More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Private off-exchange health insurance plans provide comprehensive healthcare coverage purchased directly from insurance companies outside the Health Insurance Marketplace. These plans offer flexibility, diverse coverage options, and often broader provider networks, giving you more control over your healthcare decisions and insurance choices.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right private off-exchange plan requires understanding your healthcare needs and exploring various coverage options beyond the Marketplace. Our local expertise helps individuals and families discover private coverage that offers the flexibility and benefits you’re looking for.

Why Choose Us for Your Private Off-Exchange Plans

Selecting the right private health insurance involves navigating numerous carriers, plan options, and coverage features outside the Marketplace system. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on finding you the best private coverage.

1. Private Insurance Expertise

We understand that private off-exchange plans offer unique advantages and features different from Marketplace options. Our team helps you evaluate plans based on your specific needs, including your healthcare requirements, provider preferences, and desired flexibility. We explain private insurance options clearly without confusing jargon, ensuring you understand exactly what each plan offers.

2. Local Private Insurance Knowledge

As Arizona residents ourselves living in Queen Creek and San Tan Valley, we know the local private insurance landscape thoroughly. We can tell you which carriers work well with local healthcare providers, what coverage options are available in our area, and how to maximize your benefits with private plans. This local insight helps you select coverage that truly works in our community.

3. Continuous Private Plan Support

Our service relationship extends well beyond enrollment. As your life and health needs change, your private insurance may need adjustments too. We provide ongoing support for plan changes, claims assistance, provider questions, and helping you optimize your private plan benefits year-round.

4. Customized Private Solutions

Private off-exchange plans through our agency give you maximum flexibility to select coverage that fits your unique situation. Whether you're looking for comprehensive coverage, specific provider access, or particular benefits, we help you find private plans that address your exact healthcare profile and preferences.

5. Streamlined Private Plan Enrollment

Our efficient application process makes obtaining private coverage straightforward and hassle-free. We guide you through the enrollment process, handle the paperwork, and ensure you get the private coverage you want without unnecessary delays or complications.

6. Round-the-Clock Private Plan Assistance

Questions about your private insurance don't wait for business hours. Our support team remains available whenever you need help understanding your coverage, finding specialists, or addressing urgent insurance questions about your private plan.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Private Off-Exchange Plans

Private off-exchange health insurance plans are coverage options sold directly by insurance companies outside the Health Insurance Marketplace. These plans provide an alternative to Marketplace coverage, often offering different benefits, broader networks, and more flexible terms.

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Private Off-Exchange Plans

- Broader provider networks: Often include more doctors and hospitals than Marketplace plans

- Flexible plan designs: More variety in coverage options and benefit structures

- Year-round enrollment: Available for purchase throughout the year, not just during open enrollment

- Direct carrier relationship: Work directly with the insurance company for service

- Customizable benefits: Options to add riders or modify coverage features

- No income restrictions: Available regardless of income level

Types of Private Off-Exchange Options

Different private plan structures offer various advantages:

Comprehensive Private Plans

- Full coverage similar to Marketplace plans

- Include essential health benefits

- Offer various deductible and copayment options

- Provide extensive provider networks

- Include prescription drug coverage

- Suitable for those wanting traditional insurance coverage

High-Deductible Health Plans (HDHPs)

- Lower monthly premiums with higher deductibles

- Often paired with Health Savings Accounts (HSAs)

- Cover preventive care before deductible

- Good for healthy individuals and those saving for retirement

- Provide catastrophic protection

- Offer tax advantages through HSA contributions

Short-Term Health Insurance

- Temporary coverage for gaps in insurance

- Available for limited periods with renewal options

- Lower cost alternative to traditional plans

- May not cover pre-existing conditions

- Provides basic medical coverage

- Good bridge coverage between other plans

Supplemental Insurance Plans

- Provide additional coverage beyond primary insurance

- Include options like critical illness or accident insurance

- Help cover gaps in existing coverage

- Offer cash benefits for specific events

- Available as add-ons to existing plans

- Provide extra financial protection

Arizona Private Insurance Market

Arizona offers a robust private health insurance market with multiple carriers and plan options.

Private Plan Enrollment Flexibility

Year-Round Availability Unlike Marketplace plans, private off-exchange insurance is typically available:

- Throughout the entire year

- Without waiting for open enrollment periods

- With flexible start dates

- For immediate coverage needs

- After qualifying life events

- When switching from other coverage

Medical Underwriting Some private plans may include medical underwriting:

- Health questions during application

- Potential medical exams or records reviews

- Premium adjustments based on health status

- Coverage exclusions for pre-existing conditions

- Waiting periods for certain services

- Important to understand before applying

Private Plan Categories

Private off-exchange plans come in various structures:

Traditional Health Insurance

- Comprehensive medical coverage

- Include doctor visits, hospital stays, and prescriptions

- Offer predictable copayments and deductibles

- Provide extensive provider networks

- Include preventive care benefits

- Similar structure to employer-sponsored plans

Health Sharing Plans

- Alternative to traditional insurance

- Members share medical expenses

- Based on religious or ethical beliefs

- Lower monthly costs than traditional insurance

- Different rules and protections than insurance

- Not regulated as insurance products

Limited Medical Plans

- Provide basic coverage for specific services

- Lower cost than comprehensive plans

- May have benefit limits or restrictions

- Good for temporary or basic needs

- Don’t qualify as minimum essential coverage

- Should be understood before purchasing

Understanding Private Plan Costs

Private off-exchange plans involve various cost structures that can differ significantly from Marketplace options:

Private Plan Premiums

Premium costs for private plans depend on:

- Your age, health status, and location

- Plan type and coverage level

- Deductible and out-of-pocket choices

- Provider network size and quality

- Additional benefits or riders included

- Carrier pricing and underwriting

Cost-Sharing Structures

Private plans offer various cost-sharing options:

- Deductibles ranging from low to high amounts

- Copayments for specific services

- Coinsurance percentages after deductibles

- Out-of-pocket maximums for protection

- Different costs for in-network versus out-of-network care

- Separate deductibles for specific services

Additional Cost Considerations

Private plans may include:

- Application or enrollment fees

- Riders for additional coverage

- Wellness program incentives

- HSA contribution opportunities

- Administrative fees for certain services

- Penalties for late payments or cancellations

Value-Added Benefits

Many private plans offer extra benefits:

- Telemedicine services at no additional cost

- Wellness programs and health coaching

- Prescription discount programs

- Vision and dental coverage add-ons

- Alternative therapy coverage

- International travel coverage

Private Plan Benefits and Features

Private off-exchange plans often provide benefits beyond basic medical coverage:

Financial Assistance for Families

Many families qualify for financial assistance that makes health insurance more affordable.

Enhanced Provider Networks

- Access to more specialists and hospitals

- Relationships with premier medical facilities

- Direct access to specialists without referrals

- Out-of-network coverage options

- International provider networks

- Centers of excellence for specialized care

Flexible Plan Design

- Customizable deductibles and copayments

- Optional riders for specific coverage

- Choice of prescription drug formularies

- Wellness program integration

- Family planning and maternity benefits

- Mental health and substance abuse coverage

Advanced Technology and Services

- Mobile apps for plan management

- Telehealth platforms included

- Online provider directories

- Digital ID cards and claims tracking

- Health management tools

- 24/7 nurse helplines

Specialized Coverage Options

- Executive or concierge medicine access

- Alternative and complementary therapy coverage

- International coverage for travelers

- Specialized disease management programs

- Preventive care beyond standard recommendations

- Personalized health coaching services

Choosing the Right Private Plan

Selecting an appropriate private off-exchange plan requires evaluating multiple factors:

Assess Your Healthcare Priorities

- Specific doctors or hospitals you want to keep

- Importance of broad provider network access

- Need for specialized medical services

- Prescription medication requirements

- Preference for low monthly costs versus low deductibles

- Desire for additional benefits or services

Evaluate Coverage Options

Consider the following when comparing plans:

- Essential health benefits included

- Coverage for pre-existing conditions

- Prescription drug formularies and costs

- Mental health and substance abuse benefits

- Preventive care coverage and wellness programs

- Emergency and urgent care provisions

Compare Carrier Options

Different carriers offer various advantages:

- Network size and provider relationships

- Customer service quality and availability

- Claims processing efficiency

- Technology platforms and digital tools

- Financial stability and ratings

- Local presence and support

Understand Plan Limitations

Be aware of potential restrictions:

- Pre-existing condition exclusions or waiting periods

- Annual or lifetime benefit limits

- Coverage exclusions for specific treatments

- Geographic limitations on coverage

- Renewal terms and potential rate increases

- Cancellation policies and procedures

Health Savings Accounts (HSAs) with Private Plans

Many private plans can be paired with Health Savings Accounts for additional benefits:

HSA Eligibility Requirements

- Must be enrolled in a qualified high-deductible health plan

- Cannot have other comprehensive health coverage

- Cannot be enrolled in Medicare

- Cannot be claimed as dependent on someone else’s tax return

- Plan must meet specific deductible and out-of-pocket limits

HSA Benefits and Advantages

- Triple tax advantage (deductible, growth, withdrawals)

- Funds roll over year to year

- Portable between jobs and insurance plans

- Can be used for qualified medical expenses

- Becomes retirement account for non-medical expenses after age 65

- No required minimum distributions

HSA Contribution Strategies

- Employer contributions may be available

- Catch-up contributions for those over 55

- Family versus individual contribution limits

- Coordination with other benefit accounts

- Investment options for long-term growth

- Strategic withdrawal planning

Private Plan Enrollment Process

Getting private off-exchange coverage involves several steps:

Application and Underwriting

- Complete detailed health questionnaire

- Provide medical history information

- May require medical exams or records

- Review of prescription medications

- Approval or denial decision from carrier

- Potential rate adjustments based on health

Plan Selection and Customization

- Choose from available plan options

- Select deductibles and copayment levels

- Add optional riders or benefits

- Confirm provider network adequacy

- Review prescription drug coverage

- Understand renewal and cancellation terms

Implementation and Activation

- Submit required documentation

- Set up payment methods

- Receive insurance cards and materials

- Confirm coverage effective dates

- Understand claims procedures

- Access online account management tools

Managing Your Private Plan

Effective management ensures you get maximum value from your private coverage:

Regular Plan Reviews

- Annual evaluation of plan performance

- Comparison with other available options

- Assessment of changing health needs

- Review of provider network changes

- Analysis of premium increases

- Consideration of benefit modifications

Proactive Health Management

- Regular use of preventive care benefits

- Participation in wellness programs

- Monitoring of health metrics and goals

- Early intervention for health issues

- Medication management and optimization

- Lifestyle choices supporting good health

Claims and Benefits Optimization

- Understanding claims procedures

- Keeping detailed records of medical expenses

- Maximizing HSA contributions and usage

- Utilizing all available plan benefits

- Coordinating with other insurance coverage

- Appealing claim denials when appropriate

FAQS

Frequently Asked Questions About Private Off-Exchange Plans

Private off-exchange plans are sold directly by insurance companies outside the Marketplace. They often offer broader networks, more plan options, and year-round enrollment, but don't qualify for premium tax credits or cost-sharing reductions. They may include medical underwriting and could exclude coverage for pre-existing conditions.

Yes, most private off-exchange plans are available for enrollment throughout the year, not just during open enrollment periods. This provides flexibility for immediate coverage needs or when transitioning between different insurance options. However, some plans may have specific enrollment requirements or restrictions.

Coverage for pre-existing conditions varies by private plan and carrier. Some plans exclude pre-existing conditions for waiting periods, while others may cover them immediately. The specific terms depend on the plan design and any medical underwriting requirements. We can help you find plans that provide the coverage you need.

Private plan costs vary significantly based on coverage, health status, and plan design. While you won't qualify for premium tax credits with private plans, they may offer better value for some individuals, especially those with good health who want broader networks or specific benefits not available through the Marketplace.

Many private plans are designed to work with Health Savings Accounts, especially high-deductible health plans. To use an HSA, your plan must meet specific IRS requirements for minimum deductibles and maximum out-of-pocket costs. We can help identify HSA-eligible plans and explain the benefits.

Most private plans cannot change your rates or cancel your coverage due to health changes once you're enrolled, though renewal terms may vary. Some plans guarantee renewability, while others may adjust rates at renewal. It's important to understand your plan's renewal provisions before enrolling.

Private plans work well for people who want specific doctors or hospitals, need coverage outside open enrollment, or want more plan flexibility. They're also good for those who don't qualify for Marketplace subsidies or prefer direct relationships with insurance carriers. We can help evaluate if private coverage fits your needs.

You can typically switch from a Marketplace plan to a private plan, though timing and procedures vary. If you're receiving premium tax credits, you'll want to consider the financial impact of losing those subsidies. We can help you compare options and time any transitions appropriately.

Many private plans include essential health benefits similar to Marketplace plans, but they're not legally required to do so. Some plans may have different benefit structures or exclusions. It's important to review exactly what each private plan covers before making a decision.

If you're denied coverage due to health reasons, you may have other options such as guaranteed-issue plans, Marketplace coverage during open enrollment, or state high-risk pools if available. We can help explore alternative coverage options if you face coverage denials.

Take the Next Step for Your Private Off-Exchange Plan

Finding the right private off-exchange plan provides personalized healthcare coverage tailored to your specific needs and preferences. Our local team in Queen Creek and San Tan Valley specializes in guiding individuals and families through private insurance options. We provide:

- Free private plan consultations and comparisons

- Assistance with application and underwriting processes

- Enrollment support and plan optimization

- Year-round customer service for private insurance questions

- Local expertise with Arizona carriers and provider networks

Don’t settle for one-size-fits-all coverage. Contact us today to explore your private insurance options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

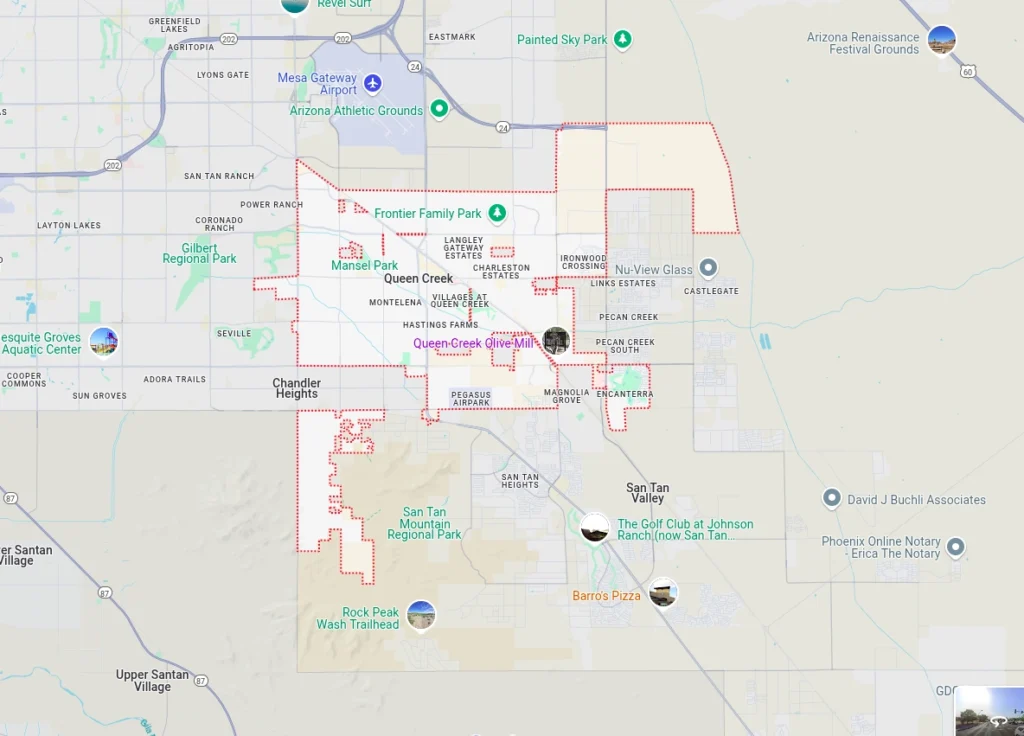

The Health Insurance Jedi proudly serves individuals and families seeking private off-exchange plans throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s private insurance landscape and local provider networks ensures you receive coverage that works perfectly for your situation. Contact us today to discover how we can help protect your health with the right private insurance solution.