More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Health insurance provides essential coverage for medical expenses, helping individuals and families manage healthcare costs effectively. Whether you’re self-employed, between jobs, or seeking better coverage options, individual health insurance offers flexibility and protection tailored to your specific needs.

In Queen Creek, San Tan Valley, and throughout Arizona, having the right health insurance ensures access to quality healthcare services while protecting your financial well-being. Our local expertise helps you navigate the complexities of health insurance to find coverage that fits your budget and healthcare requirements.

Why Choose Us for Your Health Coverage

Choosing the right health insurance plan requires understanding your options and making informed decisions. Our local team in Queen Creek and San Tan Valley provides professional guidance with personalized service that makes the process straightforward and stress-free.

1. Personalized Guidance

We explain your health insurance options in clear, simple terms. Our team helps you compare different plans side by side, highlighting the differences in coverage, costs, and benefits. We ensure you understand exactly what each plan offers and how it fits your specific needs, without using confusing insurance jargon or sales pressure.

2. Local Expertise

As members of the Queen Creek and San Tan Valley community, we possess in-depth knowledge of Arizona health insurance markets. We stay current with plan changes, pricing updates, and new healthcare legislation that affects your coverage options. Our local presence means we understand which plans work best with area hospitals and healthcare providers.

3. Ongoing Support

Our service extends beyond enrollment. We provide year-round assistance with claims questions, finding in-network providers, and navigating coverage changes during open enrollment periods. Consider us your long-term healthcare coverage partner who's always available when you need help.

4. Control Over Policy

Individual health insurance gives you complete control over your coverage choices. You can customize plans based on your healthcare needs, preferred doctors, and budget constraints. This flexibility ensures your insurance works for you, not the other way around.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Individual Health Insurance

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Individual Plans

With health insurance, you get:

- Portability: Keep your coverage when changing jobs or during employment gaps

- Customization: Choose plans that match your specific healthcare needs

- Network flexibility: Select plans that include your preferred doctors and hospitals

- Comprehensive coverage: Access to preventive care, emergency services, and specialist visits

Types of Individual Health Insurance Plans

HMO (Health Maintenance Organization)

- Lower monthly premiums

- Requires primary care physician selection

- Referrals needed for specialist visits

- Must use in-network providers except for emergencies

- Best for those who prefer coordinated care at lower costs

PPO (Preferred Provider Organization)

- Higher monthly premiums

- No referral requirements

- Flexibility to see any provider

- Lower costs when using in-network providers

- Ideal for those wanting maximum flexibility

EPO (Exclusive Provider Organization)

- Moderate premiums

- No referral requirements

- Must use in-network providers except emergencies

- Direct access to specialists

- Good balance of cost and flexibility

POS (Point of Service)

- Features of both HMO and PPO plans

- Requires primary care physician

- Can see out-of-network providers at higher cost

- Referrals needed for specialists

- Suitable for those wanting some out-of-network options

Arizona Health Insurance Marketplace

The Health Insurance Marketplace serves as the primary platform for purchasing individual health insurance in Arizona. Understanding how the Marketplace works helps you find affordable coverage that meets your needs.

Open Enrollment Period

The annual Open Enrollment Period typically runs from November 1 through January 15. During this time, anyone can:

- Enroll in a new health plan

- Switch to a different plan

- Renew existing coverage

- Apply for financial assistance

Coverage usually begins on January 1 if you enroll by December 15.

Special Enrollment Periods

Qualifying life events allow enrollment outside the Open Enrollment Period. These include:

- Loss of health coverage (job loss, aging off parent’s plan, COBRA expiration)

- Life changes (marriage, divorce, birth, adoption)

- Moving to Queen Creek, San Tan Valley, or a new coverage area

- Gaining citizenship or lawful presence

- Being released from incarceration

- Income changes affecting subsidy eligibility

You typically have 60 days from the qualifying event to enroll.

Metal Categories Explained

Health insurance plans are organized into metal categories that indicate how costs are shared between you and your insurance company:

Bronze Plans

- Lowest monthly premiums

- Highest deductibles and out-of-pocket costs

- Insurance pays a smaller portion of healthcare costs

- You pay a larger portion through deductibles, copays, and coinsurance

- Best for healthy individuals who want catastrophic coverage

Silver Plans

- Moderate monthly premiums

- Moderate deductibles and out-of-pocket costs

- Insurance pays a moderate portion of healthcare costs

- You pay a moderate portion of costs

- Most popular choice; eligible for cost-sharing reductions

Gold Plans

- Higher monthly premiums

- Lower deductibles and out-of-pocket costs

- Insurance pays a larger portion of healthcare costs

- You pay a smaller portion of costs

- Good for frequent healthcare users

Platinum Plans

- Highest monthly premiums

- Lowest deductibles and out-of-pocket costs

- Insurance pays the largest portion of healthcare costs

- You pay the smallest portion of costs

- Best for those with chronic conditions or high healthcare needs

Understanding Health Insurance Costs

Health insurance involves several types of costs. Understanding each helps you budget effectively and choose appropriate coverage.

Monthly Premiums

Your premium is the amount you pay each month to maintain coverage. This cost is due regardless of whether you use healthcare services. Premiums vary based on:

- Plan type and metal level

- Your age and location

- Tobacco use

- Number of people covered

Deductibles

The deductible is the amount you pay for covered services before insurance begins paying. Plans with lower premiums typically have higher deductibles. Some services, like preventive care, are covered before meeting your deductible.

Copayments

A copayment (copay) is a fixed amount you pay for specific services. You might have different copays for primary care visits, specialist appointments, and various tiers of prescription medications. These fixed amounts help make costs predictable.

Coinsurance

Coinsurance is your share of costs after meeting your deductible, expressed as a percentage. With coinsurance, you pay a portion of the service cost while your insurance covers the rest. This cost-sharing continues until you reach your out-of-pocket maximum.

Out-of-Pocket Maximum

This is the most you’ll pay for covered services in a plan year. Once reached, insurance pays for covered services. This protection prevents catastrophic medical expenses and provides peace of mind.

Financial Assistance Programs

Many individuals and families qualify for financial help to make health insurance more affordable. Two main types of assistance are available through the Marketplace.

Premium Tax Credits

These subsidies reduce your monthly premium costs. Eligibility depends on:

- Household income relative to the federal poverty level

- Not having access to affordable employer coverage

- Not being eligible for Medicare or Medicaid

- Filing taxes as an individual or family

You can apply credits monthly to lower premiums or claim them when filing taxes.

Cost-Sharing Reductions

These reduce your deductible, copayments, and coinsurance if you:

- Qualify for premium tax credits

- Have income within eligible ranges

- Enroll in a Silver plan

Cost-sharing reductions lower out-of-pocket expenses for eligible individuals.

Income Guidelines

Financial assistance is available at various income levels, typically based on the federal poverty level. These guidelines are updated annually and vary based on household size. Many middle-income families are surprised to learn they qualify for assistance. Our independent agents can help determine your eligibility during a consultation.

Pre-Existing Conditions

Current law prohibits health insurance companies from:

- Denying coverage based on pre-existing conditions

- Charging higher premiums due to health status

- Excluding coverage for pre-existing condition treatment

- Imposing waiting periods for coverage

This protection applies to all Marketplace plans and most individual health insurance policies, ensuring access to coverage regardless of medical history.

Essential Health Benefits

All Marketplace plans must cover ten essential health benefits:

- Ambulatory patient services (outpatient care)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Laboratory services

- Preventive services and chronic disease management

- Pediatric services, including dental and vision care

These benefits ensure comprehensive coverage for most healthcare needs.

Choosing the Right Plan

Selecting appropriate health insurance requires evaluating several factors:

Assess Your Healthcare Needs

- Frequency of doctor visits

- Prescription medications

- Planned procedures or treatments

- Preferred healthcare providers

- Chronic conditions requiring ongoing care

Evaluate Total Costs

Consider both premium and out-of-pocket expenses:

- Monthly premium payments

- Annual deductible amounts

- Copayments for common services

- Maximum out-of-pocket limits

- Prescription drug costs

Check Provider Networks

Verify that your preferred doctors, specialists, and hospitals are in-network. Out-of-network care typically costs significantly more or may not be covered at all.

Compare Plan Benefits

Look beyond basic coverage to understand:

- Prescription drug formularies

- Coverage for specific treatments

- Prior authorization requirements

- Referral policies

- Telehealth options

Using Your Health Insurance Effectively

Maximize your health insurance benefits by understanding how to use coverage wisely:

Preventive Care

Most plans cover preventive services at no cost, including:

- Annual physical exams

- Immunizations

- Cancer screenings

- Well-child visits

- Preventive lab work

Schedule these services regularly to maintain good health and catch problems early.

Understanding Networks

Using in-network providers saves money. Before receiving care:

- Verify provider network status

- Understand out-of-network costs

- Get referrals when required

- Check if prior authorization is needed

Managing Prescription Costs

Save on medications by:

- Using generic drugs when available

- Checking mail-order pharmacy options

- Understanding your plan’s formulary

- Asking about manufacturer discounts

- Comparing pharmacy prices

When to Use Different Care Settings

Choose appropriate care facilities to manage costs:

- Primary care physician for routine health issues

- Urgent care for non-emergency immediate needs

- Emergency room for life-threatening conditions

- Telehealth for minor concerns and follow-ups

Ready to Find the Right Coverage?

Don’t navigate health insurance alone. Our experienced agents can help you find the perfect plan for your needs and budget.

- Get a free personalized quote today

- Schedule a no-pressure consultation with our experts

- Have questions? Call us at +123456789

Our help comes at no extra cost to you. Let us make health insurance simple!

FAQS

Frequently asked questions

Individual health insurance is coverage you purchase directly from an insurance company or through the Health Insurance Marketplace. Unlike employer-sponsored group plans, you select and pay for this coverage independently. Plans provide financial protection against medical expenses while ensuring access to healthcare services.

Individual health insurance serves those who:

- Are self-employed or work as independent contractors

- Don't have access to employer-sponsored coverage

- Are between jobs or retired before Medicare eligibility

- Find employer coverage too expensive

- Prefer choosing their own coverage

Costs vary based on multiple factors:

- Plan type and metal level

- Your age and location

- Family size

- Income (for subsidy eligibility)

- Tobacco use

Many people qualify for premium tax credits that significantly reduce monthly costs. Our team can help calculate your actual costs after available subsidies.

Whether you can keep your doctors depends on the plan's provider network. Before enrolling, we help verify if your preferred providers are in-network. Most areas offer multiple plan options with different networks, allowing you to find coverage that includes your doctors.

All Marketplace plans cover essential health benefits including doctor visits, hospital care, emergency services, prescriptions, preventive care, mental health services, and more. Specific coverage details vary by plan, but all provide comprehensive protection against major medical expenses.

Premium tax credits reduce your monthly insurance costs based on household income. Cost-sharing reductions lower deductibles and copayments for those who qualify. These subsidies make health insurance affordable for individuals and families earning up to 400% of the federal poverty level.

Insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. All plans must cover treatment for pre-existing conditions without waiting periods.9

HMO plans typically cost less but require you to stay within a specific provider network and get referrals for specialists. PPO plans cost more but offer flexibility to see any provider and don't require referrals. Your choice depends on your preferences for cost versus flexibility.

Consider your healthcare needs, budget, preferred providers, and prescription medications. Compare total costs including premiums and out-of-pocket expenses. Our team helps analyze these factors to recommend plans that best match your situation.

You can enroll during:

- Annual Open Enrollment Period (November 1 - January 15)

- Special Enrollment Period following qualifying life events

- Any time for short-term health insurance (where available)

Coverage typically begins the first day of the month following enrollment.

You can explore options through the official Health Insurance Marketplace during the annual Open Enrollment period or if you qualify for a Special Enrollment Period due to a life event (like losing other coverage, moving, getting married, or having a baby). You can also find private health insurance plans directly from insurance companies1. Our local team in Queen Creek, AZ specializes in helping you navigate these options to find the best fit for your needs right here in the community.

Take the Next Step

Finding the right health insurance doesn’t have to be complicated. Our local team in Queen Creek and San Tan Valley specializes in helping individuals and families navigate their coverage options. We provide:

- Free consultation and plan comparisons

- Assistance with subsidy applications

- Enrollment support and guidance

- Year-round customer service

- Local expertise and personalized attention

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

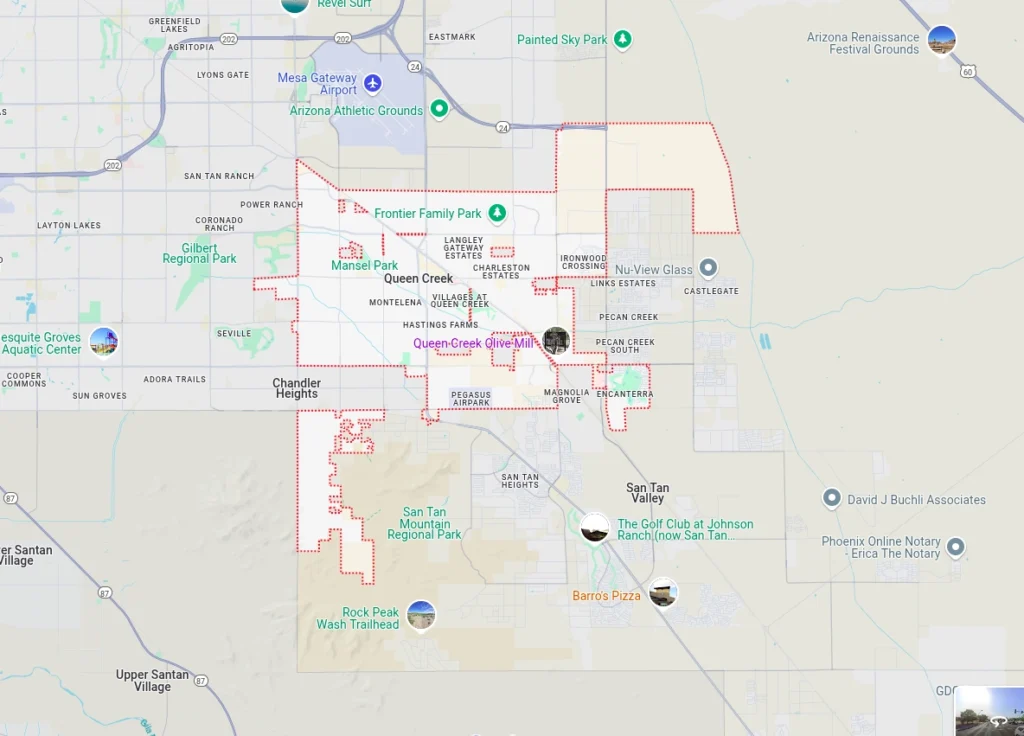

Our Service Area

We proudly serve individuals and families seeking health insurance solutions throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s healthcare landscape and local provider networks ensures you receive coverage that works in your community. Contact us today to discover how we can help protect your health and financial future.