More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Short-term health insurance provides temporary medical coverage designed to bridge gaps between permanent health insurance plans. These flexible plans offer essential protection during transitional periods, job changes, or other life circumstances when you need immediate coverage but don’t qualify for traditional health insurance options.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right short-term health insurance requires understanding your temporary coverage needs and exploring options that provide adequate protection during your transition period. Our local expertise helps individuals and families discover short-term coverage that offers essential benefits while you work toward permanent insurance solutions.

Why Choose Us for Your Short-Term Health Insurance

Selecting the right short-term coverage involves understanding policy limitations, coverage periods, and benefit structures unique to temporary insurance. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on finding you appropriate short-term protection.

1. Short-Term Insurance Expertise

We understand that short-term health insurance serves specific purposes and has unique characteristics different from traditional coverage. Our team helps you evaluate plans based on your temporary needs, including coverage duration, benefit levels, and transition planning. We explain short-term options clearly without confusing jargon, ensuring you understand exactly what each plan offers and its limitations.

2. Local Short-Term Coverage Knowledge

As Arizona residents ourselves living in Queen Creek and San Tan Valley, we know the local short-term insurance market thoroughly. We can tell you which carriers offer short-term plans in our area, what coverage options are available, and how to maximize your benefits during your temporary coverage period. This local insight helps you select protection that works in our community.

3. Continuous Short-Term Support

Our service relationship extends throughout your short-term coverage period. As your transition progresses, we provide ongoing support for extending coverage, managing claims, finding providers, and helping you transition to permanent insurance when you're ready.

4. Customized Temporary Solutions

Short-term health insurance through our agency gives you flexibility to select coverage that fits your specific transitional situation. Whether you need coverage between jobs, during school breaks, or while waiting for other insurance to begin, we help you find short-term plans that address your immediate healthcare needs.

5. Streamlined Short-Term Enrollment

Our efficient application process makes obtaining short-term coverage quick and straightforward. We guide you through the enrollment process, explain policy terms, and ensure you get the temporary coverage you need without unnecessary delays.

6. Round-the-Clock Short-Term Assistance

Questions about your short-term coverage don't wait for business hours. Our support team remains available whenever you need help understanding your policy, finding providers, or addressing urgent questions about your temporary insurance.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Short-Term Health Insurance

Short-term health insurance provides temporary medical coverage designed for specific transitional periods. These plans offer basic protection against unexpected medical expenses while you’re between permanent insurance options, making them ideal for bridging coverage gaps.

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Short-Term Plans

- Temporary coverage periods: Available for specific durations with renewal options

- Quick enrollment: Often available with immediate or next-day coverage

- Essential medical benefits: Basic protection for accidents, illnesses, and emergencies

- Lower premiums: Generally cost less than traditional comprehensive plans

- Medical underwriting: Health questions determine eligibility and rates

- Nationwide coverage: Protection while traveling or temporarily relocating

Types of Short-Term Coverage Options

Different short-term plan structures serve various temporary needs:

Basic Short-Term Plans

- Essential coverage for accidents and sudden illnesses

- Emergency room and urgent care benefits

- Hospital stays and surgical procedures

- Some outpatient services and diagnostic tests

- Limited prescription drug coverage

- Suitable for healthy individuals needing basic protection

Enhanced Short-Term Plans

- More comprehensive coverage than basic plans

- Broader range of medical services

- Better prescription drug benefits

- Preventive care may be included

- Higher coverage limits for various services

- Good for those wanting more extensive temporary protection

Renewable Short-Term Plans

- Option to extend coverage for longer periods

- Ability to renew without reapplying in some cases

- Continuity of coverage during extended transitions

- May offer rate stability during renewal periods

- Suitable for longer-term temporary situations

- Provides flexibility for uncertain timeframes

Travel-Focused Short-Term Plans

- Coverage designed for temporary relocation

- International or multi-state benefits

- Emergency medical evacuation coverage

- Travel-related medical benefits

- Suitable for students studying abroad or temporary workers

- Protection during extended travel periods

Arizona Short-Term Insurance Regulations

Arizona allows short-term health insurance with specific regulations governing these temporary plans.

Short-Term Plan Availability

Coverage Duration Options Short-term plans in Arizona typically offer:

- Initial coverage periods of varying lengths

- Renewal options for extended protection

- Maximum total coverage periods as allowed by law

- Flexibility to match your specific timeline needs

- Options for immediate or future effective dates

Enrollment Requirements Short-term insurance enrollment involves:

- Medical questionnaires about current health

- Quick approval process for most applicants

- No waiting for open enrollment periods

- Immediate coverage for approved applications

- Simple online or phone application processes

Short-Term Plan Limitations

Coverage Exclusions Short-term plans typically don’t cover:

- Pre-existing medical conditions

- Maternity and pregnancy-related care

- Mental health and substance abuse treatment

- Prescription drug coverage (limited if included)

- Preventive care and routine check-ups

- Some chronic condition management

Regulatory Considerations Short-term insurance has specific characteristics:

- Not considered minimum essential coverage under ACA

- May not meet individual mandate requirements

- State regulations govern availability and terms

- Consumer protections differ from traditional insurance

- Important to understand limitations before purchasing

Understanding Short-Term Plan Costs

Short-term health insurance involves cost structures designed for temporary coverage needs:

Short-Term Premiums

Premium costs for short-term plans depend on:

- Your age, health status, and location

- Coverage duration and benefit levels

- Deductible and out-of-pocket amounts chosen

- Medical underwriting results

- Plan type and carrier selected

- Additional benefits or riders included

Cost-Sharing Structures

Short-term plans typically include:

- Deductibles that must be met before coverage begins

- Copayments for certain covered services

- Coinsurance percentages for various treatments

- Out-of-pocket maximums for protection

- Different costs for different types of services

- Network versus non-network provider costs

Budget Considerations

When evaluating short-term plans, consider:

- Monthly premium costs during coverage period

- Potential out-of-pocket expenses if you need care

- Coverage gaps that might require separate payments

- Costs of extending or renewing coverage

- Transition costs to permanent insurance later

- Budget for services not covered by the plan

Value Comparison

Short-term insurance offers value through:

- Lower premiums than comprehensive plans

- Protection against major medical expenses

- Peace of mind during transition periods

- Flexibility in coverage duration

- Quick access to medical care when needed

- Cost-effective bridge to permanent coverage

Short-Term Plan Benefits and Services

Short-term health insurance focuses on essential medical coverage during temporary periods:

Medical Coverage Included

Most short-term plans cover:

- Emergency room visits and emergency care

- Hospital stays for sudden illnesses or injuries

- Surgical procedures when medically necessary

- Ambulance services in emergency situations

- Urgent care visits for immediate needs

- Diagnostic tests and imaging when required

Additional Services

Many short-term plans provide:

- Physician office visits for covered conditions

- Specialist consultations when referred

- Laboratory tests and blood work

- Outpatient procedures and treatments

- Prescription drugs (limited coverage)

- Medical equipment and supplies

Provider Networks

Short-term insurance typically offers:

- Access to established provider networks

- In-network and out-of-network benefits

- Nationwide coverage for travel

- Emergency care anywhere in the United States

- Online provider directories

- 24/7 customer service for provider questions

Claim Processing

Short-term plans feature:

- Streamlined claims procedures

- Online claims submission options

- Direct payment to providers in many cases

- Quick claims processing times

- Customer service support for claims questions

- Clear explanation of benefits statements

Choosing the Right Short-Term Plan

Selecting appropriate short-term health insurance requires evaluating your specific temporary needs:

Assess Your Coverage Duration

Determine how long you need coverage:

- Length of gap between permanent insurance

- Timeline for starting new employment

- Duration of school breaks or transitions

- Travel or relocation periods

- Other life circumstances requiring temporary coverage

- Flexibility needed for uncertain timelines

Evaluate Your Health Needs

Consider your current health situation:

- Overall health status and any ongoing conditions

- Medications you take regularly

- Likelihood of needing medical care during coverage period

- Preferred doctors or hospitals

- Risk tolerance for coverage gaps

- Budget for potential medical expenses

Compare Plan Options

When reviewing short-term plans, examine:

- Coverage levels for different medical services

- Deductible amounts and out-of-pocket maximums

- Provider network size and locations

- Prescription drug coverage if offered

- Renewal options and terms

- Customer service and support quality

Understand Plan Limitations

Be fully aware of what’s not covered:

- Pre-existing condition exclusions

- Routine and preventive care

- Maternity and pregnancy-related services

- Mental health and substance abuse treatment

- Long-term care or rehabilitation

- Coverage caps or benefit limits

Short-Term Insurance Application Process

Getting short-term coverage involves a straightforward application process:

Medical Underwriting

Short-term applications typically include:

- Health questionnaire about current conditions

- Questions about recent medical care

- Medication and treatment history

- Lifestyle questions affecting health

- Quick review and approval process

- Rate adjustments based on health status

Plan Selection

Choosing your short-term coverage involves:

- Selecting coverage duration and start date

- Choosing deductible and out-of-pocket amounts

- Deciding on benefit levels desired

- Adding optional coverage enhancements

- Reviewing provider network adequacy

- Understanding renewal terms and options

Enrollment and Activation

Getting your coverage active includes:

- Submitting completed application

- Providing any required documentation

- Setting up payment methods

- Receiving policy documents and ID cards

- Understanding coverage effective date

- Accessing online account management tools

Managing Your Short-Term Coverage

Effective management helps you maximize your temporary coverage benefits:

Understanding Your Benefits

Make the most of your short-term plan by:

- Reading your policy documents thoroughly

- Understanding what services are covered

- Knowing your deductibles and copayments

- Finding in-network providers in your area

- Understanding emergency care procedures

- Keeping important contact numbers handy

Planning for Permanent Coverage

While on short-term insurance, prepare for long-term solutions:

- Research permanent insurance options

- Understand enrollment periods for other plans

- Budget for transition to comprehensive coverage

- Maintain continuous medical records

- Plan timing for coverage transitions

- Consider COBRA or other bridge options

Renewal Considerations

If you need to extend coverage:

- Review renewal terms and any changes

- Assess continued eligibility requirements

- Compare with other available options

- Understand any waiting periods for renewals

- Plan for potential premium adjustments

- Consider maximum renewal limits

FAQS

Frequently Asked Questions About Short-Term Health Insurance

Short-term health insurance durations vary by state and carrier. In Arizona, initial coverage periods and renewal options are available within state regulatory limits. Some plans allow multiple renewals while others have maximum coverage periods. We can help you understand the specific duration options available to you.

Short-term insurance typically excludes pre-existing conditions, maternity care, mental health services, substance abuse treatment, preventive care, and routine medical services. Coverage focuses on unexpected accidents and sudden illnesses. It's important to understand these limitations before enrolling.

Short-term insurance involves medical underwriting, and carriers may decline coverage or exclude treatment for pre-existing conditions. Each application is reviewed individually. If you have health concerns, we can help you explore options that might provide the best coverage available.

Short-term insurance provides valuable protection against unexpected medical expenses that could be financially devastating. While it has limitations compared to comprehensive coverage, it offers important protection during transition periods when you might otherwise be uninsured.

Many short-term plans offer renewal options, though terms vary by carrier and state regulations. Some plans allow seamless renewals while others require new applications. Renewal terms, including any changes in coverage or premiums, should be understood before initial enrollment.

Yes, most short-term plans provide coverage for emergency room visits due to accidents or sudden illnesses. Emergency care is typically a key benefit of these plans. However, you'll still be responsible for deductibles, copayments, and any coinsurance specified in your policy.

Many short-term plans offer coverage that begins the day after approval or within a few days of application. This quick activation makes short-term insurance ideal for immediate coverage needs. Processing times vary by carrier and the complexity of your health history.

Most short-term plans provide nationwide coverage, making them useful for travel within the United States. Emergency care is typically covered wherever you travel domestically. Some plans may offer limited international benefits, though this varies significantly by carrier and plan.

When your short-term coverage expires, you'll need to secure new insurance. This might involve enrolling in employer coverage, purchasing individual insurance through the Marketplace, or extending short-term coverage if renewal options are available. We help you plan transitions to permanent coverage.

Yes, short-term insurance can typically be cancelled before the coverage period ends. Cancellation procedures and any applicable fees vary by carrier. Some plans offer prorated refunds for unused coverage periods, while others have different cancellation terms outlined in your policy.

Take the Next Step for Your Short-Term Health Insurance

Finding the right short-term health insurance provides essential protection during life transitions and coverage gaps. Our local team in Queen Creek and San Tan Valley specializes in guiding individuals and families through temporary insurance options. We provide:

- Free short-term insurance consultations and comparisons

- Assistance with application and enrollment processes

- Guidance on coverage duration and renewal options

- Support throughout your temporary coverage period

- Local expertise with Arizona carriers and regulations

Don’t risk going without coverage during transitions. Contact us today to explore your short-term insurance options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

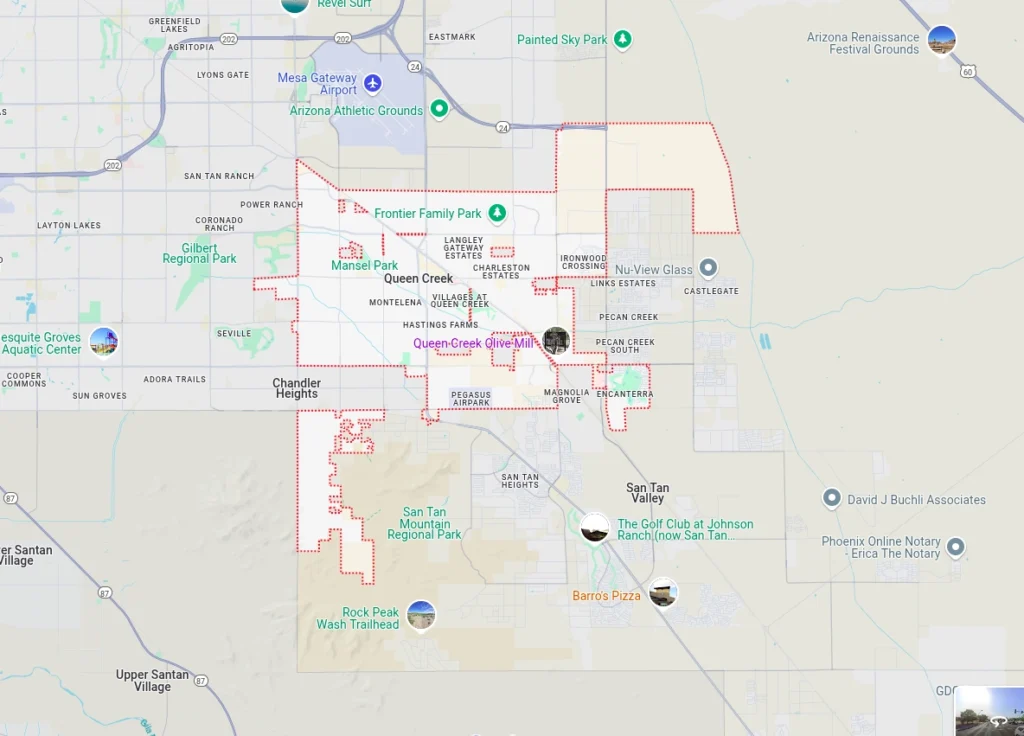

The Health Insurance Jedi proudly serves individuals and families seeking short-term health insurance throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s short-term insurance regulations and local healthcare providers ensures you receive coverage that protects you during transitional periods. Contact us today to discover how we can help bridge your coverage gap with appropriate short-term health insurance.