees to choose coverage that best fits their individual needs. Employers can establish different contribution amounts for different plans while still meeting non-discrimination requirements.

A Section 125 Plan (Cafeteria Plan) allows employees to pay their portion of health insurance premiums with pre-tax dollars. This reduces both employee and employer tax burdens, as these contributions aren't subject to federal income tax, Social Security, and Medicare taxes. Implementing a Section 125 Plan requires proper documentation but can provide significant tax savings.

No, employers typically share premium costs with employees. While there's no universal requirement for how much employers must contribute, many carriers require a minimum employer contribution (often around 50% of employee-only premiums). Different contribution strategies allow you to balance cost control with offering attractive benefits.

Employees can waive coverage if they have other options (like coverage through a spouse's plan). They should complete a waiver form documenting their decision. Depending on your carrier's requirements, you may need a certain percentage of eligible employees to enroll. Our team can explain participation requirements that apply to your situation.

Yes, you can offer coverage to part-time employees, though you're not required to do so. Many employers establish minimum hour requirements (like 20 or 30 hours weekly) for benefits eligibility. You can set different contribution amounts for part-time versus full-time workers as long as you apply these rules consistently.

Most businesses establish a waiting period before new employees become eligible for health benefits. This waiting period (typically 30-90 days) must be applied consistently to all new hires in similar positions. Once employees satisfy the waiting period, they become eligible to enroll outside of the normal open enrollment period.

Take the Next Step for Your Business's Health Plan

Finding the right small business health insurance provides both comprehensive healthcare for your team and strategic advantages for your company. Our local team in Queen Creek and San Tan Valley specializes in guiding small business owners through their coverage options. We provide:

- Free business plan consultations and comparisons

- Assistance with employer contribution strategies

- Employee enrollment support and education

- Year-round business insurance customer service

- Local expertise with Arizona small business regulations

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

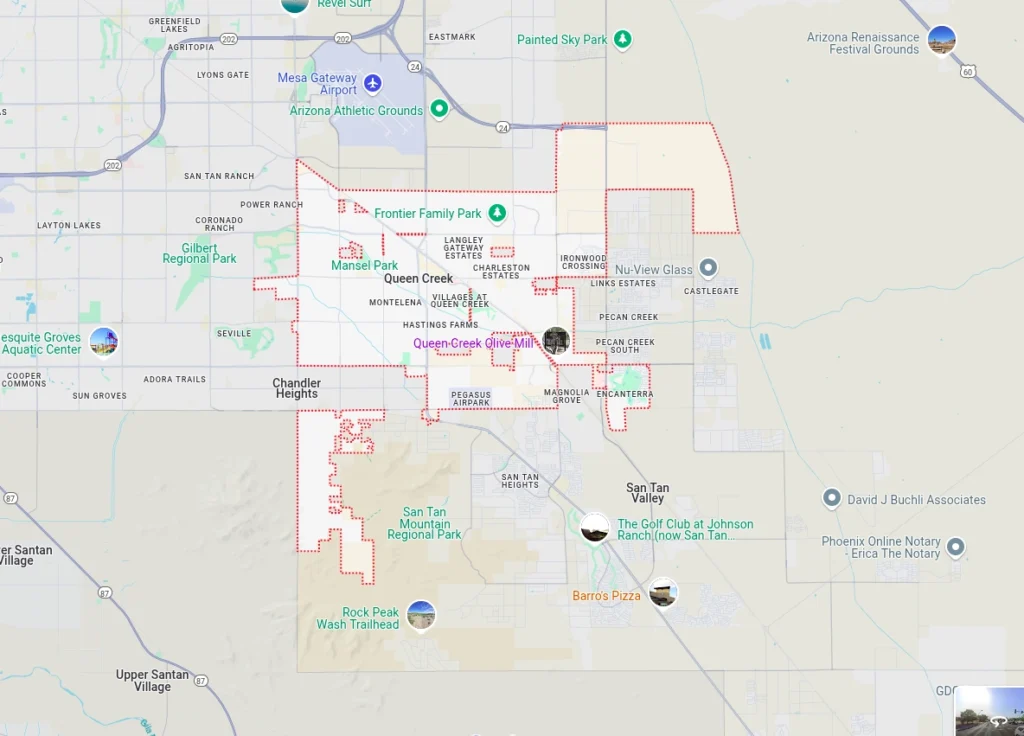

Proudly Assisting

Our Service Area

The Health Insurance Jedi proudly serves small businesses seeking health insurance solutions throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s small business healthcare landscape and local provider networks ensures your company receives coverage that works for your business and employees. Contact us today to discover how we can help protect your business and team with the right health insurance solution.