More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Business health insurance compliance and tax incentives provide essential guidance for employers navigating complex healthcare regulations while maximizing available tax benefits. Understanding these requirements and opportunities helps businesses protect themselves from potential penalties while leveraging significant tax advantages that can substantially reduce the overall cost of providing employee benefits.

In Queen Creek, San Tan Valley, and throughout Arizona, managing health insurance compliance and optimizing tax incentives requires understanding both federal and state-specific regulations while exploring cost-saving opportunities. Our local expertise helps businesses navigate complex requirements and discover tax strategies that balance legal compliance with financial advantages.

Why Choose Us for Your Business Compliance & Tax Incentive Guidance

Navigating health insurance compliance and tax incentives involves complex regulations, documentation requirements, and strategic planning. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on keeping your business compliant while maximizing available tax benefits.

1. Compliance & Tax Expertise

We understand that health insurance regulations and tax incentives have unique considerations that affect businesses of all sizes. Our team helps you evaluate compliance requirements based on your specific business situation, including ACA obligations, reporting requirements, and potential tax advantages. We explain complex regulations clearly without confusing jargon, ensuring you understand exactly how these rules affect your business operations.

2. Local Business Compliance Knowledge

As supporters of Arizona's business community in Queen Creek and San Tan Valley, we know the local compliance landscape thoroughly. We can guide you through both federal requirements and Arizona-specific regulations, what similar businesses in our area implement, and how to navigate changing rules. This local insight ensures your compliance strategy truly works for your business in our community.

3. Continuous Compliance Support

Our service relationship extends well beyond initial setup. As regulations change and your business evolves, your compliance needs shift too. We provide ongoing support for reporting requirements, penalty avoidance, tax filing considerations, and helping you optimize your benefits strategy throughout the year.

4. Customized Compliance Solutions

Compliance and tax guidance through our agency gives you flexibility to design strategies that fit your specific business structure and goals. Whether you're a small business exploring tax credits, a growing company managing ACA requirements, or a larger employer navigating complex reporting obligations, we help you develop approaches that address your specific compliance needs while maximizing available tax benefits.

5. Streamlined Compliance Process

Our efficient process makes managing health insurance compliance straightforward and business-friendly. We guide you through reporting requirements, help with documentation needs, and ensure you meet deadlines without unnecessary complications that distract from your core business operations.

6. Round-the-Clock Compliance Assistance

Business compliance questions don't follow standard hours, and neither do we. Our support team remains available whenever you need help understanding regulations, addressing reporting questions, or managing urgent compliance matters that affect your business operations.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Health Insurance Compliance for Businesses

Health insurance compliance involves meeting legal requirements related to offering, managing, and reporting on employee health benefits. These regulations vary based on business size, structure, and the types of coverage offered, creating a complex landscape that businesses must navigate.

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Compliance Areas for Businesses

- Affordable Care Act (ACA) requirements: Employer mandate and reporting obligations

- ERISA compliance: Plan documentation and fiduciary responsibilities

- HIPAA regulations: Privacy and security requirements for health information

- COBRA administration: Continuation coverage requirements and notices

- Non-discrimination testing: Ensuring benefits don’t favor highly compensated employees

- Reporting requirements: Annual filings and employee notifications

Business Size and Compliance Requirements

Different requirements apply based on company size:

Small Businesses (Under 50 Full-Time Equivalents)

- Generally exempt from employer mandate penalties

- Simpler reporting requirements

- Potential eligibility for Small Business Health Care Tax Credit

- ERISA compliance if offering health benefits

- COBRA alternatives in some cases

- Focus on maximizing available tax incentives

Applicable Large Employers (50+ Full-Time Equivalents)

- Subject to employer shared responsibility provisions

- Required to offer affordable, minimum value coverage

- Complex annual reporting requirements (Forms 1094-C/1095-C)

- Potential penalty exposure if requirements not met

- More extensive ERISA and HIPAA obligations

- Strategic compliance planning needed

Growing Businesses Near Threshold

- Careful full-time equivalent monitoring

- Transition planning as workforce grows

- Strategic benefit design considerations

- Documentation of compliance methodology

- Look-back measurement methods

- Consideration of controlled group rules

All Business Sizes

- Notice and disclosure requirements

- Fiduciary responsibilities if offering benefits

- HIPAA privacy requirements when handling health information

- Accurate record-keeping and documentation

- Regular compliance reviews and updates

- Integration with tax planning strategies

Tax Incentives for Business Health Coverage

Offering employee health insurance provides significant tax advantages for businesses:

Small Business Healthcare Tax Credit

This valuable incentive helps:

- Small employers afford employee health coverage

- Reduce the net cost of insurance premiums

- Make coverage more affordable for eligible businesses

- Potentially refund a portion of premium contributions

- Provide financial support for initial coverage years

- Make offering benefits financially feasible

General Business Tax Deductions

Standard business tax advantages include:

- Deductibility of employer premium contributions

- Reduction in overall business tax liability

- Business expense treatment for health benefits

- Potential above-the-line deductions

- Recognition as ordinary and necessary business expenses

- Documentation requirements for claiming deductions

Section 125 Cafeteria Plans

These pre-tax arrangements allow:

- Employee premium contributions with pre-tax dollars

- Reduced payroll taxes for both employer and employees

- Flexible spending account establishment

- Healthcare reimbursement arrangements

- Dependent care assistance opportunities

- Premium-only plan options for simplicity

Health Savings Account (HSA) Benefits

HSA-compatible plans offer:

- Employer HSA contribution deductibility

- Reduced payroll taxes on HSA contributions

- Triple tax advantage opportunities

- Long-term employee benefit value

- Potential for accumulated health savings

- Employee appreciation of tax-advantaged benefit

Health Reimbursement Arrangements (HRAs)

Specialized HRA models include:

- Qualified Small Employer HRAs (QSEHRAs)

- Individual Coverage HRAs (ICHRAs)

- Excepted Benefit HRAs (EBHRAs)

- Tax-free reimbursement opportunities

- Employer contribution deductibility

- Flexible design options for different business needs

ACA Compliance Requirements

The Affordable Care Act created specific obligations for employers:

Employer Shared Responsibility Provisions

For applicable large employers:

- Offer coverage to full-time employees and dependents

- Ensure coverage meets affordability requirements

- Provide minimum value coverage

- Understand potential penalty triggers

- Implement compliance tracking systems

- Document good faith compliance efforts

Affordability Determination

Coverage affordability involves:

- Appropriate safe harbor selection

- Documentation of affordability calculations

- Annual adjustment for changing thresholds

- Employee contribution strategies

- Consideration of family coverage affordability

- Strategic plan design for compliance

Minimum Value Requirements

Compliant plans must:

- Cover at least 60% of expected costs

- Provide substantial coverage of physician and hospital services

- Meet actuarial value standards

- Include essential health benefits

- Satisfy minimum essential coverage definitions

- Maintain coverage throughout stability periods

ACA Reporting Requirements

Annual employer obligations include:

- Form 1094-C (Transmittal form to IRS)

- Form 1095-C (Employee statements)

- Accurate coding of offer and coverage information

- Timely distribution to employees

- Proper filing with Internal Revenue Service

- Management of deadline extensions when available

Employer health plans typically include comprehensive benefits while allowing cost customization:

ERISA Compliance for Employers

The Employee Retirement Income Security Act creates fiduciary obligations:

Plan Documentation Requirements

Required materials include:

- Summary Plan Description (SPD)

- Summary of Benefits and Coverage (SBC)

- Plan Document detailing benefits and terms

- Summary of Material Modifications when changes occur

- Summary Annual Report in some cases

- Retention of records for required periods

Fiduciary Responsibilities

Employers must:

- Act solely in the interest of plan participants

- Carry out duties prudently

- Follow plan documents

- Diversify plan investments if applicable

- Pay only reasonable plan expenses

- Avoid prohibited transactions

ERISA Notice Requirements

Required notices include:

- COBRA continuation coverage notices

- Women’s Health and Cancer Rights Act notices

- Newborns’ and Mothers’ Health Protection Act notices

- Mental Health Parity notices

- Medicare Part D notices

- Summary of Material Modifications for plan changes

Compliance Documentation

Best practices include:

- Maintaining current plan documents

- Documenting notice distribution

- Keeping records of employee communications

- Archiving prior year filings and forms

- Recording compliance decisions and methodology

- Creating an ERISA compliance calendar

HIPAA Requirements for Employers

Health Insurance Portability and Accountability Act affects businesses:

Privacy Rule Compliance

Businesses must:

- Limit access to Protected Health Information (PHI)

- Implement appropriate safeguards

- Establish privacy policies and procedures

- Provide employee training on HIPAA requirements

- Designate a privacy official if applicable

- Maintain appropriate documentation

Security Rule Requirements

Electronic safeguards include:

- Administrative safeguards for ePHI

- Physical safeguards for devices containing health information

- Technical safeguards for data protection

- Risk analysis and management

- Security awareness training

- Breach notification procedures

Nondiscrimination Requirements

HIPAA prohibits:

- Discrimination based on health factors

- Charging higher premiums based on health status

- Imposing longer waiting periods based on health

- Denying coverage for pre-existing conditions

- Creating benefit designs that discriminate

- Differential treatment based on health-related factors

Implementing Compliance & Tax Strategies

Successfully managing compliance while maximizing tax benefits requires:

Compliance Assessment and Planning

Effective compliance begins with:

- Evaluating current business size and structure

- Identifying applicable regulations based on size

- Reviewing current health benefit offerings

- Assessing current compliance documentation

- Identifying potential compliance gaps

- Developing strategic compliance roadmaps

Documentation Systems

Maintaining proper records through:

- Systematic record-keeping procedures

- Digital documentation management

- Compliance calendar development

- Employee census management

- Coverage offer tracking

- Annual filing preparation processes

Coordination with Tax Planning

Integrating health benefits with tax strategy:

- Annual tax planning reviews

- Health benefit coordination with business tax returns

- Proper expense categorization and documentation

- HSA and HRA contribution strategies

- Tax credit qualification assessment

- Section 125 plan implementation and documentation

Ongoing Compliance Monitoring

Staying compliant through:

- Regular regulatory update reviews

- Annual compliance cycle management

- Workforce composition monitoring

- Plan document and notice updates

- Employee communication strategies

- Compliance training for key personnel

Managing Compliance Penalties and Risks

Understanding potential penalties helps businesses mitigate risks:

ACA Penalty Avoidance

Strategies include:

- Proactive compliance monitoring

- Appropriate safe harbor utilization

- Careful employment classification

- Full-time employee determination methodology

- Stability period management

- Good faith compliance efforts documentation

ERISA Penalty Mitigation

Reduce risks through:

- Timely distribution of required notices

- Prompt response to participant requests

- Proper claims procedure implementation

- Accurate and complete plan documentation

- Regular fiduciary review procedures

- ERISA compliance audits and corrections

Tax Liability Management

Minimize tax issues by:

- Proper documentation of tax deductions

- Support for business expense classifications

- Appropriate tax credit documentation

- Coordination with tax professionals

- Audit trail maintenance

- Consistent tax position development

Compliance Correction Programs

Available remediation options:

- Voluntary ERISA correction programs

- IRS correction procedures for plan failures

- HIPAA breach notification protocols

- Good faith compliance considerations

- Self-correction opportunities

- Professional guidance for material issues

FAQS

Frequently Asked Questions About Compliance & Tax Incentives

Applicable Large Employer (ALE) status is determined by counting full-time employees plus full-time equivalent part-time employees during the previous calendar year. If the total reaches 50 or more, your business is considered an ALE and subject to employer mandate requirements. This calculation can be complex for businesses with variable hour or seasonal employees, and we can help perform an accurate assessment for your specific situation.

Business health insurance offers multiple tax benefits: employer premium contributions are generally tax-deductible, employee premium contributions through Section 125 plans reduce both employer and employee payroll taxes, small businesses may qualify for the Small Business Health Care Tax Credit, and offering HSA-compatible plans provides additional tax advantages. The specific benefits vary based on business size, structure, and benefit design.

Essential documentation includes plan documents, Summary Plan Descriptions (SPDs), Summary of Benefits and Coverage (SBCs), ERISA-required notices, documentation of coverage offers to employees, affordability calculations, records of employee communications, COBRA notices, HIPAA privacy policies, and annual ACA reporting forms if applicable. Maintaining organized records of these documents is crucial for demonstrating compliance.

Health insurance regulations change frequently through new legislation, regulatory guidance, and court decisions. Key thresholds like affordability percentages typically adjust annually. Tax provisions may change with tax law updates. We recommend quarterly compliance reviews with more comprehensive assessments annually and whenever significant business changes occur to ensure ongoing compliance.

Non-compliance consequences depend on business size and the specific requirements not met. For Applicable Large Employers, potential penalties exist for failing to offer coverage or offering coverage that isn't affordable or doesn't provide minimum value. Additionally, failure to meet reporting requirements can result in separate penalties. Good faith compliance efforts and proper documentation may help mitigate penalty exposure.

Qualification depends on several factors including business size, average employee wages, employer premium contributions, and offering coverage through the Small Business Health Options Program (SHOP) Marketplace. The credit is targeted at smaller employers making initial efforts to provide employee health coverage. We can assess your eligibility and help maximize this valuable tax benefit if available.

Health Reimbursement Arrangements (HRAs) are employer-funded arrangements allowing tax-free reimbursement of qualified medical expenses. Health Savings Accounts (HSAs) are individual accounts paired with high-deductible health plans, allowing contributions from both employers and employees. Both offer tax benefits, but with different funding mechanisms, ownership structures, and compliance requirements. The optimal choice depends on your business goals and employee needs.

Multi-state employers face additional complexity, potentially dealing with different state insurance regulations, coverage requirements, and reporting obligations. You'll need to ensure compliance with both federal requirements and state-specific laws in each state where employees work. We help multi-state employers develop comprehensive compliance strategies that address this complexity while maintaining administrative efficiency.

As a health plan sponsor, you have fiduciary duties to act solely in the interest of plan participants, carry out duties prudently, follow plan documents, and avoid conflicts of interest. These responsibilities include selecting appropriate insurance providers, monitoring plan administration, ensuring proper claim procedures, maintaining required documentation, and providing accurate information to participants. Understanding these duties helps protect both your employees and your business.

Optimization requires a comprehensive review of your current health benefits strategy, business tax situation, and regulatory environment. We recommend coordinating with both benefits and tax professionals to conduct an assessment that identifies potential tax advantages, evaluates current utilization, and recommends strategic adjustments to maximize available incentives while maintaining compliance with applicable regulations.

Take the Next Step for Business Compliance & Tax Incentives

Navigating health insurance compliance while maximizing tax benefits provides essential protection for your business while improving your bottom line. Our local team in Queen Creek and San Tan Valley specializes in guiding businesses through these complex requirements. We provide:

- Free compliance and tax incentive consultations

- Assistance with ACA and ERISA compliance requirements

- Guidance on tax advantage optimization strategies

- Support for reporting and documentation needs

- Local expertise with Arizona business regulations

Don’t risk penalties or miss valuable tax opportunities. Contact us today to explore your compliance and tax incentive options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

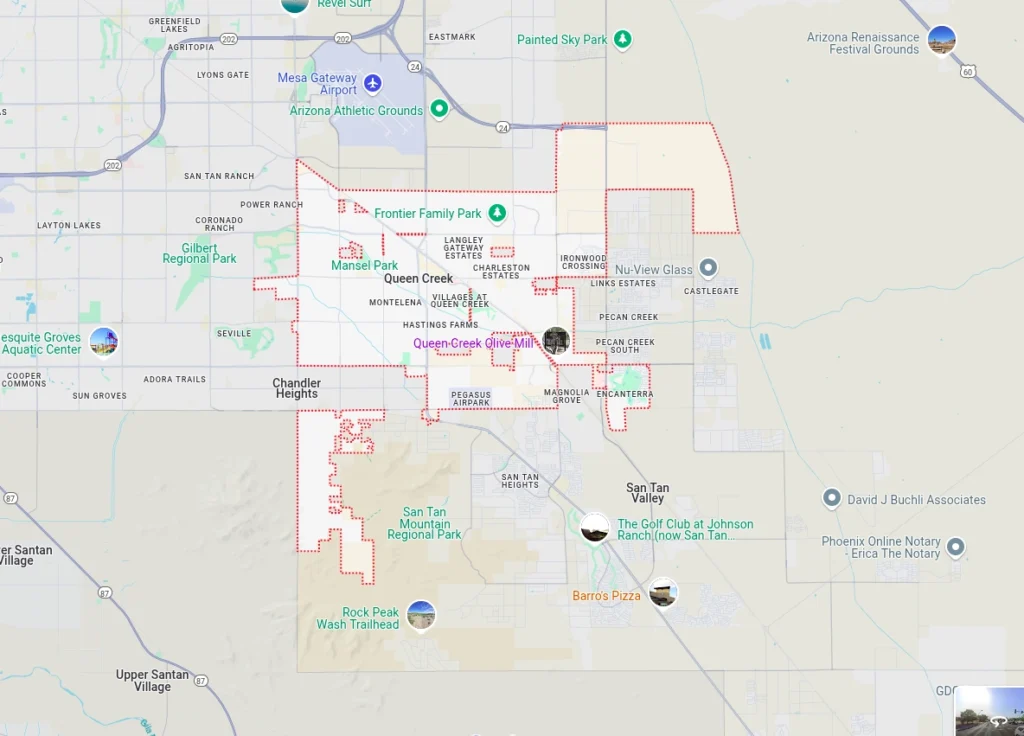

The Health Insurance Jedi proudly serves businesses seeking compliance guidance and tax incentive optimization throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s regulatory landscape for employers ensures your business receives guidance that addresses both compliance requirements and tax opportunities. Contact us today to discover how we can help protect and strengthen your business through effective health insurance compliance and tax strategies.