More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Insurance for self-employed individuals and 1099 contractors provides essential coverage that protects both your health and business interests while offering significant tax advantages. These specialized insurance solutions help independent professionals, freelancers, and solopreneurs access quality coverage options without the support of a traditional employer benefits package.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right insurance as a self-employed individual requires understanding your unique business and personal needs while exploring cost-effective coverage options. Our local expertise helps independent professionals discover insurance solutions that balance comprehensive protection with affordability while maximizing available tax benefits.

Why Choose Us for Your Self-Employed / 1099 Insurance

Selecting the right insurance as a self-employed professional involves navigating complex coverage options, tax considerations, and business protection strategies. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on creating insurance solutions that work for your independent business.

1. Self-Employed Insurance Expertise

We understand that insurance for 1099 contractors has unique considerations different from both individual and employer-sponsored coverage. Our team helps you evaluate plans based on your specific business needs, including health insurance, liability protection, and income preservation. We explain self-employed insurance options clearly without confusing jargon, ensuring you understand exactly how each option affects both your personal and business wellbeing.

2. Local Independent Business Knowledge

As supporters of Arizona's entrepreneurial community in Queen Creek and San Tan Valley, we know the local self-employed insurance landscape thoroughly. We can guide you through coverage options that work well for independent professionals in our area, what similar businesses choose, and how to navigate Arizona-specific regulations. This local insight ensures your insurance truly works for your business needs in our community.

3. Continuous Self-Employed Support

Our service relationship extends well beyond initial enrollment. As your independent business grows and changes, your insurance needs evolve too. We provide ongoing support for coverage adjustments, claims assistance, tax planning considerations, and helping you optimize your insurance benefits throughout the year.

4. Customized Self-Employed Solutions

Insurance through our agency gives you flexibility to design coverage that fits your specific business structure and budget. Whether you're a freelancer, independent contractor, consultant, or solopreneur, we help you find insurance plans that address your specific business and personal requirements while maximizing tax advantages.

5. Streamlined Self-Employed Enrollment

Our efficient application process makes obtaining coverage straightforward and business-friendly. We guide you through plan options, help with application requirements, and ensure you get the coverage you need without unnecessary paperwork or complications that take time away from your business.

6. Round-the-Clock Self-Employed Assistance

Independent businesses operate beyond traditional hours, and so do we. Our support team remains available whenever you need help understanding your coverage, addressing claims questions, or managing urgent insurance matters that affect your business operations.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Insurance for Self-Employed / 1099

Insurance for self-employed individuals encompasses both personal health protection and business coverage needs. These specialized insurance solutions support independent professionals who must secure their own coverage without the backing of a traditional employer benefits package.

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Insurance Needs for Self-Employed Professionals

- Health insurance: Comprehensive medical coverage with potential tax advantages

- Income protection: Disability insurance to replace income if unable to work

- Liability coverage: Professional and general liability protection

- Business property: Coverage for business equipment and assets

- Retirement planning: Self-employed retirement options with tax benefits

- Tax consideration: Insurance deductibility and tax planning integration

Types of Self-Employed Health Insurance Options

Different health coverage approaches serve various independent business needs:

Individual Marketplace Plans

- Comprehensive coverage through Health Insurance Marketplace

- Potential premium tax credits based on income

- Essential health benefits guaranteed

- Special enrollment consideration for self-employed

- Coverage regardless of pre-existing conditions

- Good option for many self-employed individuals

Private Individual Plans

- Direct purchase from insurance carriers outside the Marketplace

- Potentially broader provider networks

- Year-round enrollment availability

- Flexible plan options and benefit designs

- Less income verification requirements

- Alternative to Marketplace coverage

Health Share Plans

- Alternative coverage based on cost-sharing among members

- Often lower monthly costs than traditional insurance

- Different structure than conventional insurance

- Faith-based or ethical sharing principles

- Less regulatory oversight than insurance

- Appeal to some self-employed individuals

Association Health Plans

- Group coverage through professional or trade associations

- Potential access to group rates and benefits

- Industry-specific plan designs in some cases

- Shared risk pool with similar professionals

- Benefit from group purchasing power

- Available through professional memberships

Business Protection for Self-Employed / 1099

Beyond health insurance, self-employed individuals need business protection coverage:

Professional Liability Insurance

Essential protection includes:

- Coverage for professional errors and omissions

- Client claims of negligence or inadequate work

- Legal defense costs for covered claims

- Protection for your professional reputation

- Industry-specific coverage options

- Financial safeguards against lawsuits

General Liability Insurance

Business protection covering:

- Third-party bodily injury claims

- Property damage you cause to others

- Personal and advertising injury

- Protection for client visits to your space

- Coverage for on-site accidents

- Essential for client-facing businesses

Business Property Coverage

Safeguard your income stream:

- Coverage for lost income during business disruptions

- Protection during property repair periods

- Extra expense coverage for temporary locations

- Support during disaster recovery

- Protection against unexpected shutdowns

- Income preservation during difficult periods

Arizona Self-Employed Insurance Landscape

Arizona offers unique considerations for self-employed insurance seekers:

Health Insurance Considerations

Marketplace Options Arizona self-employed considerations include:

- State-specific plan availability and pricing

- Local provider network adequacy

- Rural versus urban coverage differences

- Arizona subsidy qualification guidelines

- State-specific enrollment periods

- Local insurance carrier options

Health Coverage Alternatives Beyond traditional insurance:

- Association options in Arizona

- Local health-sharing ministries

- Direct primary care arrangements

- Short-term coverage availability

- Supplemental coverage options

- Integrated healthcare approaches

Business Insurance Requirements

Arizona Business Regulations State-specific considerations include:

- Industry-specific insurance requirements

- Professional licensing insurance mandates

- State contractor insurance requirements

- Local business permit requirements

- Client contract insurance requirements

- Local liability considerations

Industry-Specific Needs Coverage varies by profession:

- Construction contractor requirements

- Professional service provider needs

- Healthcare practitioner considerations

- Real estate professional requirements

- Technology consultant protection

- Retail and service business needs

Self-Employed Insurance Tax Advantages

Self-employed insurance offers significant tax benefits:

Health Insurance Deductibility

Self-employed tax advantages include:

- Potential deduction for health insurance premiums

- Qualification requirements for deductions

- Above-the-line deduction benefits

- Family coverage deductibility

- Coordination with other tax strategies

- Documentation requirements for tax purposes

Health Savings Accounts (HSAs)

Triple tax advantage opportunities:

- HSA contribution tax deductibility

- Tax-free growth within accounts

- Tax-free withdrawals for qualified expenses

- Higher contribution limits for families

- Catch-up contributions for older individuals

- Long-term tax planning benefits

Business Insurance Deductions

Business expense considerations:

- Deductibility of liability insurance premiums

- Business property coverage deductions

- Home office insurance considerations

- Business interruption premium deductions

- Documentation for business expenses

- Separate business entity considerations

Retirement Plan Integration

Self-employed retirement options:

- Solo 401(k) contribution benefits

- SEP-IRA tax advantages

- SIMPLE IRA considerations

- Retirement plan contribution limits

- Tax-deferred growth opportunities

- Coordination with insurance strategies

Choosing the Right Self-Employed Insurance

Selecting appropriate insurance requires evaluating your specific self-employed business needs:

Assess Your Business Profile

Consider your business characteristics:

- Business structure (sole proprietor, LLC, etc.)

- Industry and professional requirements

- Client expectations and contract requirements

- Business assets requiring protection

- Revenue and income protection needs

- Growth projections and future plans

Evaluate Your Personal Situation

Personal factors affecting choices:

- Family coverage requirements

- Personal health status and needs

- Risk tolerance and preference

- Budget constraints and priorities

- Tax situation and strategy

- Long-term business goals

Compare Coverage Options

When reviewing plans, examine:

- Health insurance premiums and benefits

- Liability coverage limits and exclusions

- Business property protection scope

- Income protection features

- Policy limitations and restrictions

- Claims process and customer service

Consider Cost Management

Affordability strategies include:

- High-deductible health plans with HSAs

- Bundled insurance policies for discounts

- Association or group membership benefits

- Strategic use of supplemental coverage

- Customized coverage limits based on risk

- Regular policy reviews and adjustments

Implementing Self-Employed Insurance Plans

Successfully securing self-employed insurance involves several key steps:

Health Insurance Enrollment

Obtaining health coverage includes:

- Determining eligibility for Marketplace plans

- Gathering income documentation for applications

- Understanding enrollment period requirements

- Completing accurate application information

- Setting up premium payment methods

- Accessing provider networks and benefits

Business Insurance Setup

Establishing business protection:

- Assessing specific business risks

- Selecting appropriate coverage types

- Completing business information forms

- Providing business operation details

- Understanding policy effective dates

- Setting up policy renewal tracking

Integration With Business Planning

Coordinating with business strategy:

- Incorporating insurance costs into business budget

- Setting aside funds for deductibles and copayments

- Planning for premium increases

- Integrating with tax planning strategy

- Building emergency funds for uncovered expenses

- Including insurance in business plan documents

Annual Insurance Review

Regular evaluation includes:

- Assessing changing business needs

- Reviewing coverage adequacy as business grows

- Comparing current plans with market options

- Adjusting coverage limits based on experience

- Evaluating new risks or business changes

- Optimizing tax benefits and strategies

Balancing Personal and Business Coverage

Self-employed insurance requires balancing both personal and business protection:

Health and Personal Protection

Personal coverage considerations:

- Comprehensive health insurance for yourself and family

- Personal disability insurance for income replacement

- Life insurance for family protection

- Personal liability umbrella coverage

- Long-term care planning

- Critical illness and accident protection

Business Continuation

Business protection strategies:

- Key person insurance considerations

- Business succession planning

- Buy-sell agreement funding

- Business debt protection

- Client project completion protection

- Business legacy planning

Integrated Protection Planning

Holistic approach benefits:

- Coordination between personal and business coverage

- Elimination of coverage gaps and overlaps

- Strategic use of business entity structures

- Personal asset protection strategies

- Liability limitation approaches

- Comprehensive risk management

FAQS

Frequently Asked Questions About Self-Employed / 1099 Insurance

Yes, self-employed individuals can often deduct health insurance premiums as a business expense. This "self-employed health insurance deduction" is taken as an adjustment to income rather than an itemized deduction, potentially reducing both income tax and self-employment tax. This valuable tax benefit should be coordinated with your tax professional as part of your overall business strategy.

When self-employed, you're responsible for finding, purchasing, and managing your own insurance without employer contributions. However, you gain complete control over plan selection, may qualify for tax deductions unavailable to employees, and can customize coverage exactly to your needs. Self-employed insurance also stays with you regardless of client or project changes.

Most self-employed professionals should seriously consider professional liability insurance (also called errors and omissions insurance). This coverage protects you if clients claim your work caused them financial harm, whether through errors, omissions, or negligence. Many clients require this coverage before contracting with 1099 professionals, especially in consulting, IT, design, and professional services.

While traditional group plans typically require multiple employees, self-employed individuals have several alternatives. These include professional association health plans, membership in business groups offering health coverage, or forming a group plan if you have even one W-2 employee. Health reimbursement arrangements (HRAs) provide another option for certain business structures.

Income variability is a common challenge for self-employed professionals. For Marketplace plans, subsidies are based on annual income projections, with reconciliation at tax time. Private plans aren't affected by income changes. For business insurance, most policies don't fluctuate with income, though some liability coverage might be tied to revenue. We can help develop strategies for managing insurance during variable income periods.

Business structure decisions and insurance strategies should work together. Forming an LLC or corporation can provide additional liability protection beyond insurance policies and may affect insurance pricing and availability. Some coverage options may be available only to certain business entities. We recommend coordinating with both insurance and legal professionals when making these important decisions.

Once you hire employees, your insurance needs expand significantly. You'll likely need workers' compensation insurance, employment practices liability coverage, and possibly benefit plans for employees. When using independent contractors, you should verify they have their own insurance coverage and consider contingent liability protection. We can help you transition your insurance strategy as your business grows.

Proper coverage typically includes health insurance, professional liability protection appropriate for your industry, general liability coverage, business property insurance, and income protection. Contract requirements from clients, industry standards, professional licensing mandates, and risk assessment all factor into determining adequacy. We provide comprehensive reviews to identify and address potential coverage gaps.

Many insurers offer business owner policies (BOPs) that combine multiple coverage types into one package, often at lower rates than purchasing separately. These typically include general liability, property insurance, and business interruption coverage. Personal and health insurance policies usually remain separate, but we can help identify bundling opportunities for potential savings.

We recommend a comprehensive review at least annually and whenever significant business changes occur. These changes might include new services offered, revenue increases, equipment purchases, location changes, or taking on larger clients. Insurance needs evolve as your business grows, making regular reviews essential for maintaining appropriate protection.

Take the Next Step for Your Self-Employed / 1099 Insurance

Finding the right insurance protection as a self-employed professional or 1099 contractor provides essential coverage for both your business and personal needs. Our local team in Queen Creek and San Tan Valley specializes in guiding independent professionals through their insurance options. We provide:

- Free self-employed insurance consultations and policy reviews

- Assistance with health and business insurance selection

- Guidance on tax-advantaged coverage strategies

- Support for policy management and claims

- Local expertise with Arizona self-employed insurance regulations

Don’t let your independent business status leave you vulnerable. Contact us today to explore your self-employed insurance options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

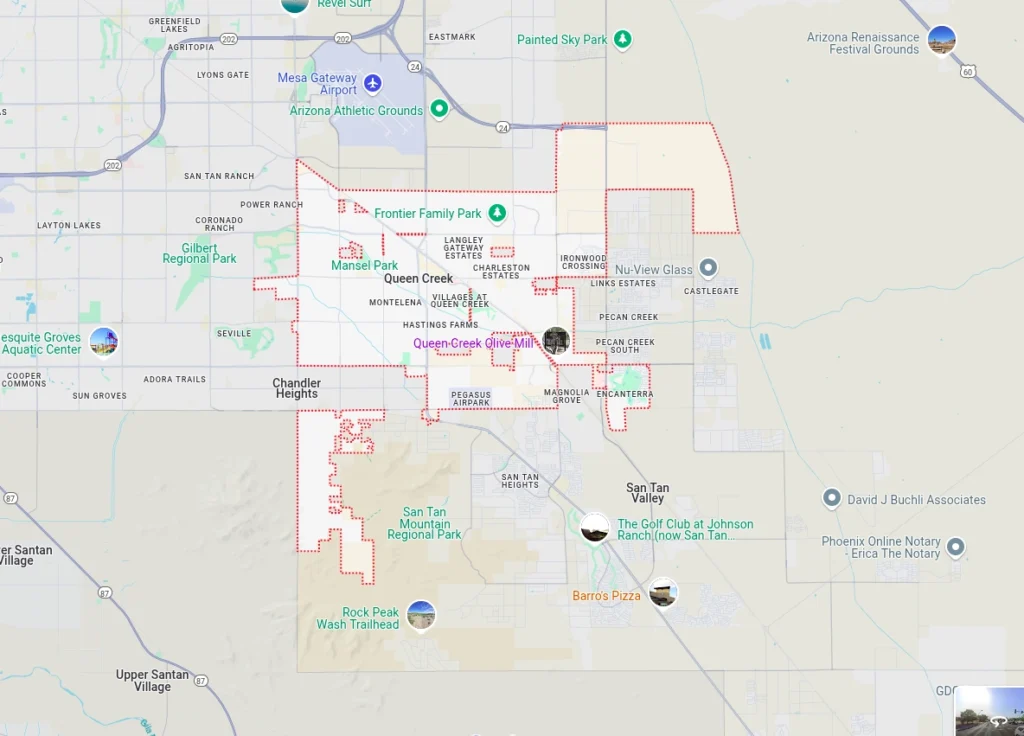

The Health Insurance Jedi proudly serves self-employed individuals and 1099 contractors seeking insurance protection throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s insurance landscape for independent professionals ensures you receive coverage that protects both your business and personal needs. Contact us today to discover how we can help secure your self-employed business with the right insurance solutions.