More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Family health insurance provides comprehensive coverage for all members of your household, ensuring everyone receives the care they need while protecting your finances. A quality family plan covers everything from routine check-ups and vaccinations to emergency care and specialized treatments, keeping your loved ones healthy and giving you peace of mind.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right family health insurance plan requires understanding your family’s unique healthcare needs and navigating various coverage options. Our local expertise helps families discover coverage that balances quality care with affordability.

Why Choose Us for Your Family's Health Coverage

Selecting health insurance for your entire family involves considering multiple factors and balancing various needs. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service.

1. Family-Focused Guidance

We understand that every family has different healthcare needs, from young children to teenagers and adults. Our team helps you evaluate plans based on your family's specific situation, including pediatric care, family doctors, and specialists that everyone might need. We explain options clearly without insurance jargon, ensuring you understand exactly what coverage your family will receive.

2. Local Family Healthcare Knowledge

As parents and family members ourselves living in Queen Creek and San Tan Valley, we know the local healthcare landscape for families. We can tell you which plans work well with preferred pediatricians, family practitioners, and children's specialists in our community. This local insight helps your family connect with the best healthcare providers in the area.

3. Continuous Family Support

Our service relationship extends well beyond enrollment. As your family grows and changes, your insurance needs evolve too. We provide ongoing support for adding newborns to your policy, transitioning coverage for college-age dependents, answering claims questions, and helping you maximize your family benefits year-round.

4. Customized Family Coverage

Family health insurance through our agency gives you the flexibility to select coverage that accommodates everyone's needs. Whether you have children with specific healthcare requirements, teenagers needing orthodontics, or adults managing chronic conditions, we help you find plans that address your family's complete healthcare profile.

5. Streamlined Family Enrollment

Our efficient application process reduces paperwork and confusion, especially important for busy families. We guide you through enrollment step-by-step, ensuring your entire family gains coverage without delays or complications.

6. Round-the-Clock Family Assistance

Families need support at all hours – from midnight fevers to weekend injuries. Our support team remains available whenever your family needs help understanding coverage, finding emergency care options, or answering urgent insurance questions.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Family Health Insurance

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Family Plans

- Shared benefits: Family members share certain benefits like deductibles and out-of-pocket maximums

- Comprehensive pediatric care: Enhanced coverage for children’s needs including well-child visits, immunizations, and developmental screenings

- Preventive services: Coverage for preventive care for all family members at different life stages

- Maternity and newborn care: Support for pregnancy, childbirth, and newborn care

- Dependent coverage: Children can remain on family plans until age 26, regardless of student status, marital status, or financial independence

Types of Family Health Insurance Plans

Different plan structures offer various advantages for families:

HMO (Health Maintenance Organization) Family Plans

- Lower monthly premiums benefit family budgets

- Requires selecting a primary care physician for each family member

- Referrals needed for specialists

- Must use in-network providers except for emergencies

- Ideal for families wanting predictable costs and coordinated care

PPO (Preferred Provider Organization) Family Plans

- Higher monthly premiums

- No referral requirements for family members to see specialists

- Flexibility for different family members to see different providers

- Partial coverage for out-of-network care

- Best for families needing flexibility and specialized care options

EPO (Exclusive Provider Organization) Family Plans

- Moderate premium costs

- No referral requirements for specialists

- Must use in-network providers except for emergencies

- Direct specialist access without primary care referrals

- Good balance of affordability and flexibility for families

POS (Point of Service) Family Plans

- Combines features of HMO and PPO plans

- Requires primary care physicians for family members

- Allows out-of-network care at higher costs

- Referrals needed for specialists

- Works well for families wanting some network flexibility with coordination

Arizona Health Insurance Marketplace

The Health Insurance Marketplace offers numerous family plan options with standardized benefits and the possibility of financial assistance.

Family Enrollment Periods

Open Enrollment Period The annual Open Enrollment Period typically runs from November 1 through January 15. During this time, families can:

- Enroll in new family coverage

- Switch family plans

- Add or remove family members from coverage

- Apply for family financial assistance

Coverage typically begins January 1 if you enroll by December 15.

Special Family Enrollment Periods

Families can qualify for Special Enrollment Periods outside the regular enrollment window due to qualifying life events:

- Having a baby or adopting a child

- Getting married or divorced

- Family member losing other health coverage

- Moving to a new coverage area

- Changes in family income affecting subsidy eligibility

- Gaining custody of a child

Families typically have 60 days from the qualifying event to make coverage changes.

Family Metal Category Plans

Family health insurance follows the same metal category system as individual plans:

Bronze Family Plans

- Lowest monthly premiums

- Highest family deductibles and out-of-pocket costs

- Insurance covers a smaller portion of healthcare costs

- Your family pays more when services are used

- Suitable for healthy families seeking primarily catastrophic protection

Silver Family Plans

- Moderate monthly premiums

- Moderate family deductibles and out-of-pocket costs

- Balanced cost-sharing between insurance and your family

- Most popular for families

- Only category eligible for extra cost-sharing reductions

Gold Family Plans

- Higher monthly premiums

- Lower family deductibles and out-of-pocket costs

- Insurance covers a larger portion of healthcare costs

- Your family pays less when services are used

- Good for families with children needing regular care

Platinum Family Plans

- Highest monthly premiums

- Lowest family deductibles and out-of-pocket costs

- Insurance covers the largest portion of healthcare costs

- Your family pays the least when services are used

- Ideal for families with ongoing medical needs or planned procedures

Understanding Family Health Insurance Costs

Family health insurance involves several types of costs that affect your household budget:

Family Premiums

Your premium is the monthly amount you pay to maintain family coverage, regardless of whether healthcare services are used. Family premiums are typically higher than individual premiums but lower than purchasing separate policies for each family member. Premium costs vary based on:

- Plan type and metal level

- Ages of family members

- Location

- Tobacco use

- Number of people covered

Family Deductibles

Family plans often include both individual deductibles and family deductibles. The family deductible is the total amount your household must pay before insurance begins covering services for all family members. Some plans use an “embedded deductible” approach, where insurance begins paying for an individual family member once they meet their personal deductible, even if the family deductible hasn’t been met.

Family Copayments

A copayment is a fixed amount your family pays for specific services, such as doctor visits or prescriptions. Each family member might have different copay amounts depending on age, service type, and other factors.

Family Coinsurance

After meeting your deductible, your family shares costs with the insurance company through coinsurance. Your family pays a portion of service costs while insurance covers the rest, continuing until you reach your family out-of-pocket maximum.

Family Out-of-Pocket Maximum

This is the maximum amount your family would pay for covered services during the plan year. Once reached, insurance pays for covered services for all family members. This provides critical financial protection for families facing serious illness or injury.

Financial Assistance for Families

Many families qualify for financial assistance that makes health insurance more affordable.

Family Premium Tax Credits

These subsidies reduce your monthly premium costs. Eligibility depends on:

- Household income relative to the federal poverty level

- Not having access to affordable employer coverage

- Not being eligible for Medicare or Medicaid

- Filing taxes as an individual or family

You can apply credits monthly to lower premiums or claim them when filing taxes.

Family Cost-Sharing Reductions

These reduce your family’s deductibles, copayments, and coinsurance if you:

- Qualify for premium tax credits

- Have income within eligible ranges

- Enroll in a Silver-level family plan

These additional savings make healthcare services more affordable when your family uses them.

Family Income Guidelines

Financial assistance for families is available across various income levels, based on family size and the federal poverty level. Guidelines update annually. Many working families are surprised to discover they qualify for substantial assistance. Our agents can help determine your family’s eligibility and potential savings during a consultation.

Children's Health Insurance Program (CHIP)

For families with income too high for Medicaid but who still need affordable coverage for their children, the Children’s Health Insurance Program (CHIP) provides low-cost health coverage for children. This program offers comprehensive benefits with minimal out-of-pocket costs for eligible families.

Family Pre-Existing Conditions Protection

Health insurance companies cannot:

- Deny family coverage based on pre-existing conditions

- Charge higher premiums for family members with health issues

- Exclude coverage for family members’ pre-existing conditions

- Impose waiting periods for condition treatment

These protections apply to all Marketplace family plans, ensuring every family member receives needed care regardless of health history.

Family Essential Health Benefits

All Marketplace family plans cover ten essential health benefits:

- Ambulatory patient services (outpatient care)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Laboratory services

- Preventive services and chronic disease management

- Pediatric services, including dental and vision care

Family plans place particular emphasis on pediatric services, ensuring children receive comprehensive coverage including dental and vision care that might be optional for adults.

Choosing the Right Family Plan

Selecting appropriate family health insurance requires careful consideration:

Assess Your Family's Healthcare Needs

- Ages of family members

- Existing health conditions

- Medications taken by family members

- Anticipated healthcare needs (pregnancy, planned surgeries)

- Children’s requirements (immunizations, check-ups, braces)

- Family history that might indicate future health concerns

Evaluate Total Family Costs

Consider both premium and out-of-pocket expenses:

- Monthly premium payments

- Family deductible structure

- Copayments for services your family uses regularly

- Family out-of-pocket maximum

- Prescription costs for family medications

Check Family Provider Networks

Verify that your family’s preferred healthcare providers are in-network:

- Family doctors and pediatricians

- Specialists needed by various family members

- Children’s hospitals or specialized care facilities

- Mental health providers

- Convenient urgent care locations

Compare Family-Specific Benefits

Look beyond basic coverage to understand:

- Pediatric dental and vision coverage details

- Family prescription drug coverage

- Maternity and newborn benefits

- Developmental services for children

- Mental health support for all ages

Using Your Family Health Insurance Effectively

Maximize your family’s health insurance benefits through strategic usage:

Family Preventive Care

Most plans cover preventive services at no cost for all family members:

- Well-child visits and developmental screenings

- Adult annual physicals

- Age-appropriate immunizations

- Cancer screenings based on age and risk factors

- Prenatal care during pregnancy

Schedule these services regularly to maintain family health and identify issues early.

Managing Your Family's Network

Keep healthcare affordable by following network guidelines:

- Maintain a current list of in-network providers for each family member

- Understand referral requirements before seeing specialists

- Research in-network options before traveling

- Know emergency coverage rules for all family members

Family Prescription Management

Control medication costs for all family members:

- Use your plan’s preferred pharmacies

- Ask about generic alternatives

- Consider mail-order options for maintenance medications

- Understand how your plan handles specialty medications

- Review prescription coverage when choosing plans

Appropriate Care Settings for Families

Choose the right care facility based on the situation:

- Primary care for routine family health issues

- Urgent care for non-emergency immediate needs

- Pediatric urgent care for child-specific concerns

- Emergency room for truly life-threatening situations

- Telehealth options for minor issues and follow-ups

Ready to Protect Your Family’s Health?

Don’t navigate health insurance alone. Our experienced agents specialize in finding the right coverage for families-balancing affordability, comprehensive care, and peace of mind.

- Get a free, personalized quote tailored to your family’s needs

- Schedule a no-pressure consultation to compare plans

- Have questions? Call us at +123456789

Our help comes at no extra cost to you. Let us simplify health insurance for your loved ones!

FAQS

Frequently asked questions

For health insurance purposes, a family typically includes the policyholder, spouse or domestic partner, and dependent children under age 26. Some plans also allow coverage for other dependents like elderly parents or disabled adult children. Our team can help determine who qualifies as family members under different insurance options.

Yes, having a baby qualifies you for a Special Enrollment Period. You typically have 60 days from birth to add your newborn to your existing family plan. Coverage is retroactive to the baby's birth date when added properly. We recommend contacting us as soon as possible after your baby's arrival to ensure proper coverage.

Under current law, children can remain on their parents' health insurance until age 26, regardless of whether they live at home, are financially dependent, married, or eligible for their own employer coverage. This provision helps young adults maintain continuous coverage during transitional years.

Family plans accommodate different healthcare needs among members. The plan you select should consider everyone's requirements. Sometimes, it makes financial sense to place family members on separate plans if needs differ dramatically. Our advisors evaluate your family's specific situation to recommend the most cost-effective approach.

Yes, most plans allow family members to see different healthcare providers. HMO plans require each family member to select their own primary care physician, while PPO plans offer more flexibility for family members to see different specialists without referrals. We help you find plans compatible with each family member's preferred doctors.

Yes, all Marketplace family plans cover maternity and newborn care as essential health benefits. This includes prenatal visits, labor and delivery, and postnatal care. Coverage extends to both routine and complicated pregnancies. No additional riders or waiting periods apply for maternity coverage.

Family plans typically have both individual and family deductibles. Once a family member meets their individual deductible, the plan begins covering that person's care. The family deductible is met when eligible expenses for all family members combined reach the family deductible amount. We help explain how specific plans structure their family deductibles.

Children need coverage for well-child visits, immunizations, developmental screenings, common childhood illnesses, injury treatment, dental care including preventive services and orthodontics, vision exams and corrective lenses, hearing screenings, behavioral health services, and potential specialty care for chronic conditions. Marketplace family plans include pediatric dental and vision as essential health benefits.

This decision depends on your family's specific situation. Factors include whether any family members qualify for different programs (like Medicare, Medicaid, or CHIP), significant differences in healthcare needs among family members, and total cost comparisons. Our team analyzes these factors to help determine the most cost-effective approach for your family.

When a family member turns 26, they'll need to transition to their own health insurance. This qualifying event creates a Special Enrollment Period for them to obtain individual coverage. We provide guidance for both the family plan adjustment and the transitioning dependent's new coverage options.

Take the Next Step for Your Family's Health

Finding the right family health insurance provides both comprehensive healthcare access and financial protection for your loved ones. Our local team in Queen Creek and San Tan Valley specializes in guiding families through their coverage options. We provide:

- Free family plan consultations and comparisons

- Assistance with family subsidy applications

- Family enrollment support and guidance

- Year-round family customer service

- Local expertise with family healthcare providers

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

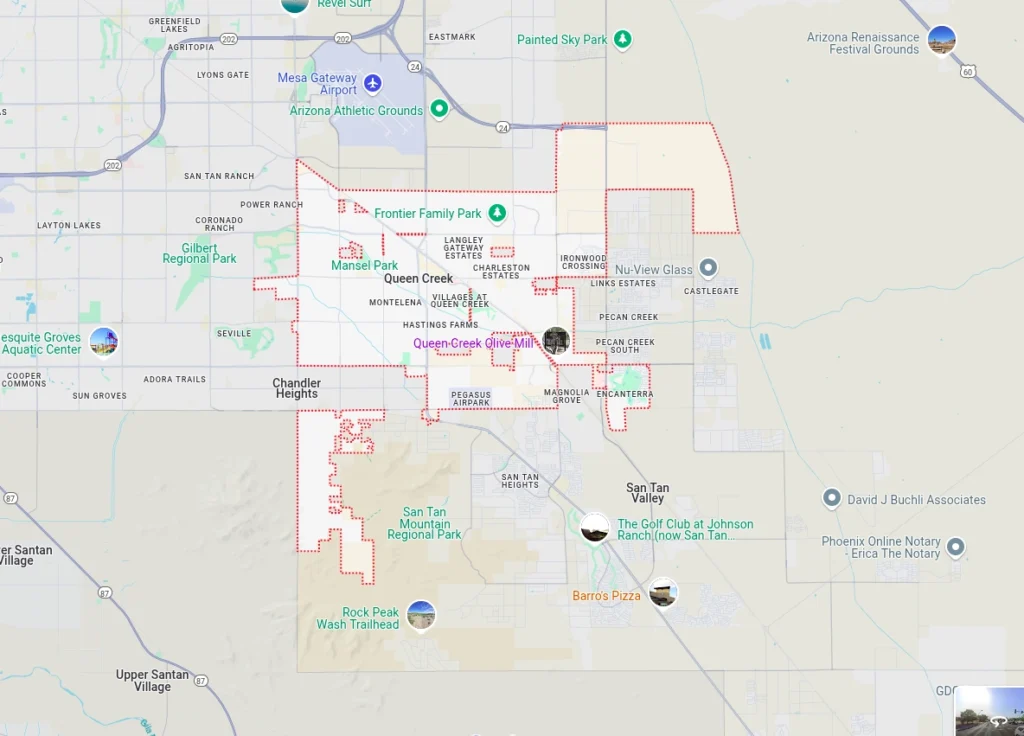

The Health Insurance Jedi proudly serves families seeking health insurance solutions throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s family healthcare landscape and local provider networks ensures your family receives coverage that works in your community. Contact us today to discover how we can help protect your family’s health and financial future.