More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Medicare Supplement Plans, also known as Medigap, provide essential additional coverage that works alongside Original Medicare to reduce your out-of-pocket healthcare costs. These specialized insurance policies help fill the “gaps” in Medicare coverage, including deductibles, copayments, and coinsurance, giving you greater financial protection and peace of mind for your healthcare needs.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right Medicare Supplement Plan requires understanding your specific healthcare needs and exploring various standardized plans while comparing carrier options. Our local expertise helps Medicare beneficiaries discover Medigap coverage that balances comprehensive protection with affordability.

Why Choose Us for Your Medicare Supplement (Medigap) Guidance

Selecting the right Medicare Supplement Plan involves navigating standardized benefits, enrollment periods, and carrier options. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on finding you the right Medigap coverage.

1. Medicare Supplement Expertise

We understand that Medicare Supplement Plans have unique features and standardized benefits different from other Medicare options. Our team helps you evaluate plans based on your specific healthcare needs, including coverage gaps, provider preferences, and budget considerations. We explain Medigap options clearly without confusing jargon, ensuring you understand exactly what each standardized plan covers.

2. Local Medicare Knowledge

As Arizona residents ourselves living in Queen Creek and San Tan Valley, we know the local Medicare landscape thoroughly. We can guide you through which Medigap carriers offer the most competitive rates in our area, which plans local seniors typically choose, and how to maximize your benefits with Arizona providers. This local insight ensures your Medicare Supplement truly works for your healthcare needs in our community.

3. Continuous Medicare Support

Our service relationship extends well beyond enrollment. As your healthcare needs evolve, we provide ongoing support for claim questions, provider issues, rate adjustments, and helping you review your coverage annually to ensure it continues meeting your needs as you age.

4. Customized Medicare Solutions

Medicare Supplement guidance through our agency gives you flexibility to select the standardized plan that best fits your specific healthcare utilization patterns and budget. Whether you're newly eligible for Medicare or considering switching your current Medigap plan, we help you find options that address your particular needs and preferences.

5. Streamlined Medigap Enrollment

Our efficient application process makes obtaining Medicare Supplement coverage straightforward and stress-free. We guide you through eligibility requirements, help with application completion, and ensure you get coverage without unnecessary delays or complications during this important transition.

6. Round-the-Clock Medicare Assistance

Questions about your Medicare Supplement Plan don't follow standard hours, and neither do we. Our support team remains available whenever you need help understanding your coverage, resolving billing issues, or addressing urgent questions about your Medigap benefits.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Medicare Supplement Plans (Medigap)

Medicare Supplement Insurance, commonly called Medigap, works alongside your Original Medicare coverage (Parts A and B) to help pay for certain healthcare costs that Medicare doesn’t cover. These private insurance policies help “fill the gaps” in Medicare coverage, providing more complete financial protection.

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Medicare Supplement Plans

- Works with Original Medicare: Supplements your Medicare Part A and Part B coverage

- Standardized benefits: Plans are standardized with letter designations (A, B, C, D, F, G, K, L, M, N)

- Private insurance: Offered by private insurance companies but with standardized benefits

- Flexibility: Use any doctor or hospital that accepts Medicare nationwide

- Guaranteed renewable: Coverage continues as long as premiums are paid

- Individual coverage: Each person needs their own Medigap policy

What Medicare Supplement Plans Cover

Medicare Supplement Plans help cover costs that Original Medicare doesn’t pay:

Medicare Part A Coinsurance and Hospital Costs

- Additional hospital days beyond Medicare limits

- Hospital coinsurance amounts

- Blood usage coinsurance

- Skilled nursing facility coinsurance

- Hospice care coinsurance

- Protection against extended hospital stays

Medicare Part B Coinsurance and Copayments

- Doctor visit coinsurance

- Outpatient procedure costs

- Preventive care coinsurance

- Emergency room copayments

- Ambulance service coinsurance

- Durable medical equipment costs

Additional Coverage Areas Depending on the specific plan, Medigap may also cover:

- Medicare Part A and Part B deductibles

- Foreign travel emergency healthcare

- Medicare Part B excess charges

- Preventive care coinsurance

- Skilled nursing facility coinsurance

- Blood coverage (first three pints)

Standardized Medicare Supplement Plans

Medicare Supplement Plans are standardized with letter designations, each offering different levels of coverage:

Most Popular Medigap Plans

Plan G Coverage One of the most comprehensive plans offering:

- Part A coinsurance and hospital costs

- Part B coinsurance or copayment

- Blood (first three pints)

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B excess charges

- Foreign travel emergency coverage (up to plan limits)

- Widely chosen by Medicare beneficiaries

Plan N Coverage A cost-effective option providing:

- Part A coinsurance and hospital costs

- Part B coinsurance or copayment (with some copays for office and ER visits)

- Blood (first three pints)

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Foreign travel emergency coverage (up to plan limits)

- Lower premiums with modest cost-sharing

Other Standardized Plans Additional options include:

- Plan A (basic benefits)

- Plan B (basic benefits plus Part A deductible)

- Plan D (moderate coverage without excess charges)

- Plan K and L (partial coverage plans with out-of-pocket limits)

- Plan M (moderate coverage with 50% Part A deductible coverage)

- Legacy Plans C and F (only available to those eligible for Medicare before 2020)

Plan Comparison Considerations

When evaluating Medicare Supplement Plans, consider:

- Coverage level needed based on healthcare utilization

- Premium costs versus benefits provided

- Future healthcare needs anticipation

- Provider acceptance preferences

- Travel needs and frequency

- Budget constraints and priorities

Medicare Supplement Enrollment Guidelines

Understanding when and how to enroll in Medicare Supplement Plans is crucial:

Medigap Open Enrollment Period

This critical enrollment window includes:

- Six-month period starting the first month you have Medicare Part B

- Age 65 or older to qualify for federal protections

- Guaranteed issue rights regardless of health conditions

- Cannot be denied coverage or charged more for pre-existing conditions

- Best time to enroll for optimal plan choices

- Important timing considerations for those still working

Guaranteed Issue Rights

Special situations providing enrollment rights:

- Loss of employer or union coverage

- Moving out of a Medicare Advantage plan’s service area

- Medicare Advantage plan leaving Medicare program

- Plan discontinuation by insurance company

- Moving back to Original Medicare during trial rights period

- Limited time periods for exercising these rights

Underwriting Considerations

Outside of guaranteed issue periods:

- Medical underwriting may be required

- Health questions on applications

- Possible coverage denials based on health

- Potential premium adjustments

- Pre-existing condition waiting periods

- Importance of enrollment timing

Choosing the Right Medicare Supplement Plan

Selecting appropriate Medigap coverage requires evaluating several factors:

Assess Your Healthcare Needs

Consider your personal health situation:

- Frequency of doctor visits and hospitalizations

- Prescription medication requirements

- Specialist care needs

- Travel plans domestically and internationally

- Current health status and family health history

- Balance between premium costs and coverage

Evaluate Provider Preferences

Medicare Supplement gives you provider freedom:

- Access to any provider accepting Medicare nationwide

- No network restrictions or referral requirements

- Coverage when traveling throughout the United States

- International travel coverage with some plans

- Freedom to see specialists without referrals

- Provider relationship maintenance

Compare Carriers and Rates

While benefits are standardized, other factors vary:

- Premium pricing methods (attained-age, issue-age, community-rated)

- Company financial stability and history

- Customer service reputation

- Rate increase history

- Household discounts availability

- Additional services or benefits offered

Consider Future Healthcare Needs

Plan for long-term coverage needs:

- Anticipated healthcare utilization as you age

- Potential health condition development

- Coverage portability if you relocate

- Financial planning for premium increases

- Sustainability of coverage long-term

- Balance between immediate and future needs

Medicare Supplement vs. Other Medicare Options

Understanding how Medigap compares to alternatives helps with decision-making:

Medicare Supplement vs. Medicare Advantage

Key differences include:

- Medicare Supplements work with Original Medicare; Medicare Advantage replaces it

- Medigap offers nationwide provider access; Medicare Advantage uses networks

- Supplements have standardized benefits; Advantage plans vary significantly

- Medigap typically has higher premiums but lower out-of-pocket costs

- Medicare Advantage often includes prescription coverage; Medigap requires separate Part D

- Different enrollment periods and rules apply

Medicare Supplement vs. Employer Coverage

Important considerations when transitioning from employer insurance:

- Coordination of benefits with employer plans

- Medicare as primary or secondary payer rules

- COBRA coverage considerations with Medicare

- Special enrollment periods when employer coverage ends

- HSA contribution restrictions with Medicare

- Guaranteed issue rights timing

Medicare Supplement vs. Medicare Cost Plans

In areas where Medicare Cost Plans are available:

- Different structure and payment mechanisms

- Network versus non-network coverage differences

- Enrollment timing considerations

- Premium and benefit comparisons

- Geographic availability limitations

- Conversion options when relocating

Medicare Prescription Drug Coverage with Medigap

Medicare Supplement Plans don’t include prescription coverage:

Medicare Part D Coordination

Understanding prescription coverage needs:

- Separate enrollment in Medicare Part D required

- Part D enrollment periods and penalties

- Coordination between Medigap and Part D coverage

- Stand-alone Prescription Drug Plan selection

- Formulary considerations for medications

- Premium and cost-sharing management

Drug Coverage Considerations

Factors affecting prescription coverage decisions:

- Current medication requirements

- Formulary coverage of necessary drugs

- Pharmacy network preferences

- Mail-order prescription options

- Coverage gap (“donut hole”) management

- Catastrophic coverage protection

Managing Your Medicare Supplement Plan

Effectively using your Medigap coverage ensures maximum benefit:

Claims Processing

Medicare Supplement Plans streamline claims:

- Medicare processes claims first

- Automatic forwarding to Medigap carrier in most cases

- Minimal paperwork for beneficiaries

- Explanation of Benefits monitoring

- Provider billing coordination

- Foreign travel claim procedures

Annual Coverage Review

Regularly evaluate your coverage:

- Review premium adjustments annually

- Assess changing healthcare needs

- Compare current plan with alternatives

- Understand birthday rule options in some states

- Monitor plan notification letters

- Evaluate emerging health conditions

Premium Management

Control long-term costs through:

- Payment method options (monthly, quarterly, annual)

- Premium adjustment preparation

- Household discount verification

- Carrier comparison during open periods

- Rate increase history monitoring

- Budget planning for increases

FAQS

Frequently Asked Questions About Medicare Supplement Plans

The best time to purchase a Medicare Supplement Plan is during your Medigap Open Enrollment Period, which begins the first month you have Medicare Part B and are 65 or older. This six-month period provides guaranteed issue rights, meaning insurance companies cannot deny you coverage or charge higher premiums based on health conditions. Enrolling outside this period may subject you to medical underwriting.

Yes, you can apply to switch Medicare Supplement Plans at any time, but outside your initial enrollment period or guaranteed issue situations, you may face medical underwriting. Some states offer additional protections like "birthday rules" allowing changes around your birthday. We can help you understand the specific rules that apply to your situation and timing.

No, Medicare Supplement Plans do not include prescription drug coverage. To get prescription coverage, you need to enroll in a separate Medicare Part D Prescription Drug Plan. We recommend enrolling in Part D when you're first eligible to avoid late enrollment penalties, even if you currently take few medications.

Yes, one of the primary benefits of Medicare Supplement Plans is the freedom to use any doctor or hospital nationwide that accepts Medicare. There are no network restrictions, no referrals needed for specialists, and no prior authorizations required. This provides exceptional flexibility for healthcare provider choices and when traveling.

Medicare Supplement premiums typically increase over time due to several factors including inflation, medical cost trends, and the pricing method used by the insurance company. The three common pricing methods are attained-age (increases with age), issue-age (based on age when purchased), and community-rated (same for all beneficiaries regardless of age). Understanding these differences helps with long-term planning.

Medicare Supplement Plans are portable across all 50 states, allowing you to keep your same coverage if you move. You don't need to qualify again medically, though your premium may change based on your new location. This portability is a significant advantage for those who relocate or maintain multiple residences.

During your Medigap Open Enrollment Period or guaranteed issue situations, insurance companies cannot refuse to cover pre-existing conditions or charge more because of them. Outside these periods, companies may impose waiting periods (usually six months) before covering pre-existing conditions, though they must still cover other benefits during this time.

Choosing the right plan depends on your healthcare needs, budget, and risk tolerance. Consider factors like your expected medical services usage, comfort with potential out-of-pocket costs, premium affordability over time, and whether benefits like foreign travel coverage are important to you. Our expert advisors can provide personalized guidance based on your specific situation.

No, it's illegal for an insurance company to sell you a Medicare Supplement Plan if you have a Medicare Advantage Plan. You must choose either Original Medicare with a Supplement or a Medicare Advantage Plan. If you want to switch from Medicare Advantage to Original Medicare with a Supplement, specific enrollment rules and timing considerations apply.

If your Medigap insurance company goes out of business, you have guaranteed issue rights to purchase a new Medicare Supplement Plan from another company. These special protections ensure you can maintain continuous coverage without facing medical underwriting. It's important to exercise these rights promptly within the specified timeframe.

Take the Next Step for Your Medicare Supplement Plan

Finding the right Medicare Supplement Plan provides essential financial protection and healthcare freedom during your retirement years. Our local team in Queen Creek and San Tan Valley specializes in guiding Medicare beneficiaries through their Medigap options. We provide:

- Free Medicare Supplement consultations and comparisons

- Side-by-side benefit and premium analysis

- Assistance with enrollment timing and applications

- Coordination with Medicare Part D prescription coverage

- Local expertise with Arizona Medicare regulations

Don’t navigate Medicare’s complexities alone. Contact us today to explore your Medicare Supplement options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

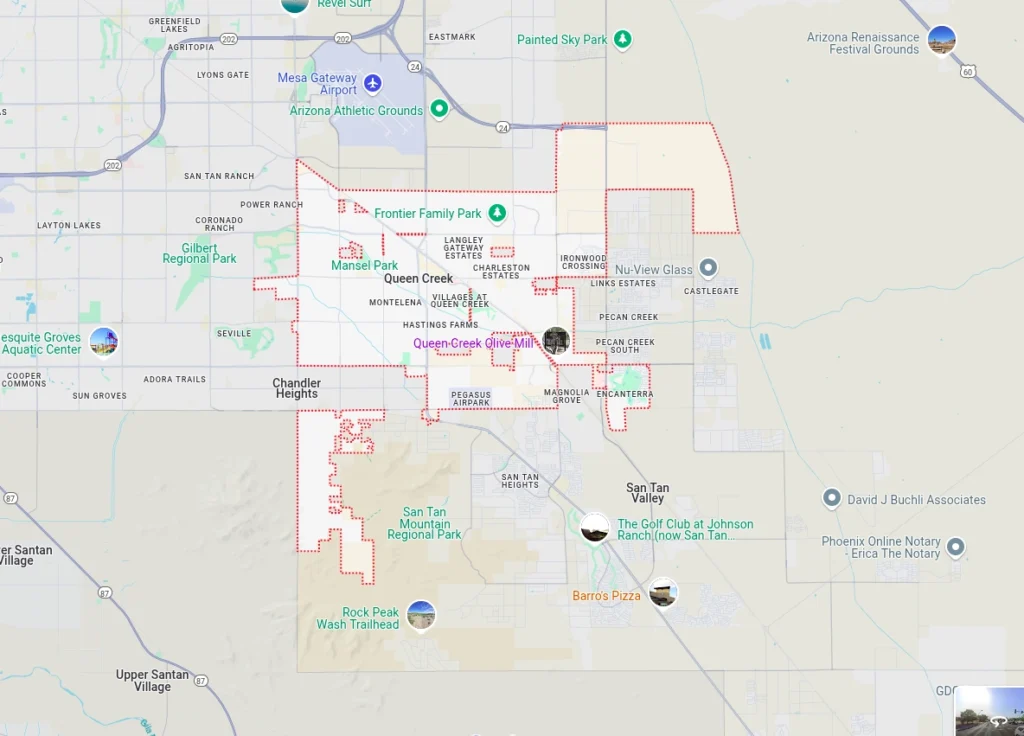

The Health Insurance Jedi proudly serves Medicare beneficiaries seeking Medicare Supplement Plans throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s Medicare landscape and local healthcare providers ensures you receive guidance that addresses your specific needs. Contact us today to discover how we can help protect your health and finances with the right Medicare Supplement Plan for your situation.