More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Health insurance for self-employed individuals provides essential medical coverage designed specifically for entrepreneurs, freelancers, consultants, and small business owners. These flexible plans offer comprehensive protection tailored to the unique needs of self-employed professionals who must secure their own coverage outside of traditional employer-sponsored benefits.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right health insurance as a self-employed individual requires understanding your options and navigating various coverage choices. Our local expertise helps self-employed professionals discover coverage that balances comprehensive protection with affordability while supporting your business goals and personal health needs.

Why Choose Us for Your Self-Employed Health Insurance

Selecting the right health insurance as a self-employed person involves understanding unique tax considerations, coverage options, and business implications. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on the specific needs of self-employed professionals.

1. Self-Employed Insurance Expertise

We understand that self-employed health insurance has unique characteristics and considerations different from employee coverage. Our team helps you evaluate plans based on your business needs, including tax implications, Health Savings Account opportunities, and family coverage options. We explain self-employed insurance options clearly without confusing jargon, ensuring you understand how each choice affects both your health and your business.

2. Local Self-Employed Market Knowledge

As Arizona business supporters ourselves living in Queen Creek and San Tan Valley, we know the local landscape for self-employed health insurance. We understand what other entrepreneurs choose in our area, which carriers work well with local healthcare providers, and how to navigate Arizona-specific regulations. This local insight helps you select coverage that truly serves your self-employed lifestyle in our community.

3. Continuous Self-Employed Support

Our service relationship adapts to your evolving business needs. As your income fluctuates, your business grows, or your family situation changes, your insurance needs may evolve too. We provide ongoing support for plan adjustments, tax planning considerations, claims assistance, and helping you optimize your self-employed coverage year-round.

4. Customized Self-Employed Solutions

Health insurance for self-employed individuals through our agency gives you maximum flexibility to select coverage that fits your unique business and personal situation. Whether you're a solo entrepreneur, have a spouse to cover, or employ others, we help you find plans that address your specific needs and business objectives.

5. Streamlined Self-Employed Enrollment

Our efficient application process makes obtaining self-employed coverage straightforward and business-friendly. We guide you through the enrollment process, explain tax benefits, and ensure you get the coverage that supports both your health and your business success.

6. Round-the-Clock Self-Employed Assistance

Self-employed professionals work around the clock, and so do we. Our support team remains available whenever you need help understanding your coverage, managing claims, or addressing urgent insurance questions that affect your business operations.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Health Insurance for Self-Employed

Health insurance for self-employed individuals includes coverage options purchased independently, offering protection for entrepreneurs who don’t have access to employer-sponsored benefits. These plans provide essential coverage while often offering tax advantages and the flexibility self-employed professionals need.

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Self-Employed Health Plans

- Individual control: Complete autonomy over plan selection and coverage decisions

- Tax deductions: Potential for significant tax benefits on premium payments

- HSA compatibility: Many plans work with Health Savings Accounts for additional tax advantages

- Year-round enrollment: Marketplace plans available during open enrollment, private plans anytime

- Scalable coverage: Options that can grow with your business and family

- Professional support: Coverage that protects your ability to work and earn income

Types of Self-Employed Insurance Options

Different coverage structures serve various self-employed situations:

Marketplace Plans for Self-Employed

- Comprehensive coverage through the Health Insurance Marketplace

- Potential premium tax credits based on projected income

- Essential health benefits guaranteed coverage

- Metal tier options from Bronze to Platinum

- Subsidies available for qualifying income levels

- Family coverage options available

Private Individual Plans

- Direct purchase from insurance carriers outside the Marketplace

- Broader provider networks often available

- Year-round enrollment without waiting periods

- No income restrictions for eligibility

- Customizable plan features and benefits

- Direct relationships with insurance carriers

Health Sharing Plans

- Alternative coverage based on shared medical expenses

- Lower monthly costs than traditional insurance

- Faith-based or ethical sharing principles

- Different rules and protections than insurance

- May appeal to certain self-employed individuals

- Not technically insurance but provides some protection

Group Coverage Options

- Professional association group plans

- Freelancers union or trade organization coverage

- Small business group plans if you have employees

- COBRA continuation from previous employment

- Spousal coverage if spouse has employer benefits

- Temporary group options during transitions

Arizona Health Insurance for Self-Employed

Arizona offers various options for self-employed individuals seeking health coverage, with both state and federal programs available.

Self-Employment Tax Benefits

Premium Deductibility Self-employed health insurance premiums may be:

- Tax-deductible as a business expense

- Deducted from self-employment income

- Available for self-employed individuals and their families

- Applied above-the-line as an adjustment to income

- Available even if you don’t itemize deductions

- Subject to specific IRS rules and limitations

Health Savings Account Benefits Self-employed individuals can often:

- Contribute to HSAs with qualifying high-deductible plans

- Deduct HSA contributions from business income

- Use HSA funds tax-free for qualified medical expenses

- Build long-term savings for healthcare and retirement

- Enjoy triple tax advantages on HSA funds

- Control investment options for HSA growth

Income Considerations

Variable Income Challenges Self-employed professionals often face:

- Fluctuating income throughout the year

- Difficulty predicting annual earnings

- Challenges qualifying for Marketplace subsidies

- Need for flexible payment options

- Budgeting for healthcare costs alongside business expenses

- Planning for both lean and prosperous periods

Subsidy Planning Marketplace subsidies for self-employed individuals:

- Based on projected annual income

- Require annual reconciliation at tax time

- May result in repayment if income exceeds projections

- Can provide significant savings for qualifying income levels

- Should be carefully planned with tax professional

- Affect choice between Marketplace and private plans

Understanding Self-Employed Insurance Costs

Health insurance costs for self-employed individuals involve unique considerations and planning strategies:

Premium Costs for Self-Employed

Health insurance premiums depend on:

- Plan type and coverage level selected

- Your age, location, and family size

- Tobacco use and health status (private plans)

- Income level (for Marketplace subsidy eligibility)

- Deductible and out-of-pocket choices

- Additional benefits or riders included

Business Budget Planning

Self-employed insurance budgeting involves:

- Monthly premium costs as a business expense

- Planning for variable income periods

- Setting aside funds for deductibles and copayments

- Considering HSA contributions as part of planning

- Building healthcare costs into business pricing

- Preparing for annual premium increases

Tax Planning Considerations

Health insurance affects self-employed taxes through:

- Premium deductions reducing taxable income

- HSA contributions lowering self-employment tax

- Marketplace subsidy impacts on tax returns

- Self-employment tax savings from deductions

- Estimated tax payment adjustments

- Professional tax advice recommendations

Cost-Benefit Analysis

Evaluating self-employed insurance value includes:

- Protection against catastrophic medical expenses

- Tax savings from premium deductibility

- Peace of mind for business continuity

- Family protection and coverage

- Network access to quality healthcare

- Long-term health and financial planning

Self-Employed Plan Benefits and Features

Health insurance for self-employed individuals focuses on flexibility and comprehensive protection:

Comprehensive Medical Coverage

Most self-employed plans include:

- Doctor visits and specialist consultations

- Hospital stays and surgical procedures

- Emergency room and urgent care services

- Prescription drug coverage

- Preventive care and wellness visits

- Mental health and substance abuse services

Business-Friendly Features

Self-employed plans often offer:

- Flexible payment options for variable income

- Online account management for busy professionals

- Telehealth services for convenient care

- Nationwide coverage for business travel

- Direct primary care options in some plans

- Concierge or executive health services

Family Protection

Self-employed family coverage provides:

- Spouse and dependent coverage options

- Maternity and pediatric care

- Family deductibles and out-of-pocket maximums

- Preventive care for all family members

- Coverage during business transitions

- Protection for family financial security

Long-Term Benefits

Self-employed health insurance supports:

- Business continuity during health issues

- Protection of earning capacity

- Long-term healthcare relationships

- Retirement healthcare planning

- Health Savings Account growth

- Professional reputation protection

Choosing the Right Self-Employed Plan

Selecting appropriate health insurance as a self-employed individual requires evaluating multiple factors:

Assess Your Business Situation

Consider your professional circumstances:

- Type of self-employment or business

- Income stability and seasonality

- Number of dependents to cover

- Geographic mobility for business

- Risk tolerance for healthcare costs

- Long-term business and family plans

Evaluate Healthcare Needs

Assess your health-related priorities:

- Current health status and medical needs

- Preferred doctors and healthcare providers

- Prescription medications required

- Chronic conditions requiring ongoing care

- Mental health and wellness priorities

- Emergency and urgent care preferences

Compare Coverage Options

When reviewing plans, examine:

- Marketplace versus private plan benefits

- Provider network size and quality

- Prescription drug coverage and costs

- Deductibles and out-of-pocket maximums

- HSA eligibility and benefits

- Premium tax credit opportunities

Consider Tax Implications

Evaluate the tax impact of different plans:

- Premium deductibility for different plan types

- HSA contribution opportunities and limits

- Marketplace subsidy income thresholds

- Self-employment tax implications

- Overall tax strategy alignment

- Professional tax planning coordination

Health Savings Accounts for Self-Employed

HSAs offer significant advantages for self-employed individuals when paired with qualifying health plans:

HSA Eligibility for Self-Employed

To use an HSA, you must:

- Enroll in a qualifying high-deductible health plan

- Not have other comprehensive health coverage

- Not be enrolled in Medicare

- Not be someone else’s dependent

- Meet specific deductible and out-of-pocket requirements

Self-Employment HSA Benefits

HSAs provide self-employed individuals:

- Tax deductions for contributions

- Tax-free growth of invested funds

- Tax-free withdrawals for qualified medical expenses

- Reduced self-employment tax burden

- Long-term retirement healthcare savings

- Flexibility and portability across jobs

HSA Strategy for Self-Employed

Effective HSA use includes:

- Maximizing annual contributions when possible

- Investing HSA funds for long-term growth

- Using current income for medical expenses while HSA grows

- Planning for healthcare costs in retirement

- Coordinating with business tax planning

- Understanding qualified expense rules

Self-Employed Insurance Application Process

Getting health insurance as a self-employed individual involves specific considerations:

Income Documentation

Self-employed applications may require:

- Previous year tax returns

- Profit and loss statements

- Bank statements or business records

- Projected income for the coming year

- Self-employment tax documentation

- Business license or registration papers

Plan Selection for Self-Employed

Choosing coverage involves:

- Comparing Marketplace versus private options

- Evaluating subsidy eligibility carefully

- Selecting appropriate deductible levels

- Choosing HSA-compatible plans if desired

- Adding family members if applicable

- Understanding renewal and change options

Enrollment Timing

Self-employed enrollment requires attention to:

- Marketplace open enrollment periods

- Special enrollment qualifying events

- Private plan year-round availability

- Coverage effective dates

- Premium payment schedules

- Tax year planning implications

Managing Your Self-Employed Coverage

Effective management helps self-employed individuals maximize their health insurance value:

Income Monitoring

Stay on top of earnings changes:

- Track income throughout the year

- Report significant changes to Marketplace

- Adjust subsidy payments if needed

- Plan for tax reconciliation

- Consider quarterly reviews

- Coordinate with tax professional

Business Integration

Integrate health coverage with business planning:

- Budget premiums as business expenses

- Plan for healthcare-related business interruptions

- Consider coverage when pricing services

- Build relationships with healthcare providers

- Use HSA as business tax strategy

- Include health insurance in business planning

Annual Reviews

Regularly evaluate your coverage:

- Compare plan performance with needs

- Review tax benefits received

- Assess provider network satisfaction

- Evaluate premium increases

- Consider changing business needs

- Plan for family or business changes

FAQS

Frequently Asked Questions About Self-Employed Health Insurance

Yes, self-employed individuals can typically deduct health insurance premiums for themselves and their families as an above-the-line deduction. This reduces your adjusted gross income and can result in significant tax savings. The deduction is limited to your self-employment income and has specific rules about eligibility.

Self-employed individuals may qualify for premium tax credits and cost-sharing reductions based on their projected annual income. However, variable self-employment income can make subsidy qualification challenging. You'll reconcile advance payments with actual income on your tax return, potentially owing money back if income exceeds projections.

The best option depends on your income, health needs, and business situation. Marketplace plans offer potential subsidies but require income predictions. Private plans provide flexibility but no subsidies. HSA-compatible high-deductible plans offer significant tax advantages for healthy, self-employed individuals.

With irregular income, consider choosing plans with lower premiums to ensure affordability during lean periods. Build health insurance costs into your business planning and pricing. Consider HSAs to save during good months for healthcare expenses. Private plans may offer more payment flexibility than Marketplace plans.

Options for group coverage include professional association plans, freelancers union coverage, or forming a group plan if you have employees. Some associations offer group purchasing power. Spousal employer coverage may also be an option if available.

For Marketplace plans, report income changes promptly to adjust subsidy payments and avoid owing money at tax time. Private plans aren't affected by income changes. Consider the impact on HSA contribution limits and overall tax planning when income fluctuates significantly.

HSA-compatible plans offer significant tax advantages for self-employed individuals, including deductible contributions and reduced self-employment tax. They work well if you're healthy, can afford the high deductible, and want to build long-term healthcare savings. Consider your current health needs and financial situation.

Build health insurance costs into your business model and pricing. Set aside funds monthly for premiums, deductibles, and out-of-pocket costs. Consider seasonal income variations and plan accordingly. Use HSAs to save for healthcare expenses during profitable periods.

Marketplace plan changes require qualifying life events or open enrollment periods. Private plans often allow changes throughout the year. Significant income changes may qualify you for Marketplace special enrollment periods. Business structure changes may also create qualifying events.

You may need tax returns, profit and loss statements, business registration documents, bank statements, and income projections. Marketplace applications require income estimates for subsidy calculations. Private plans may require less documentation but could include medical underwriting.

Take the Next Step for Your Self-Employed Health Insurance

Finding the right health insurance as a self-employed individual provides essential protection for both your health and your business success. Our local team in Queen Creek and San Tan Valley specializes in guiding self-employed professionals through their coverage options. We provide:

- Free self-employed insurance consultations and comparisons

- Assistance with tax benefit analysis and planning

- Marketplace and private plan evaluation

- HSA setup and strategy guidance

- Ongoing support for self-employed coverage needs

Don’t let lack of employer benefits leave you unprotected. Contact us today to explore your self-employed health insurance options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

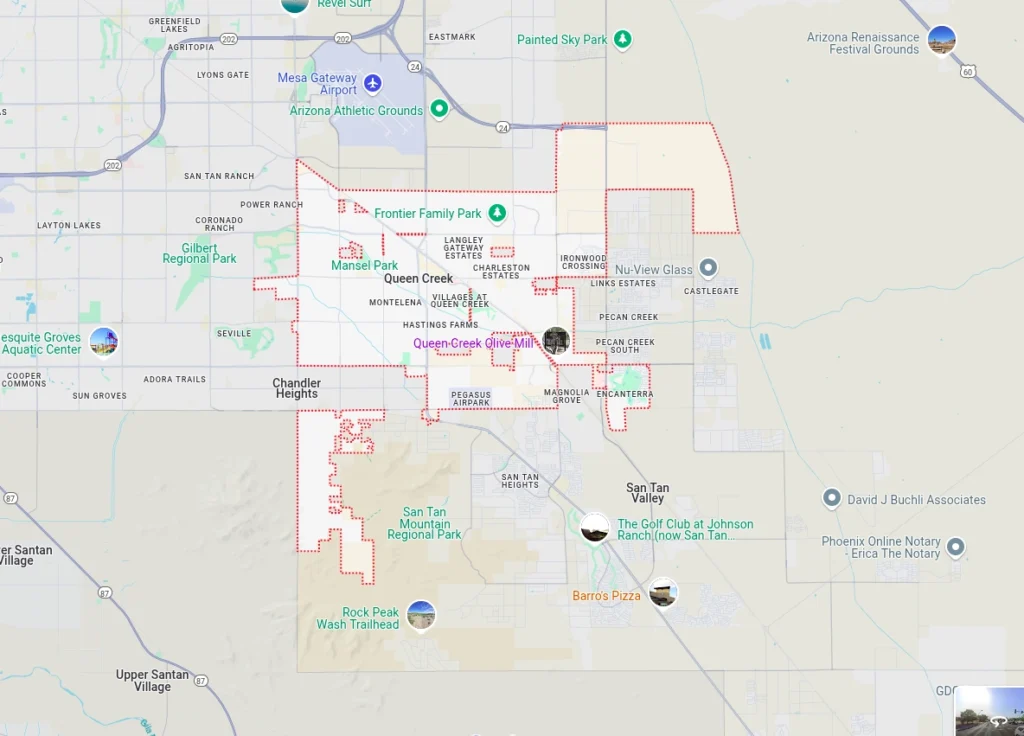

The Health Insurance Jedi proudly serves self-employed individuals and entrepreneurs seeking health insurance throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s self-employed insurance options and local business landscape ensures you receive coverage that supports both your health and your entrepreneurial success. Contact us today to discover how we can help protect you and your business with the right health insurance solution.