More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Medicare Prescription Drug Plans, also known as Part D, provide essential coverage for prescription medications that Original Medicare alone doesn’t cover. These specialized insurance plans help reduce your prescription drug costs, ensure access to necessary medications, and provide protection against high pharmacy expenses, giving you greater peace of mind about your medication needs.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right Prescription Drug Plan requires understanding your specific medication needs and exploring various plan options while comparing formularies and pharmacy networks. Our local expertise helps Medicare beneficiaries discover Part D coverage that balances comprehensive protection with affordability while ensuring access to your essential medications.

Why Choose Us for Your Prescription Drug Plan (Part D) Guidance

Selecting the right Medicare Part D Plan involves navigating numerous options, formulary lists, and pharmacy networks. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on finding you the right prescription drug coverage.

1. Medicare Part D Expertise

We understand that Prescription Drug Plans have unique features and varying formularies different from other Medicare options. Our team helps you evaluate plans based on your specific medication needs, including current prescriptions, pharmacy preferences, and budget considerations. We explain Part D options clearly without confusing jargon, ensuring you understand exactly how each plan covers your medications.

2. Local Pharmacy Network Knowledge

As Arizona residents ourselves living in Queen Creek and San Tan Valley, we know the local Medicare Part D landscape thoroughly. We can guide you through which plans work with your preferred local pharmacies, which ones offer mail-order savings, and how to maximize your prescription benefits with Arizona providers. This local insight ensures your Part D plan truly works for your medication needs in our community.

3. Continuous Medicare Part D Support

Our service relationship extends well beyond enrollment. As your medication needs evolve, we provide ongoing support for formulary questions, pharmacy issues, coverage concerns, and helping you review your plan annually during the Medicare Annual Enrollment Period to ensure it continues to cover your prescriptions effectively.

4. Customized Part D Solutions

Prescription Drug Plan guidance through our agency gives you flexibility to select the plan that best fits your specific medication regimen and budget. Whether you're newly eligible for Medicare or considering switching your current drug plan, we help you find options that address your particular medication needs and preferences.

5. Streamlined Part D Enrollment

Our efficient application process makes obtaining Medicare Part D coverage straightforward and stress-free. We guide you through eligibility requirements, help with application completion, and ensure you understand how to use your new prescription benefits without unnecessary confusion during this important transition.

6. Round-the-Clock Medicare Part D Assistance

Questions about your Prescription Drug Plan don't follow standard hours, and neither do we. Our support team remains available whenever you need help understanding your coverage, resolving pharmacy issues, or addressing urgent questions about your medication benefits.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Medicare Prescription Drug Plans (Part D)

Medicare Part D provides insurance coverage specifically for prescription medications. These plans are offered by private insurance companies approved by Medicare and work alongside your Original Medicare or Medicare Supplement coverage to help pay for both brand-name and generic prescription drugs.

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Medicare Part D Plans

- Prescription-specific coverage: Focuses exclusively on medication costs

- Standalone option: Can be purchased separately from other Medicare coverage

- Formulary-based benefits: Covers medications listed in the plan’s drug list

- Pharmacy networks: Features preferred pharmacies for maximum savings

- Annual contract: Plans renew yearly with potential formulary changes

- Standard benefit structure: Following Medicare’s design with some variations

What Medicare Part D Plans Cover

Medicare Prescription Drug Plans provide comprehensive medication coverage:

Medication Types Covered

- Brand-name prescription drugs

- Generic medications

- Specialty medications and biologics

- Many preventive vaccines

- Drugs across various therapeutic classes

- Medications for acute and chronic conditions

Formulary Tiers and Categories Drugs are typically organized in tiers:

- Generic medications in lower tiers

- Preferred brand-name drugs

- Non-preferred brand-name drugs

- Specialty tier medications

- Injectable medications

- Coverage for most commonly prescribed drugs

Coverage Requirements Medicare Part D plans must cover:

- At least two drugs in each therapeutic category

- All or substantially all drugs in six protected classes

- Medications for mental health conditions

- HIV/AIDS treatments

- Cancer drugs

- Immunosuppressants

Types of Prescription Drug Coverage Options

Medicare beneficiaries have different ways to access prescription drug coverage:

Medicare Part D Plan Options

Standalone Prescription Drug Plans (PDPs) These plans work with Original Medicare:

- Pair with Original Medicare Parts A and B

- Compatible with Medicare Supplement Plans

- Focus exclusively on prescription coverage

- Various premium levels and coverage designs

- Nationwide availability with regional variations

- Good option for those with Original Medicare

Medicare Advantage Prescription Drug Plans (MA-PDs) Many Medicare Advantage Plans include:

- Integrated medical and prescription coverage

- Single insurance card for all services

- Coordinated care between medical and pharmacy benefits

- Provider network and pharmacy network coordination

- Unified customer service for all healthcare needs

- All-in-one coverage alternative

Special Coverage Situations Additional options for specific circumstances:

- Employer or union drug coverage

- Veterans Affairs (VA) prescription benefits

- TRICARE prescription coverage

- Program of All-inclusive Care for the Elderly (PACE)

- AIDS Drug Assistance Programs

- State Pharmaceutical Assistance Programs

Plan Comparison Considerations

When evaluating Prescription Drug Plans, consider:

- Your specific medications and their coverage status

- Preferred pharmacy network participation

- Mail-order pharmacy options and savings

- Formulary restrictions and requirements

- Overall premium and cost-sharing structure

- Star rating quality measures

Medicare Part D Enrollment Guidelines

Understanding when and how to enroll in Prescription Drug Plans is essential:

Initial Enrollment Opportunities

Initial Enrollment Period (IEP) This first enrollment window includes:

- Seven-month period around your 65th birthday

- Starts 3 months before your birthday month

- Includes your birthday month

- Extends 3 months after your birthday month

- Best time to enroll to avoid late enrollment penalties

- Special timing for disability-related Medicare eligibility

Annual Enrollment Period (AEP) Every year from October 15 to December 7:

- Switch between Part D Plans

- Join a Part D Plan if you don’t have one

- Drop your Part D coverage

- Change from a Medicare Advantage Plan to Original Medicare with Part D

- Review and compare plan options annually

- Changes become effective January 1

Special Enrollment Periods

Special situations creating Part D enrollment rights:

- Moving to a new address outside your plan’s service area

- Losing creditable prescription drug coverage

- Plan leaving the Medicare program

- Qualifying for Extra Help with Medicare costs

- Moving into, residing in, or leaving a long-term care facility

- Qualifying for Medicaid coverage

- 5-star Special Enrollment Period opportunities

Late Enrollment Penalty Considerations

Understanding potential penalties:

- Importance of enrolling when first eligible

- Definition of creditable prescription drug coverage

- Penalty calculation methodology

- Lifetime nature of Part D penalties

- Exceptions to penalty assessments

- Documentation for creditable coverage periods

Family Copayments

A copayment is a fixed amount your family pays for specific services, such as doctor visits or prescriptions. Each family member might have different copay amounts depending on age, service type, and other factors.

Understanding the Part D Drug Formulary

The formulary is the heart of your Part D plan’s coverage

Formulary Basics

Essential aspects of Part D drug lists:

- List of covered prescription medications

- Tier structure determining cost-sharing levels

- Regular updates and possible changes

- Generic and brand-name options

- Therapeutic categories and classes

- Plan-specific coverage exceptions

Formulary Restrictions and Rules

Common management tools include:

- Prior authorization requirements

- Quantity limits on certain medications

- Step therapy protocols requiring trial of certain drugs first

- Therapeutic substitution options

- Formulary exception processes

- Non-formulary medication procedures

Specialty Medication Coverage

Handling high-cost, complex medications:

- Specialty tier designation and cost-sharing

- Limited distribution drugs

- Specialty pharmacy requirements

- Administration method considerations

- Clinical management programs

- Manufacturer support programs

Choosing the Right Prescription Drug Plan

Selecting appropriate Part D coverage requires evaluating several factors:

Assess Your Medication Needs

Consider your prescription situation:

- Current prescription medications

- Dosages and frequency of medications

- Brand-name versus generic preferences

- Anticipated medication changes

- Specialized medication requirements

- Chronic condition management drugs

Evaluate Pharmacy Networks

Part D pharmacy considerations:

- Preferred versus standard network pharmacies

- Proximity of network pharmacies to your home

- Mail-order pharmacy options and requirements

- Specialty pharmacy access if needed

- Out-of-network coverage limitations

- Travel considerations and national pharmacy chains

Compare Formulary Coverage

Medication list evaluation:

- Confirmation your drugs are on the formulary

- Tier placement of your medications

- Prior authorization or other restrictions

- Quantity limitations

- Generic alternatives availability

- Formulary exception process

Consider Overall Value

Look beyond the premium:

- Annual deductible amount and application

- Copayment or coinsurance for your specific drugs

- Coverage gap provisions

- Catastrophic coverage protection

- Customer service quality

- Convenience features like automatic refills

Understanding the Part D Coverage Stages

Prescription Drug Plans have a standardized benefit structure:

Annual Deductible Stage

The first phase of coverage:

- Plan-specific deductible amounts

- Some plans cover certain tiers before deductible

- Applying only to covered prescriptions

- Resets annually on January 1

- Payment responsibility before plan begins to pay

- Deductible variations between plans

Initial Coverage Stage

After meeting your deductible:

- Copayment or coinsurance for covered drugs

- Tier-based cost-sharing for medications

- Calculation of total drug costs

- Tracking toward coverage gap entry

- Cost differences between pharmacy types

- Benefit period through calendar year

Coverage Gap Stage

Commonly known as the “donut hole”:

- Understanding discounts and coverage during this stage

- Manufacturer discounts on brand-name drugs

- Generic drug coverage in the gap

- Progressive closure under Medicare reforms

- Tracking out-of-pocket spending

- Movement toward catastrophic coverage

Catastrophic Coverage Stage

Final stage of Part D benefit:

- Lower cost-sharing after reaching threshold

- Significant cost protection for high medication expenses

- Coverage through the end of calendar year

- Resets annually on January 1

- Essential protection for those with high drug costs

- Automatic qualification process

Medication Management Strategies

Maximizing your Part D benefits requires strategic approaches:

Cost-Saving Approaches

Reducing medication expenses:

- Generic substitution opportunities

- Therapeutic alternatives in lower tiers

- Mail-order pharmacy savings

- Preferred pharmacy network utilization

- Manufacturer assistance programs

- Medication synchronization benefits

Medication Therapy Management

Programs to optimize medication use:

- Comprehensive medication reviews

- Action plans for medication issues

- Medication-related problem resolution

- Personalized medication record creation

- Coordination between healthcare providers

- Educational resources and counseling

Formulary Exceptions and Appeals

When you need non-covered medications:

- Exception request procedures

- Medical necessity documentation

- Tiering exception requests

- Prior authorization process navigation

- Appeal rights for denials

- Multi-level appeal options

Extra Help for Prescription Drug Costs

Financial assistance programs can reduce Part D expenses:

Extra Help Program (Low-Income Subsidy)

Medicare’s assistance program:

- Premium assistance benefits

- Reduced deductibles and copayments

- Modified coverage gap provisions

- Application process through Social Security

- Automatic qualification situations

- Annual eligibility redetermination

State Pharmaceutical Assistance Programs

State-specific help:

- Arizona program availability and eligibility

- Coordination with Medicare Part D benefits

- Application procedures and documentation

- Additional cost-sharing reductions

- Eligibility criteria and coverage levels

- Supplemental benefits to Part D

Manufacturer Patient Assistance Programs

Direct help from drug companies:

- Programs for brand-name medications

- Eligibility requirements and application process

- Coordination with Part D benefits

- Potential premium and copayment assistance

- Disease-specific assistance programs

- Transitions between assistance programs

Annual Plan Review and Changes

Prescription Drug Plans can change yearly:

Annual Notice of Change

Understanding plan modifications:

- Review Annual Notice of Change document each September

- Identify formulary changes affecting your medications

- Note pharmacy network adjustments

- Recognize premium and cost-sharing alterations

- Evaluate if current plan remains the best option

- Make informed decisions during Annual Enrollment

Annual Plan Comparison

Regular evaluation of options:

- Review current medication list completely

- Compare available plans in your area

- Check formulary coverage for your specific drugs

- Assess pharmacy network changes

- Compare overall costs based on your usage

- Consider convenience features and star ratings

FAQS

Frequently Asked Questions About Medicare Part D Plans

Medicare Part D is voluntary, but there are important considerations. If you don't have Part D or other creditable prescription drug coverage when first eligible, you may face a late enrollment penalty if you join later. This penalty adds to your premium for as long as you have Part D. Even if you don't currently take medications, having coverage protects you from unexpected future costs and penalties.

Formulary tiers determine how much you pay for different medications. Typically, lower tiers include generic drugs with lower copayments, while higher tiers include brand-name and specialty drugs with higher costs. A common structure includes Tier 1 for preferred generics, Tier 2 for non-preferred generics, Tier 3 for preferred brand-name drugs, Tier 4 for non-preferred brand-name drugs, and Tier 5 for specialty medications. Understanding your medications' tier placement helps predict your costs.

If your medication isn't covered, you have several options. You can request a formulary exception where your doctor explains why you need this specific drug. Your plan may approve coverage based on medical necessity. Alternatively, you can discuss therapeutic alternatives with your doctor or pharmacist – medications in the same class that are covered by your plan. During Annual Enrollment, you can also switch to a plan that covers your medication.

Many Part D plans offer mail-order pharmacy services that can provide convenience and cost savings. Typically, you can receive a 90-day supply of maintenance medications delivered to your home. This often costs less than getting the same medications monthly at retail pharmacies. Mail-order services usually include automatic refill options, pharmacist consultations by phone, and online ordering tools. They work especially well for medications you take regularly.

Generally, no. If you join a Medicare Advantage Plan that includes prescription drug coverage (MA-PD), you already have Part D benefits and cannot enroll in a separate standalone plan. If you're in a Medicare Advantage Plan without drug coverage (rare), you can sometimes add a standalone Part D plan. If you have Original Medicare, you can and should enroll in a standalone Part D plan for prescription coverage.

Part D plans can make formulary changes during the year, but they must follow Medicare rules. If a plan removes a drug, moves it to a higher cost tier, or adds restrictions, it must provide written notice at least 30 days before the change. You'll typically be able to get a temporary supply during the notice period. Your doctor can request an exception, or you may qualify for a Special Enrollment Period to switch plans if the change significantly impacts your treatment.

Part D plans have specific pharmacy networks, which may impact coverage when traveling. Most national plans include major pharmacy chains throughout the U.S., allowing you to fill prescriptions while traveling domestically. Before traveling, check if there are in-network pharmacies at your destination. Consider getting vacation overrides for extended trips or using mail-order options. For international travel, Part D generally doesn't cover medications purchased outside the U.S., so plan accordingly.

The most effective way to compare plans is based on your specific medications. Make a complete list of your prescriptions, including dosages and frequency. Use Medicare's Plan Finder tool or get assistance from our experienced agents to compare how each plan covers your drugs, what pharmacies you can use, and your estimated annual costs. Consider both premium and out-of-pocket costs, as the lowest premium plan isn't always the most affordable overall.

If you enter a skilled nursing facility or hospital, your Part D plan still covers your prescribed medications. However, if you're in a skilled nursing facility receiving Medicare Part A benefits, some medications may be covered under Part A instead of Part D. Once your Part A skilled nursing coverage ends, all prescribed medications would be covered by your Part D plan again, subject to your plan's formulary and cost-sharing requirements.

You can change your Part D plan during the Annual Enrollment Period (October 15-December 7) for coverage starting January 1. If you're enrolled in a Medicare Advantage Plan with drug coverage, you can also make changes during the Medicare Advantage Open Enrollment Period (January 1-March 31). Additionally, certain life events may qualify you for a Special Enrollment Period to make changes outside these times, such as moving outside your plan's service area or losing other drug coverage.

Take the Next Step for Your Prescription Drug Plan

Finding the right Medicare Part D Plan provides essential protection against prescription medication costs and ensures access to the drugs you need. Our local team in Queen Creek and San Tan Valley specializes in guiding Medicare beneficiaries through their prescription drug coverage options. We provide:

- Free Part D consultations and comparisons

- Personalized drug list evaluation

- Formulary verification for your specific medications

- Pharmacy network analysis

- Assistance with enrollment timing and applications

- Local expertise with Arizona Medicare Part D plans

Don’t navigate Medicare’s prescription drug complexities alone. Contact us today to explore your Part D options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

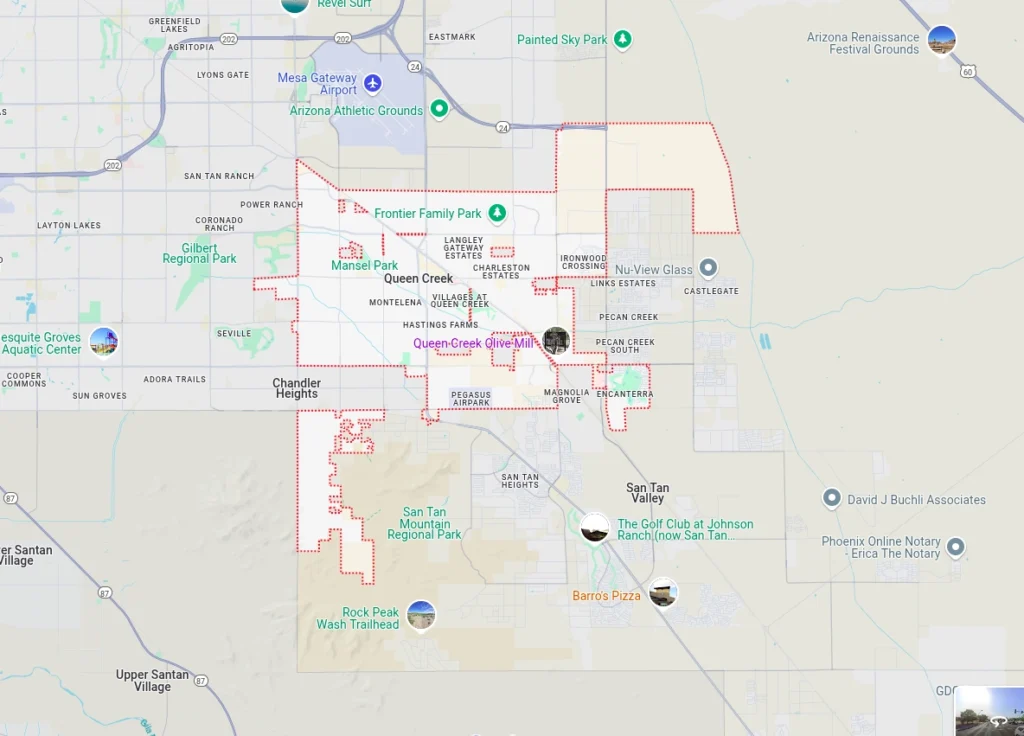

Our Service Area

The Health Insurance Jedi proudly serves Medicare beneficiaries seeking Prescription Drug Plans throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s Medicare Part D landscape and local pharmacy networks ensures you receive guidance that addresses your specific medication needs. Contact us today to discover how we can help secure your prescription drug coverage with the right Medicare Part D Plan for your situation.