More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Group health insurance plans provide comprehensive healthcare coverage for multiple employees under a single policy, offering significant advantages for both employers and their workforce. These plans leverage group purchasing power to deliver quality healthcare benefits at more affordable rates than individual policies, while providing tax benefits and helping businesses attract top talent.

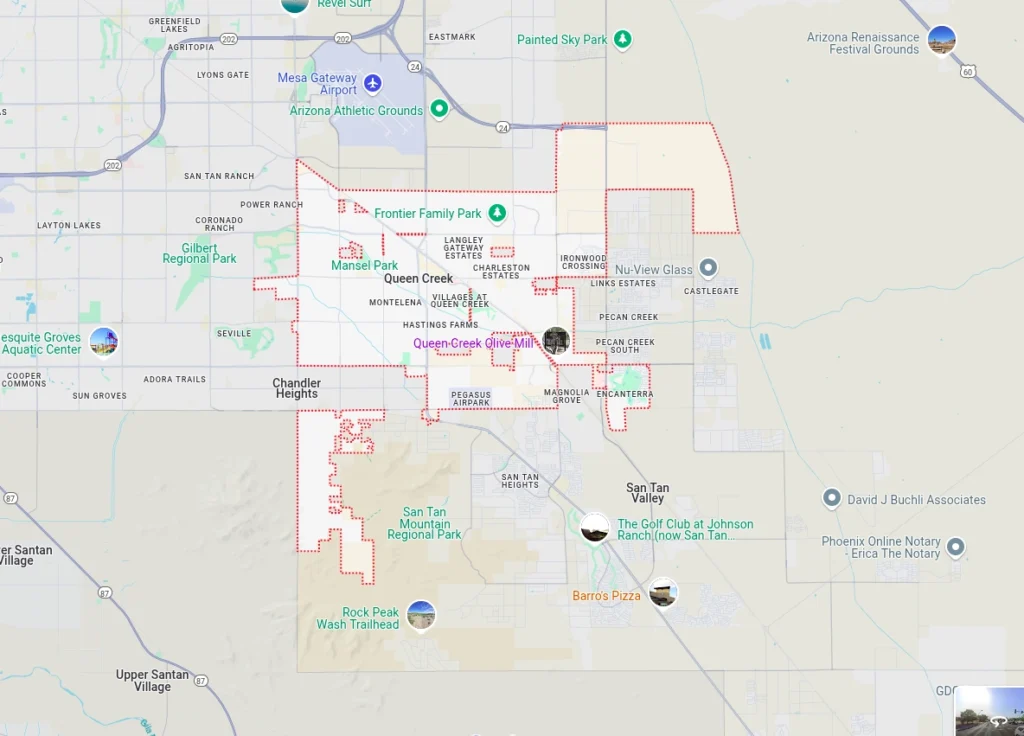

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right group health insurance plan requires understanding your organization’s specific needs and navigating various coverage options. Our local expertise helps employers discover group coverage that balances comprehensive care with cost-effectiveness while meeting compliance requirements.

Why Choose Us for Your Group Health Insurance Plans

Selecting the right group health insurance involves complex decisions about coverage levels, cost-sharing strategies, and regulatory compliance. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service for employers of all sizes.

1. Group-Focused Insurance Expertise

We understand that group health insurance has unique characteristics and requirements different from individual coverage. Our team helps you evaluate plans based on your organization's specific needs, including workforce demographics, budget parameters, and strategic business goals. We explain complex group insurance concepts in clear terms, ensuring you understand exactly what each plan offers your organization.

2. Local Group Health Insurance Knowledge

As Arizona business supporters ourselves in Queen Creek and San Tan Valley, we know the local landscape for group health insurance. We can guide you through carrier options that work well in our area, understand which plans other similar-sized employers choose, and help you navigate Arizona-specific regulations. This local insight ensures your group plan truly serves your workforce in our community.

3. Continuous Group Plan Support

Our service relationship extends well beyond initial enrollment. As your organization evolves, your group insurance needs change too. We provide ongoing support for adding new employees, managing annual renewals, addressing claims issues, and helping you optimize your group benefits package throughout the year.

4. Customized Group Solutions

Group health insurance through our agency gives you flexibility to design coverage that meets your organization's unique requirements. Whether you're a growing startup or an established company, we help you find group plans that address your specific workforce profile and organizational objectives.

5. Streamlined Group Enrollment

Our efficient application and enrollment process reduces administrative burden for your HR team. We manage the technical details while ensuring your employees receive clear information about their benefits, making the entire group enrollment experience smooth and professional.

6. Round-the-Clock Group Support

Organizations need insurance support at all times. Our support team remains available whenever you need help understanding coverage changes, addressing employee benefits questions, or managing urgent group insurance matters that affect your business operations.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Group Health Insurance Plans

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Group Plans

- Shared risk pool: Spreads healthcare costs across the entire group

- Standardized benefits: Consistent coverage for all eligible employees

- Group purchasing power: Access to rates and benefits not available individually

- Simplified administration: Single plan management for multiple people

- Tax advantages: Potential tax benefits for both employers and employees

- Guaranteed acceptance: Coverage available to all eligible employees regardless of health status

Types of Group Health Insurance Plans

Different group plan structures offer various advantages for organizations:

Traditional Group Health Plans

- Fully-insured arrangements with insurance carriers

- Predictable monthly premiums for budget planning

- Insurance carrier assumes claims risk

- Comprehensive regulatory compliance handled by carrier

- Wide network access through carrier partnerships

- Ideal for most small to medium-sized organizations

Self-Funded Group Plans

- Organization pays claims directly rather than insurance premiums

- Potential for cost savings with healthy employee populations

- Requires stop-loss insurance for protection against large claims

- Greater control over plan design and benefits

- More complex administration requiring specialized expertise

- Best suited for larger organizations with stable cash flow

Level-Funded Group Plans

- Hybrid approach combining predictable costs with potential savings

- Fixed monthly payments like traditional insurance

- Surplus returned if claims are lower than expected

- Stop-loss protection included automatically

- Good option for mid-sized employers wanting self-funding benefits

- Provides cost transparency without full self-funding complexity

Multiple Employer Welfare Arrangements (MEWAs)

- Allows smaller employers to join together for group purchasing

- Creates larger risk pools potentially reducing costs

- Shared administrative costs among participating employers

- May offer specialized benefits for specific industries

- Requires careful evaluation of arrangement stability

- Can provide small employers with large group plan features

Arizona Group Health Insurance Requirements

Arizona employers offering group health insurance must understand both state and federal requirements affecting their plans.

Group Eligibility Requirements

- Minimum participation requirements vary by carrier and group size

- Must offer coverage to all eligible full-time employees

- Cannot discriminate based on health status or pre-existing conditions

- Waiting periods cannot exceed 90 days for new employees

- Must provide equal access to all employees in similar classifications

Affordable Care Act (ACA) Compliance

For applicable large employers (generally 50+ full-time employees):

- Must offer minimum essential coverage to full-time employees

- Coverage must be affordable and provide minimum value

- Subject to potential penalties for non-compliance

- Required to provide specific employee notices

- Must complete and file annual ACA reporting

State-Specific Regulations

Arizona group health plans must comply with:

- State insurance department requirements

- Arizona continuation coverage laws (mini-COBRA)

- State-mandated benefits and protections

- Provider network adequacy standards

- Claims processing and appeal procedures

Group Health Plan Categories

Group health insurance follows metal tier systems similar to individual plans but with additional considerations for group dynamics:

Bronze Group Plans

- Lowest monthly premiums for the group

- Highest employee deductibles and out-of-pocket costs

- Insurance covers a smaller portion of healthcare expenses

- Employees pay more when using healthcare services

- Suitable for organizations prioritizing low premium costs

Silver Group Plans

- Moderate monthly premiums for the group

- Balanced employee deductibles and out-of-pocket costs

- Reasonable cost-sharing between insurance and employees

- Popular choice among diverse employee groups

- Good balance of affordability and coverage

Gold Group Plans

- Higher monthly premiums for the group

- Lower employee deductibles and out-of-pocket costs

- Insurance covers a larger portion of healthcare expenses

- Employees pay less when accessing healthcare services

- Attractive offering for employee recruitment and retention

Platinum Group Plans

- Highest monthly premiums for the group

- Lowest employee deductibles and out-of-pocket costs

- Insurance covers the largest portion of healthcare expenses

- Minimal employee costs when receiving healthcare services

- Premium offering for organizations competing for top talent

Understanding Group Health Insurance Costs

Group health insurance involves several cost components that affect both organizational budgets and employee satisfaction:

Group Premium Structure

Group premiums are calculated based on the collective risk of the entire employee population. Factors affecting group premiums include:

- Employee demographics (age, gender, location)

- Industry classification and associated risks

- Claims experience of the group

- Plan design and coverage levels

- Geographic location and provider networks

- Group size and participation rates

Employer Contribution Strategies

Organizations have flexibility in structuring their contribution to employee premiums:

- Percentage-based contributions (paying a portion of each employee’s premium)

- Fixed dollar amounts (contributing set amounts toward coverage)

- Tiered contributions (different amounts based on coverage level)

- Composite rating (same contribution regardless of employee demographics)

- Salary-based contributions (contributions proportional to employee earnings)

Employee Premium Sharing

Most group plans involve cost-sharing between employers and employees:

- Employee payroll deductions for their portion of premiums

- Different contribution levels for employee-only versus family coverage

- Pre-tax premium payments through Section 125 plans

- Flexible contribution arrangements based on employee choices

- Clear communication about actual coverage costs

Additional Cost Factors

Beyond premiums, group plans involve other cost considerations:

- Deductibles that employees must meet before coverage begins

- Copayments for specific services

- Coinsurance percentages after deductible requirements

- Out-of-pocket maximums protecting employees from catastrophic costs

- Administrative fees for plan management

Group Health Plan Administration

Effective administration ensures your group health plan operates smoothly and provides value to both your organization and employees:

Enrollment Management

Proper enrollment procedures include:

- Clear communication about available options

- Defined enrollment periods and deadlines

- Assistance with employee decision-making

- Verification of employee and dependent eligibility

- Coordination with payroll systems for premium deductions

Ongoing Plan Management

Day-to-day administration involves:

- Processing new hire additions and terminations

- Managing qualifying life event changes

- Coordinating with insurance carriers on coverage issues

- Assisting employees with claims questions

- Maintaining accurate records for compliance

Annual Renewal Process

Yearly renewal requires:

- Review of plan performance and employee satisfaction

- Analysis of rate changes and market alternatives

- Communication of any benefit modifications

- Re-enrollment coordination if necessary

- Documentation of renewal decisions

Compliance Monitoring

Staying compliant includes:

- Maintaining required employee notices

- Filing necessary reports with appropriate agencies

- Ensuring non-discrimination in plan offerings

- Managing COBRA or continuation coverage obligations

- Keeping documentation for audits

Essential Health Benefits in Group Plans

All group health plans must provide comprehensive coverage including ten essential health benefits:

- Ambulatory patient services (outpatient medical care)

- Emergency services (emergency room visits and urgent care)

- Hospitalization (inpatient care and surgery)

- Maternity and newborn care (pregnancy and childbirth services)

- Mental health and substance use disorder services (behavioral health treatment)

- Prescription drugs (medication coverage with formularies)

- Rehabilitative services and devices (physical therapy and medical equipment)

- Laboratory services (diagnostic tests and screenings)

- Preventive services and chronic disease management (wellness care and health screenings)

- Pediatric services (child healthcare including dental and vision when applicable)

These comprehensive benefits ensure your employees receive complete healthcare coverage addressing diverse medical needs.

Choosing the Right Group Health Plan

Selecting an appropriate group health insurance plan requires careful evaluation of multiple factors:

Assess Your Organization's Needs

- Total number of eligible employees

- Employee demographics and health needs

- Budget parameters and cost objectives

- Geographic distribution of workforce

- Industry-specific health considerations

- Strategic goals for benefits offerings

Evaluate Employee Preferences

Understanding your workforce helps guide plan selection:

- Current healthcare utilization patterns

- Preferred providers and hospitals

- Prescription medication needs

- Family coverage requirements

- Financial constraints and cost sensitivity

- Interest in wellness programs

Compare Plan Options

Key areas for comparison include:

- Premium costs and contribution requirements

- Network adequacy for your employee locations

- Coverage levels and benefit richness

- Customer service and support quality

- Claims processing efficiency

- Technology platforms and resources

Consider Long-Term Value

Beyond immediate costs, evaluate:

- Rate stability and increase history

- Carrier financial strength and reliability

- Plan flexibility for organizational changes

- Employee satisfaction with current or proposed options

- Integration with other benefit programs

- Compliance support and administrative assistance

Group Health Plan Implementation

Successfully launching a new group health plan requires careful planning and execution:

Pre-Implementation Planning

Effective preparation includes:

- Establishing clear timelines for implementation

- Communicating changes to affected employees

- Coordinating with payroll and HR systems

- Training staff on new plan features

- Preparing educational materials for employees

Employee Communication

Clear communication ensures successful adoption:

- Explaining benefit changes and new features

- Providing comparison tools for plan options

- Offering educational sessions about healthcare benefits

- Creating accessible resources for ongoing questions

- Highlighting value of employer-provided coverage

System Integration

Technical implementation involves:

- Coordinating with payroll systems for deductions

- Setting up eligibility feeds to insurance carriers

- Implementing online enrollment platforms

- Establishing claims and ID card processes

- Testing all systems before go-live dates

Post-Implementation Support

Ongoing support includes:

- Monitoring successful transition to new plans

- Addressing initial questions and concerns

- Tracking utilization and satisfaction

- Making adjustments as needed

- Preparing for future renewal cycles

Ready to Protect Your Family’s Health?

Don’t navigate health insurance alone. Our experienced agents specialize in finding the right coverage for families-balancing affordability, comprehensive care, and peace of mind.

- Get a free, personalized quote tailored to your family’s needs

- Schedule a no-pressure consultation to compare plans

- Have questions? Call us at +123456789

Our help comes at no extra cost to you. Let us simplify health insurance for your loved ones!

FAQS

Frequently Asked Questions About Group Health Insurance Plans

Most insurance carriers require at least one full-time employee (not including owners or their spouses) to qualify for group coverage. However, specific requirements can vary by carrier and state. Some carriers may have higher minimums or different rules for certain industries. Our team can help determine your eligibility based on your specific situation.

Group rates are based on multiple factors including employee demographics, industry classification, geographic location, claims experience, and plan design choices. Smaller groups typically receive age-banded or composite rates, while larger groups may have rates based on their specific claims experience. We can explain how rating works for your particular group size and circumstances.

Yes, employees can generally waive coverage if they have alternative options like coverage through a spouse's plan. However, many group plans require minimum participation rates to remain viable. Employees who waive coverage may have limited opportunities to enroll later unless they experience qualifying life events.

Fully-insured plans involve paying premiums to an insurance carrier who assumes the risk for all claims. Self-funded plans involve the employer paying claims directly and assuming the financial risk, though stop-loss insurance provides protection against large claims. Self-funding is typically more suitable for larger employers with predictable claims patterns.

Employers have discretion over whether to offer coverage to part-time employees, though they must apply eligibility rules consistently. Many employers establish minimum hour requirements (like 20 or 30 hours weekly) for benefits eligibility. The ACA requires coverage for employees working 30+ hours weekly at applicable large employers.

Annual renewals involve reviewing your current plan's performance, analyzing proposed rate changes, and evaluating alternative options. Your broker should present you with renewal options well in advance, allowing time to communicate any changes to employees. Renewal is also an opportunity to adjust benefit designs or contribution strategies.

New employees typically become eligible for coverage after completing any waiting period (up to 90 days). They can then enroll outside of the normal open enrollment period. You'll need to notify your insurance carrier of new additions and coordinate premium adjustments. We help streamline this process for our group clients.

Employers can typically deduct group health insurance premiums as business expenses. Employees can often pay their portion of premiums with pre-tax dollars through Section 125 plans, reducing both employee and employer payroll taxes. Small businesses may also qualify for health care tax credits under certain circumstances.

You can offer different plans to employees as long as the distinctions are based on bona fide job-related criteria (like full-time vs. part-time status) and not discriminatory factors. Many employers offer choice among multiple plans, allowing employees to select coverage that best fits their needs while maintaining compliance with non-discrimination rules.

Compliance involves understanding federal laws like the ACA, ERISA, HIPAA, and COBRA, as well as state-specific requirements. Working with experienced brokers and carriers helps ensure your plan meets all legal requirements. We help our group clients navigate complex compliance issues and maintain proper documentation.

Take the Next Step for Your Group Health Insurance Plan

Finding the right group health insurance plan provides comprehensive healthcare for your team while supporting your organization’s strategic objectives. Our local team in Queen Creek and San Tan Valley specializes in guiding employers through their group coverage options. We provide:

- Free group plan consultations and comparisons

- Assistance with contribution strategy development

- Employee education and enrollment support

- Year-round group insurance customer service

- Local expertise with Arizona group health regulations

Don’t navigate group health insurance complexities alone. Contact us today to explore your group coverage options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

The Health Insurance Jedi proudly serves employers seeking group health insurance solutions throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s group health insurance landscape and local provider networks ensures your organization receives coverage that works for your business and employees. Contact us today to discover how we can help protect your organization with the right group health insurance solution.