More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Medicare Advantage Plans, also known as Medicare Part C, provide an all-in-one alternative to Original Medicare that combines hospital, medical, and often prescription drug coverage in one convenient plan. These comprehensive insurance options are offered by private insurance companies approved by Medicare, delivering additional benefits and potential cost savings while providing the essential coverage you need.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right Medicare Advantage Plan requires understanding your specific healthcare needs and exploring various plan options while comparing network coverage and additional benefits. Our local expertise helps Medicare beneficiaries discover Medicare Advantage coverage that balances comprehensive protection with affordability while maintaining access to preferred providers.

Why Choose Us for Your Medicare Advantage (Part C) Guidance

Selecting the right Medicare Advantage Plan involves navigating numerous options, provider networks, and benefit structures. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on finding you the right Medicare Advantage coverage

1. Medicare Advantage Expertise

We understand that Medicare Advantage Plans have unique features and varying benefits different from Original Medicare and Supplements. Our team helps you evaluate plans based on your specific healthcare needs, including provider relationships, prescription requirements, and budget considerations. We explain Medicare Advantage options clearly without confusing jargon, ensuring you understand exactly what each plan covers

2. Local Medicare Network Knowledge

As Arizona residents ourselves living in Queen Creek and San Tan Valley, we know the local Medicare Advantage landscape thoroughly. We can guide you through which plans include your preferred local doctors and hospitals, which Medicare Advantage options local seniors typically choose, and how to maximize your benefits with Arizona providers. This local insight ensures your Medicare Advantage plan truly works for your healthcare needs in our community.

3. Continuous Medicare Support

Our service relationship extends well beyond enrollment. As your healthcare needs evolve, we provide ongoing support for network questions, benefit issues, claim concerns, and helping you review your coverage annually during the Medicare Annual Enrollment Period to ensure it continues meeting your needs.

4. Customized Medicare Solutions

Medicare Advantage guidance through our agency gives you flexibility to select the plan that best fits your specific healthcare utilization patterns and budget. Whether you're newly eligible for Medicare or considering switching your current Medicare coverage, we help you find options that address your particular needs and preferences.

5. Streamlined Medicare Advantage Enrollment

Our efficient application process makes obtaining Medicare Advantage coverage straightforward and stress-free. We guide you through eligibility requirements, help with application completion, and ensure you understand how to use your new benefits without unnecessary confusion during this important transition.

6. Round-the-Clock Medicare Assistance

Questions about your Medicare Advantage Plan don't follow standard hours, and neither do we. Our support team remains available whenever you need help understanding your coverage, resolving network issues, or addressing urgent questions about your Medicare Advantage benefits.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Medicare Advantage Plans (Part C)

Medicare Advantage Plans are an alternative way to get your Medicare benefits, combining Original Medicare Parts A and B coverage while often including additional benefits. These plans are offered by private insurance companies approved by Medicare and must provide all the same coverage as Original Medicare, with many plans offering extra benefits.

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Medicare Advantage Plans

- All-in-one coverage: Combines Medicare Parts A (hospital) and B (medical) in one plan

- Often includes Part D: Many Medicare Advantage plans include prescription drug coverage

- Additional benefits: May offer vision, dental, hearing, fitness memberships, and more

- Network-based care: Usually operates with specific provider networks

- Annual contracts: Plans renew yearly with potential benefit changes

- Out-of-pocket limits: Caps on your annual healthcare spending for covered services

What Medicare Advantage Plans Cover

Medicare Advantage Plans provide comprehensive healthcare coverage:

All Original Medicare Services

- Hospital care (Part A services)

- Doctor visits and outpatient care (Part B services)

- Preventive services and screenings

- Emergency and urgent care services

- Skilled nursing facility care

- Home health services

Additional Benefits Often Included Many Medicare Advantage Plans also offer:

- Prescription drug coverage (Part D)

- Routine vision care and eyeglasses

- Dental services and dentures

- Hearing exams and hearing aids

- Fitness program memberships

- Over-the-counter allowances for health products

Supplemental Benefits in Some Plans Depending on the specific plan, you might also find:

- Transportation to medical appointments

- Meal delivery after hospitalizations

- Telehealth services

- Wellness programs

- Home safety modifications

- Support for chronic condition management

Types of Medicare Advantage Plans

Medicare Advantage comes in several plan structures, each with different features:

Most Common Medicare Advantage Options

Health Maintenance Organization (HMO) Plans HMO Medicare Advantage features include:

- Primary care physician coordination

- Referrals typically required for specialists

- In-network providers for most routine care

- Lower premiums in many cases

- Predictable copayments for services

- Emergency coverage outside the network

Preferred Provider Organization (PPO) Plans PPO Medicare Advantage offers:

- Flexibility to see any provider, in or out of network

- No referrals required for specialists

- Lower costs when using in-network providers

- Greater provider choice and flexibility

- Coverage when traveling within the United States

- Higher premiums than HMO plans in many cases

Special Needs Plans (SNPs) Specialized plans designed for specific groups:

- Chronic Condition SNPs for specific health conditions

- Dual-Eligible SNPs for those with both Medicare and Medicaid

- Institutional SNPs for those in long-term care facilities

- Tailored benefits for specific health needs

- Care coordination services

- Specialized provider networks

Other Plan Types Additional Medicare Advantage options include:

- Private Fee-for-Service (PFFS) Plans

- Medicare Savings Account (MSA) Plans

- HMO Point-of-Service (HMO-POS) Plans

- Provider Sponsored Organizations (PSOs)

- Religious Fraternal Benefit Society Plans

Plan Comparison Considerations

When evaluating Medicare Advantage Plans, consider:

- Provider network adequacy for your needs

- Prescription drug formulary coverage

- Additional benefits that match your priorities

- Out-of-pocket cost structures

- Star rating quality measures

- Local provider participation

Medicare Advantage Enrollment Guidelines

Understanding when and how to enroll in Medicare Advantage Plans is essential:

Initial Enrollment Opportunities

Initial Enrollment Period (IEP) This first enrollment window includes:

- Seven-month period around your 65th birthday

- Starts 3 months before your birthday month

- Includes your birthday month

- Extends 3 months after your birthday month

- Opportunity to enroll without health questions

- Special timing for disability-related Medicare eligibility

Annual Enrollment Period (AEP) Every year from October 15 to December 7:

- Switch between Medicare Advantage Plans

- Move from Original Medicare to Medicare Advantage

- Change from Medicare Advantage to Original Medicare

- Add, drop, or change prescription drug coverage

- Review and compare plan options annually

- Changes become effective January 1

Medicare Advantage Open Enrollment Period Each year from January 1 to March 31:

- If you’re already in a Medicare Advantage Plan

- Switch to another Medicare Advantage Plan

- Return to Original Medicare (with or without Part D)

- One change allowed during this period

- Changes effective the first of the month following enrollment

Special Enrollment Periods

Special situations creating enrollment rights:

- Moving outside your plan’s service area

- Losing other coverage like employer insurance

- Plan leaving the Medicare program

- Qualifying for Extra Help with Medicare costs

- Moving into or out of an institutional setting

- Qualifying for Medicaid coverage

- 5-star Special Enrollment Period opportunities

Choosing the Right Medicare Advantage Plan

Selecting appropriate Medicare Advantage coverage requires evaluating several factors:

Assess Your Healthcare Needs

Consider your personal health situation:

- Current doctors and specialists you want to keep

- Prescription medications you take regularly

- Anticipated medical services and treatments

- Interest in extra benefits like dental or vision

- Your travel patterns and seasonal residences

- Specific health conditions requiring management

Evaluate Provider Networks

Medicare Advantage network considerations:

- Confirming your doctors participate in the plan

- Hospital and facility network inclusion

- Specialist availability within the network

- Pharmacy network if prescription coverage included

- Travel coverage and out-of-area service access

- Referral and authorization requirements

Compare Plan Benefits

Look beyond the basic coverage:

- Prescription drug formulary tier placement

- Cost-sharing for frequently used services

- Additional benefits like dental, vision, and hearing

- Fitness memberships and wellness programs

- Over-the-counter benefit allowances

- Telehealth options and convenience services

Consider Quality and Satisfaction

Quality indicators for Medicare Advantage:

- Medicare Star Ratings (1-5 stars)

- Member satisfaction scores

- Complaint and appeal statistics

- Care management programs

- Customer service reputation

- Local provider feedback

Medicare Advantage vs. Other Medicare Options

Understanding how Medicare Advantage compares to alternatives helps with decision-making:

Medicare Advantage vs. Original Medicare

Key differences include:

- Medicare Advantage provides all-in-one coverage; Original Medicare has separate parts

- Advantage plans usually include drug coverage; Original requires separate Part D

- Medicare Advantage offers additional benefits not covered by Original Medicare

- Medicare Advantage has out-of-pocket maximums; Original Medicare doesn’t

- Original Medicare allows any provider nationwide; Advantage uses networks

- Medicare Advantage may require plan approval for certain services

Medicare Advantage vs. Medicare Supplement

Important distinctions:

- Medicare Advantage replaces Original Medicare; Supplements work with it

- Advantage often includes prescription coverage; Supplements require separate Part D

- Medicare Advantage uses provider networks; Supplements allow any Medicare provider

- Advantage plans may offer extra benefits; Supplements only cover Medicare gaps

- Medicare Advantage typically has lower premiums; Supplements usually higher

- Different enrollment periods and eligibility rules apply

Medicare Advantage vs. Employer Coverage

Considerations when transitioning from employer insurance:

- Comparing network coverage and provider access

- Evaluating total cost compared to employer plan

- Assessing prescription drug coverage differences

- Reviewing additional benefits versus employer offerings

- Understanding coordination of benefits if keeping employer coverage

- Special enrollment periods when employer coverage ends

Prescription Drug Coverage in Medicare Advantage

Many Medicare Advantage Plans include prescription coverage:

Integrated Prescription Benefits

Understanding drug coverage in Medicare Advantage:

- Formulary (list of covered drugs) variations between plans

- Tier structure determining cost-sharing for medications

- Prior authorization and step therapy requirements

- Pharmacy network options and preferred pharmacies

- Mail-order pharmacy services

- Coverage gap provisions

Drug Coverage Considerations

Factors affecting prescription coverage decisions:

- Current medication inclusion in plan formulary

- Tier placement of your specific medications

- Pharmacy preferences and convenience

- Medication management programs

- Specialty drug coverage and requirements

- Insulin coverage programs

Using Your Medicare Advantage Plan

Effectively using your Medicare Advantage coverage ensures maximum benefit:

Network Utilization

Working within your plan’s network:

- Understanding primary care physician role

- Referral processes for specialists if required

- Prior authorization for certain services

- Emergency versus urgent care coverage

- Out-of-network coverage limitations

- Travel and out-of-area service access

Preventive Benefits

Taking advantage of covered preventive care:

- Annual wellness visits

- Recommended screenings and vaccines

- Health risk assessments

- Preventive dental services if included

- Vision screenings if covered

- No-cost preventive services

Additional Benefits Utilization

Maximizing plan extras:

- Fitness program participation

- Over-the-counter benefit allowances

- Transportation services

- Meal benefits after hospitalizations

- Telehealth services for convenience

- Care management program enrollment

Annual Plan Review and Changes

Medicare Advantage Plans can change annually:

Annual Notice of Change

Understanding plan modifications:

- Review Annual Notice of Change document each September

- Identify changes to benefits, networks, or costs

- Compare changes against your current needs

- Evaluate if current plan remains the best option

- Consider alternative plans during Annual Enrollment

- Make informed decisions about coverage changes

Annual Plan Comparison

Regular evaluation of options:

- Review current health and prescription needs

- Compare available plans in your area annually

- Check provider networks for continuing participation

- Evaluate prescription drug formulary changes

- Assess new benefits or enhanced offerings

- Consider overall value versus alternatives

FAQS

Frequently Asked Questions About Medicare Advantage Plans

Medicare Advantage (Part C) is an alternative way to receive your Medicare benefits through private insurance companies approved by Medicare. While Original Medicare includes separate Part A (hospital) and Part B (medical) coverage administered by the federal government, Medicare Advantage combines these benefits in one plan. Medicare Advantage plans often include prescription drug coverage and additional benefits not covered by Original Medicare, like dental, vision, and fitness memberships.

Whether you can keep your current doctors depends on the specific Medicare Advantage Plan you choose. Most Medicare Advantage Plans have provider networks, and your costs are lowest when using network providers. Before enrolling, we'll help you verify if your preferred doctors and hospitals participate in the plan's network. PPO plans offer more flexibility to see out-of-network providers at higher costs, while HMO plans typically require you to use network providers for routine care.

Most Medicare Advantage Plans include prescription drug coverage (Medicare Part D). These are called MA-PD plans. When evaluating plans, it's important to check the plan's drug formulary to ensure your specific medications are covered and to understand which tier they fall under, as this affects your costs. Some Medicare Advantage Plans don't include drug coverage, so it's essential to choose a plan that meets your medication needs.

Medicare Advantage Plans always cover emergency and urgent care within the United States, even if you're outside your plan's service area. For routine care while traveling, coverage varies by plan type. PPO plans typically offer more flexibility for out-of-area care than HMO plans. If you travel frequently or spend time in different locations throughout the year, this is an important consideration when selecting a plan. Some plans offer travel benefits or worldwide emergency coverage.

Medicare Advantage Plans have various cost structures, including monthly premiums (in addition to your Part B premium), deductibles, copayments, and coinsurance for services. Many plans feature fixed copayments for doctor visits, hospital stays, and prescriptions, making costs more predictable. Unlike Original Medicare, Medicare Advantage Plans have annual out-of-pocket maximums that cap your spending on covered services, providing financial protection.

Yes, you can switch Medicare Advantage Plans during specific enrollment periods. The Annual Enrollment Period (October 15-December 7) allows you to change plans for the following year. Additionally, the Medicare Advantage Open Enrollment Period (January 1-March 31) allows those already in Medicare Advantage to switch to another plan or return to Original Medicare. Special Enrollment Periods may also apply in certain situations like moving or plan termination.

Yes, you must continue paying your Medicare Part B premium when enrolled in a Medicare Advantage Plan. This is in addition to any premium charged by your Medicare Advantage Plan, though many plans have low or even zero additional premiums. Your Part B premium is typically deducted from your Social Security benefits if you receive them, or you'll be billed directly if not receiving Social Security.

If your doctor leaves your plan's network mid-year, your Medicare Advantage Plan must notify you before the change occurs. Depending on circumstances, plans may allow you to continue seeing that provider for a transitional period. If a significant number of providers leave the network, you might qualify for a Special Enrollment Period to switch plans. We recommend reviewing your plan's provider network during each Annual Enrollment Period.

Medicare evaluates Medicare Advantage Plans with a 5-Star Rating System based on quality, customer service, and member satisfaction. Higher-rated plans often provide better care coordination, customer service, and overall member experience. While star ratings are important, they should be considered alongside other factors like network coverage and costs. Beneficiaries enrolled in plans with lower star ratings have additional opportunities to switch to 5-star plans if available in their area.

If you move outside your Medicare Advantage Plan's service area, you'll qualify for a Special Enrollment Period to choose a new plan in your new location. This period begins the month before your move and lasts for two full months after your move. If you notify your plan before moving, your Special Enrollment Period can begin up to one month before your move and last for two months after. Moving within your plan's service area may also trigger a Special Enrollment Period if new plan options become available.

Take the Next Step for Your Medicare Advantage Plan

Finding the right Medicare Advantage Plan provides comprehensive healthcare coverage and valuable additional benefits to support your health and wellness. Our local team in Queen Creek and San Tan Valley specializes in guiding Medicare beneficiaries through their Medicare Advantage options. We provide:

- Free Medicare Advantage consultations and comparisons

- Network analysis to ensure your doctors are covered

- Prescription drug formulary verification

- Benefit and cost structure explanations

- Assistance with enrollment timing and applications

- Local expertise with Arizona Medicare Advantage plans

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

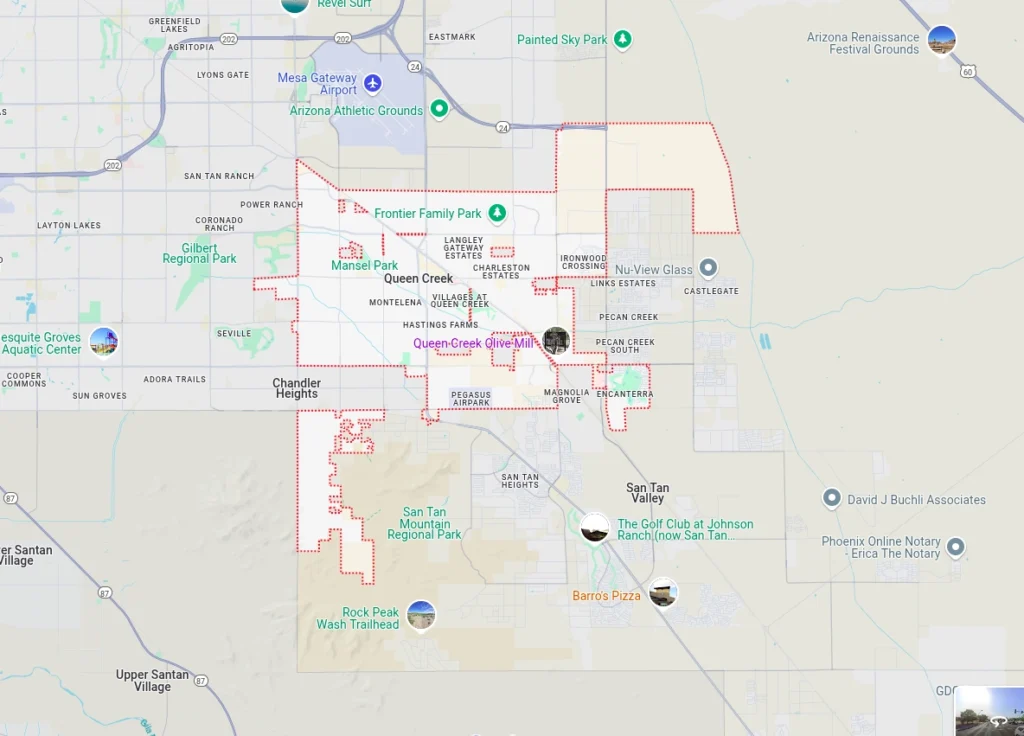

The Health Insurance Jedi proudly serves Medicare beneficiaries seeking Medicare Advantage Plans throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s Medicare Advantage landscape and local provider networks ensures you receive guidance that addresses your specific needs. Contact us today to discover how we can help enhance your Medicare coverage with the right Medicare Advantage Plan for your situation.