More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Employee benefits solutions provide comprehensive benefit packages that go beyond basic health insurance, offering a strategic approach to attracting, retaining, and rewarding your workforce. These solutions combine health coverage, supplemental benefits, wellness programs, and financial security options to create competitive packages that boost employee satisfaction while supporting your business objectives.

In Queen Creek, San Tan Valley, and throughout Arizona, developing the right employee benefits solution requires understanding your workforce needs and navigating various benefit options. Our local expertise helps employers create comprehensive benefits packages that balance employee satisfaction with cost-effectiveness while meeting compliance requirements.

Why Choose Us for Your Employee Benefits Solutions

Creating effective employee benefits solutions involves balancing diverse benefit options, managing costs, and ensuring compliance across multiple programs. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service for employers seeking comprehensive benefits strategies.

1. Comprehensive Benefits Expertise

We understand that modern employee benefits extend far beyond basic health insurance. Our team helps you evaluate complete benefits packages including health coverage, dental and vision plans, life insurance, disability coverage, retirement benefits, and voluntary programs. We explain complex benefits concepts in clear terms, ensuring you understand how each component contributes to your overall employee value proposition.

2. Local Employee Benefits Knowledge

As Arizona business supporters ourselves in Queen Creek and San Tan Valley, we know the local landscape for employee benefits. We understand what benefits packages other similar-sized employers offer, which vendors work well in our area, and how to navigate Arizona-specific regulations. This local insight ensures your benefits solution truly serves your workforce in our community.

3. Continuous Benefits Support

Our service relationship extends well beyond initial implementation. As your organization grows and employee needs evolve, your benefits package must adapt too. We provide ongoing support for program modifications, vendor management, annual renewals, and helping you optimize your entire benefits portfolio throughout the year.

4. Customized Benefits Solutions

Employee benefits solutions through our agency give you flexibility to design packages that meet your organization's unique requirements. Whether you're a startup seeking basic coverage or an established company wanting comprehensive benefits, we help you find solutions that address your specific workforce profile and business objectives.

5. Streamlined Benefits Administration

Our efficient implementation and management process reduces administrative burden for your HR team. We coordinate multiple vendors, manage enrollment processes, and ensure your employees receive clear information about all their benefits, making the entire benefits experience smooth and professional.

6. Round-the-Clock Benefits Support

Organizations need benefits support at all times. Our support team remains available whenever you need help understanding program changes, addressing employee benefits questions, or managing urgent benefits matters that affect your business operations.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Employee Benefits Solutions

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Components of Benefits Solutions

- Core health benefits: Medical, dental, and vision coverage options

- Financial protection: Life insurance, disability coverage, and accident insurance

- Retirement planning: 401(k) plans, retirement savings programs, and planning services

- Wellness programs: Health screening, fitness incentives, and employee assistance programs

- Work-life balance: Flexible spending accounts, paid time off, and family support benefits

- Voluntary benefits: Supplemental coverage options employees can choose to purchase

Types of Employee Benefits Programs

Different benefits structures offer various advantages for organizations:

Traditional Benefits Packages

- Core benefits provided to all eligible employees

- Standardized coverage across the workforce

- Predictable costs for budget planning

- Simplified administration and communication

- Easy employee understanding and appreciation

- Ideal for organizations wanting consistency

Flexible Benefits Programs

- Employee choice among multiple benefit options

- Allows customization based on individual needs

- May include flexible spending accounts or benefit credits

- Higher employee satisfaction through personalization

- More complex administration requiring specialized support

- Best for diverse workforces with varying needs

Voluntary Benefits Platforms

- Additional benefits employees can purchase at group rates

- Minimal or no employer cost for expanded options

- Includes options like critical illness, accident, or legal insurance

- Payroll deduction convenience for employees

- Vendor management handled by benefits administrator

- Good way to enhance benefits without increasing employer costs

Wellness-Focused Solutions

- Emphasis on preventive care and healthy lifestyle promotion

- May include biometric screenings, health coaching, and fitness programs

- Potential for premium discounts or incentive rewards

- Focus on reducing long-term healthcare costs

- Employee engagement through health challenges and education

- Suitable for organizations prioritizing employee health

Arizona Employee Benefits Requirements

Arizona employers offering employee benefits must understand both state and federal requirements affecting their programs.

Benefits Compliance Requirements

- Fair Labor Standards Act (FLSA) provisions for wage and hour benefits

- Family and Medical Leave Act (FMLA) requirements where applicable

- Equal Employment Opportunity Commission (EEOC) non-discrimination standards

- Employee Retirement Income Security Act (ERISA) requirements for benefit plans

- Affordable Care Act (ACA) compliance for health benefit

State-Specific Benefit Regulations

Arizona employee benefits must comply with:

- State insurance department requirements for group benefits

- Arizona minimum wage and overtime provisions

- State family and medical leave protections

- Workers’ compensation requirements

- Unemployment insurance obligations

Reporting and Documentation

Benefit programs may require:

- Summary plan descriptions for employee benefits

- Annual Form 5500 filings for qualified retirement plans

- COBRA or continuation coverage administration

- ACA reporting for applicable large employers

- Maintenance of benefit plan documents and employee communications

Core Employee Benefits Categories

Employee benefits solutions typically include several core categories that address different aspects of employee needs:

Health and Medical Benefits

- Medical insurance with various plan options

- Dental coverage for preventive and restorative care

- Vision insurance for eye care and corrective lenses

- Prescription drug coverage and pharmacy benefits

- Mental health and substance abuse treatment coverage

- Preventive care and wellness program integration

Financial Security Benefits

- Life insurance providing financial protection for families

- Short-term disability coverage for temporary inability to work

- Long-term disability protection for extended absences

- Accidental death and dismemberment insurance

- Critical illness coverage for serious health conditions

- Hospital indemnity plans for additional financial support

Retirement and Savings Benefits

- 401(k) retirement savings plans with potential employer matching

- Pension plans for long-term retirement security

- Individual retirement account (IRA) options

- Financial planning and retirement counseling services

- Investment education and guidance programs

- Social Security optimization planning

Work-Life Balance Benefits

- Flexible spending accounts for healthcare and dependent care expenses

- Health savings accounts paired with high-deductible health plans

- Paid time off policies including vacation and sick leave

- Family and medical leave beyond legal requirements

- Employee assistance programs for personal and work challenges

- Childcare assistance or on-site childcare options

Understanding Employee Benefits Costs

Employee benefits solutions involve various cost structures that affect both organizational budgets and employee satisfaction:

Employer Benefit Contributions

Organizations structure benefit contributions in multiple ways:

- Full premium payment for core benefits

- Percentage-based contributions toward benefit costs

- Fixed dollar amounts contributed toward coverage

- Tiered contributions based on employee level or tenure

- Flexible credits allowing employee choice in benefit allocation

Employee Cost-Sharing

Most benefits programs involve some employee participation:

- Premium contributions through payroll deduction

- Deductibles and copayments for health benefits

- Employee contributions to retirement savings plans

- Voluntary benefit premiums for additional coverage

- Flexible spending account contributions for tax advantages

Administrative and Management Costs

Benefits programs include various administrative expenses:

- Third-party administrator fees

- Benefits platform and technology costs

- Vendor management and coordination expenses

- Employee communication and education costs

- Compliance monitoring and reporting fees

Total Cost of Benefits

Comprehensive benefits packages represent significant organizational investments:

- Direct costs of premiums and contributions

- Administrative time and resources

- Tax implications and potential savings

- Productivity impacts of benefits programs

- Return on investment through employee retention and satisfaction

Voluntary Benefits and Supplemental Coverage

Voluntary benefits expand employee options while minimizing employer costs:

Popular Voluntary Benefit Options

- Supplemental life insurance beyond employer-provided coverage

- Critical illness insurance for specific health conditions

- Accident insurance providing cash benefits for injuries

- Legal services plans for personal legal matters

- Identity theft protection and resolution services

- Pet insurance for employee companion animals

Advantages of Voluntary Benefits

- Increased benefit options without employer premium costs

- Group rates typically lower than individual purchases

- Payroll deduction convenience for employees

- Enhanced overall benefits package perceived value

- Minimal administrative burden with proper vendor management

- Appeals to diverse employee demographics and life stages

Implementation Considerations

- Employee education about voluntary benefit values

- Enrollment process integration with core benefits

- Vendor selection and management requirements

- Communication strategies to promote awareness

- Technology platforms for enrollment and administration

- Ongoing support for employee questions and claims

Wellness Programs and Employee Health

Wellness programs represent strategic investments in employee health and organizational productivity:

Wellness Program Components

- Health risk assessments and biometric screenings

- Preventive care incentives and premium discounts

- Fitness challenges and activity tracking programs

- Smoking cessation and weight management support

- Stress management and mental health resources

- Nutrition education and healthy eating initiatives

Wellness Program Benefits

- Potential reduction in healthcare costs over time

- Improved employee morale and engagement

- Decreased absenteeism and increased productivity

- Enhanced company culture focused on employee wellbeing

- Competitive advantage in recruiting health-conscious employees

- Demonstration of organizational commitment to employee welfare

Wellness Program Implementation

- Baseline health assessments to identify focus areas

- Goal setting and incentive structure development

- Communication campaigns to promote participation

- Integration with existing health benefits

- Regular program evaluation and adjustment

- Privacy protection and HIPAA compliance maintenance

Benefits Technology and Administration

Modern benefits solutions rely on technology platforms to streamline administration and enhance employee experience:

Benefits Administration Platforms

- Online enrollment systems with decision support tools

- Employee self-service portals for benefit management

- Mobile applications for on-the-go benefits access

- Integration with payroll and HR information systems

- Real-time eligibility updates and life event processing

- Automated compliance reporting and documentation

Employee Communication Tools

- Benefits websites with educational resources

- Video content explaining benefit options and values

- Interactive calculators for cost and coverage comparisons

- Email campaigns and newsletters about benefits updates

- Social media integration for wellness program promotion

- Personalized benefit statements showing total compensation value

Data Analytics and Reporting

- Utilization analysis to optimize benefit offerings

- Cost tracking and budget forecasting tools

- Employee satisfaction surveys and feedback collection

- ROI measurement for wellness and voluntary programs

- Compliance monitoring and audit preparation

- Benchmarking against industry standards

Employee Benefits Communication Strategy

- Effective communication ensures employees understand and appreciate their benefits:

Communication Planning

- Annual communication calendar coordinating all benefit messages

- Multi-channel approach using various communication methods

- Targeted messaging for different employee demographics

- Integration with existing company communication strategies

- Feedback mechanisms to assess communication effectiveness

- Regular updates reflecting program changes or enhancements

Education and Engagement

- Benefits fairs and informational meetings

- One-on-one counseling sessions for complex decisions

- Educational workshops on specific benefit topics

- Decision support tools and planning calculators

- Testimonials and success stories from fellow employees

- Recognition programs for benefit program participation

Year-Round Benefits Awareness

- Quarterly benefit spotlights highlighting specific programs

- Life event reminders about benefit changes and deadlines

- Wellness program updates and achievement celebrations

- Financial education workshops and retirement planning seminars

- Open forum sessions for employee questions and suggestions

- Integration of benefits information into onboarding programs

Measuring Benefits Program Success

Regular evaluation ensures your benefits solution continues meeting organizational and employee needs:

Key Performance Indicators

- Employee participation rates across benefit programs

- Employee satisfaction scores through surveys and feedback

- Health outcomes and wellness program engagement metrics

- Recruitment and retention statistics related to benefits

- Cost per employee and budget variance analysis

- Compliance audit results and risk management assessments

Employee Feedback Mechanisms

- Annual benefits satisfaction surveys with detailed questions

- Focus groups discussing specific benefit programs

- Exit interviews exploring benefits-related departure reasons

- Suggestion systems for benefit improvements or additions

- Regular pulse surveys measuring overall benefits sentiment

- Demographic analysis of satisfaction across employee groups

Continuous Improvement Process

- Regular benefits strategy reviews with organizational leadership

- Market research on emerging benefit trends and options

- Vendor performance evaluation and relationship management

- Cost-benefit analysis of program additions or modifications

- Employee demographic changes requiring benefit adjustments

- Integration of feedback into annual benefits planning cycles

FAQS

Frequently Asked Questions About Employee Benefits Solutions

Competitive benefits packages typically include health insurance, dental and vision coverage, retirement savings plans, paid time off, and life insurance. Additional benefits like flexible work arrangements, wellness programs, and professional development opportunities are increasingly important. We can help you research what comparable employers in your industry and location offer to ensure your package remains competitive.

Employee surveys, focus groups, and demographic analysis help identify desired benefits. Consider conducting anonymous surveys asking employees to rank benefit importance and gather feedback on current offerings. We can help design surveys and analyze results to guide your benefits strategy decisions.

Core benefits are typically employer-paid or heavily subsidized programs like health insurance, basic life insurance, and retirement plans. Voluntary benefits are additional options employees can purchase at group rates through payroll deduction, such as supplemental life insurance, critical illness coverage, or legal services. This distinction allows you to provide comprehensive options while controlling costs.

Start with essential benefits like basic health coverage and gradually add programs as your budget allows. Voluntary benefits expand options without employer cost. Wellness programs may reduce long-term healthcare costs. Consider level-funded health plans or association health plans that might offer cost savings. We can help prioritize benefits based on your budget and employee needs.

Many benefits offer tax advantages. Employer contributions to health insurance and retirement plans are typically tax-deductible business expenses. Employees often pay their share of premiums with pre-tax dollars through Section 125 plans. Some benefits like health savings accounts provide triple tax advantages. We recommend consulting with tax professionals about specific implications for your situation.

Benefits can usually extend to remote employees, though some location-specific considerations may apply. Health insurance networks, state tax implications, and local compliance requirements may vary by location. Many benefit platforms handle multi-state administration automatically. We can help design benefits solutions that work across your entire workforce regardless of location.

Employees who miss open enrollment typically cannot make changes until the next enrollment period unless they experience qualifying life events (marriage, birth of child, loss of other coverage, etc.). Some employers allow new hires to enroll outside open enrollment periods. Clear communication about deadlines and consequences helps ensure employees don't miss important opportunities.

Success metrics include employee satisfaction scores, participation rates, recruitment and retention statistics, healthcare cost trends, and wellness program outcomes. Regular surveys and feedback sessions provide insights into program effectiveness. We can help establish benchmarks and tracking systems to measure your benefits program's impact on your organization.

The decision depends on your organization's size, complexity, and internal resources. Outsourcing provides expertise, technology platforms, and reduced administrative burden but involves additional costs. Internal administration offers more control but requires dedicated staff and systems. We can help evaluate the pros and cons based on your specific situation.

Annual reviews are standard, typically coinciding with renewal periods and budget planning. However, significant organizational changes, employee feedback, market shifts, or legislative changes might prompt mid-year evaluations. Regular pulse surveys throughout the year help identify emerging needs or concerns requiring attention.

Take the Next Step for Your Employee Benefits Solutions

Creating comprehensive employee benefits solutions provides competitive advantages for your organization while supporting your team’s diverse needs. Our local team in Queen Creek and San Tan Valley specializes in guiding employers through complete benefits strategy development. We provide:

- Free comprehensive benefits consultations and analysis

- Assistance with benefits package design and vendor selection

- Employee communication and education support

- Year-round benefits administration and customer service

- Local expertise with Arizona benefits regulations and market trends

Don’t navigate employee benefits complexities alone. Contact us today to explore how comprehensive benefits solutions can enhance your organization.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

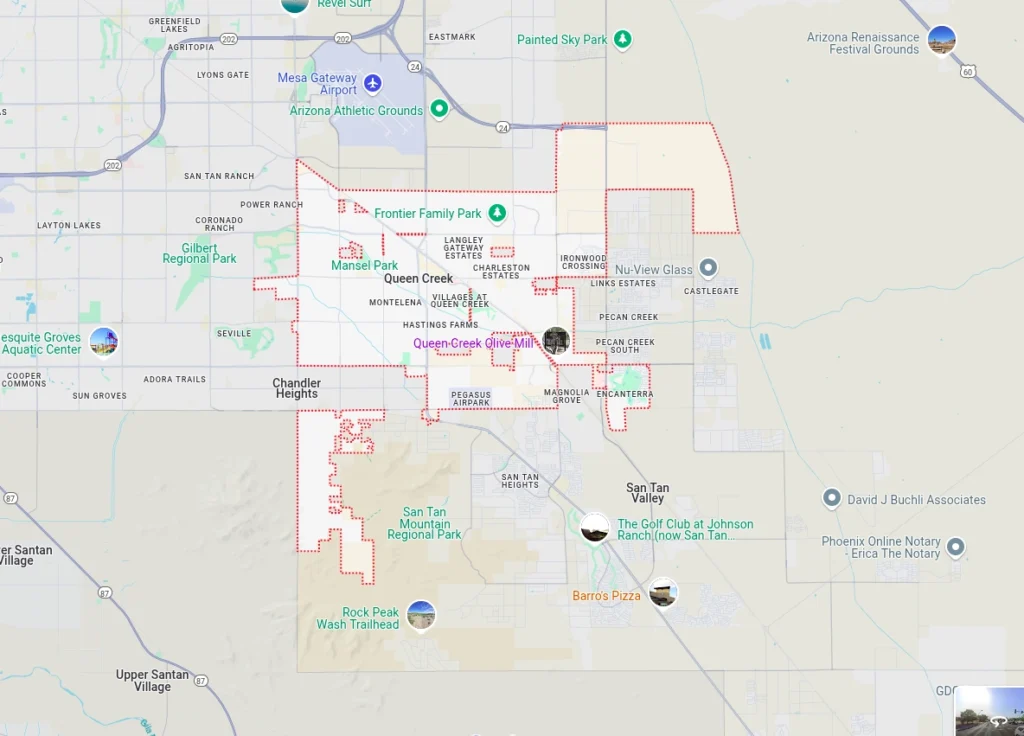

The Health Insurance Jedi proudly serves employers seeking comprehensive employee benefits solutions throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s employee benefits landscape and local vendor networks ensures your organization receives solutions that work for your business and employees. Contact us today to discover how we can help create the perfect employee benefits package for your organization.