More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Affordable Marketplace plans provide comprehensive health insurance coverage through the Health Insurance Marketplace, offering quality healthcare options at prices that fit your budget. These plans include essential health benefits, financial assistance opportunities, and protection against high medical costs, ensuring you get the care you need without breaking the bank.

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right affordable Marketplace plan requires understanding your healthcare needs and navigating various coverage options and financial assistance programs. Our local expertise helps individuals and families discover Marketplace coverage that balances quality care with affordability.

Why Choose Us for Your Affordable Marketplace Plans

Selecting the right Marketplace plan involves understanding complex options, financial assistance programs, and enrollment requirements. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on finding you affordable, quality coverage.

1. Marketplace-Focused Guidance

We understand that Marketplace plans have unique features and benefits different from other insurance options. Our team helps you evaluate plans based on your specific needs, including your healthcare requirements, budget constraints, and eligibility for financial assistance. We explain Marketplace options clearly without confusing jargon, ensuring you understand exactly what each plan offers.

2. Local Marketplace Knowledge

As Arizona residents ourselves living in Queen Creek and San Tan Valley, we know the local Marketplace landscape inside and out. We can tell you which plans work well with local healthcare providers, what other community members choose, and how to maximize your benefits in our area. This local insight helps you select coverage that truly works in our community.

3. Continuous Marketplace Support

Our service relationship extends well beyond enrollment. As your life changes, your Marketplace insurance needs may evolve too. We provide ongoing support for life event changes, annual renewals, understanding your benefits, and helping you maximize your Marketplace plan advantages year-round.

4. Customized Affordable Solutions

Marketplace plans through our agency give you the flexibility to select coverage that fits your specific situation. Whether you're looking for basic protection, comprehensive coverage, or something in between, we help you find Marketplace plans that address your healthcare profile and budget requirements.

5. Streamlined Marketplace Enrollment

Our efficient application process reduces confusion and ensures you don't miss important deadlines. We guide you through Marketplace enrollment step-by-step, help you apply for financial assistance, and ensure you get the coverage you need without complications.

6. Round-the-Clock Marketplace Assistance

Questions about your Marketplace plan don't follow business hours. Our support team remains available whenever you need help understanding your coverage, finding in-network providers, or addressing urgent insurance questions about your affordable plan.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Affordable Marketplace Plans

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Marketplace Plans

- Essential health benefits: All plans cover ten essential health benefits required by law

- Financial assistance: Premium tax credits and cost-sharing reductions available for eligible enrollees

- Metal categories: Plans organized into Bronze, Silver, Gold, and Platinum levels for easy comparison

- Guaranteed acceptance: Cannot be denied coverage due to pre-existing conditions

- Network coverage: Access to qualified healthcare providers in your area

- Preventive care: Most preventive services covered at no additional cost

Types of Marketplace Plan Options

Different plan structures offer various advantages for different situations:

Bronze Marketplace Plans

- Lowest monthly premiums available

- Higher deductibles and out-of-pocket costs

- Suitable for healthy individuals wanting catastrophic protection

- Good choice for those primarily concerned with premium costs

- Covers essential health benefits with higher cost-sharing

- Ideal for emergency coverage and basic preventive care

Silver Marketplace Plans

- Moderate monthly premiums and deductibles

- Most popular choice among Marketplace enrollees

- Only plans eligible for extra cost-sharing reductions

- Good balance of affordability and coverage

- Suitable for most individuals and families

- Best value for those qualifying for cost-sharing assistance

Gold Marketplace Plans

- Higher monthly premiums with lower deductibles

- Lower out-of-pocket costs when you need care

- Good for people who use healthcare services regularly

- Provides more predictable healthcare costs

- Suitable for those with ongoing medical needs

- Better value for frequent healthcare users

Platinum Marketplace Plans

- Highest monthly premiums with lowest deductibles

- Lowest out-of-pocket costs when receiving care

- Most comprehensive coverage available

- Ideal for those with significant medical needs

- Provides maximum financial protection

- Best for those wanting minimal cost-sharing

Arizona Marketplace Enrollment

The Arizona Health Insurance Marketplace provides a structured way to shop for and enroll in affordable health coverage.

Marketplace Enrollment Periods

Open Enrollment Period The annual Open Enrollment Period typically runs from November 1 through January 15. During this time, anyone can:

- Enroll in new Marketplace coverage

- Switch between Marketplace plans

- Update existing coverage

- Apply for financial assistance

- Compare plans side-by-side

Coverage typically begins January 1 if you enroll by December 15.

Special Enrollment Periods

You can enroll outside Open Enrollment if you experience qualifying life events:

- Losing other health coverage (job loss, COBRA expiration, aging off parent’s plan)

- Life changes (marriage, divorce, birth, adoption)

- Moving to Queen Creek, San Tan Valley, or a new ZIP code

- Income changes affecting subsidy eligibility

- Gaining citizenship or lawful presence

- Being released from incarceration

You typically have 60 days from the qualifying event to enroll.

Marketplace Plan Categories

Marketplace plans are organized into metal categories that show how costs are shared:

Bronze Plans

- Lower monthly premiums

- Higher annual deductibles

- You pay more when you use healthcare services

- Insurance covers a smaller portion of costs

- Good for healthy individuals wanting basic protection

Silver Plans

- Moderate monthly premiums

- Moderate annual deductibles

- Balanced cost-sharing with insurance

- Eligible for cost-sharing reductions with qualifying income

- Most popular choice for Marketplace enrollees

Gold Plans

- Higher monthly premiums

- Lower annual deductibles

- You pay less when you use healthcare services

- Insurance covers a larger portion of costs

- Good for people who use healthcare regularly

Platinum Plans

- Highest monthly premiums

- Lowest annual deductibles

- You pay the least when you receive care

- Insurance covers the most costs

- Best for those with ongoing medical needs

Understanding Marketplace Plan Costs

Marketplace plans involve several types of costs that affect your overall healthcare expenses:

Monthly Premiums

Your premium is the amount you pay each month to keep your coverage active. Marketplace premiums vary based on:

- Plan type and metal level

- Your age and location

- Tobacco use

- Number of people covered

- Income level (for subsidy calculations)

Deductibles

The deductible is what you pay for covered services before your insurance starts paying. Marketplace plans have varying deductible amounts:

- Bronze plans typically have the highest deductibles

- Silver plans have moderate deductibles

- Gold and Platinum plans have lower deductibles

- Some services are covered before meeting your deductible

Copayments and Coinsurance

After meeting your deductible, you’ll typically share costs with your insurance:

- Copayments are fixed amounts for specific services

- Coinsurance is a percentage of the service cost

- Different services may have different cost-sharing amounts

- In-network providers typically have lower cost-sharing

Out-of-Pocket Maximum

This is the most you’ll pay for covered services in a plan year:

- Once reached, insurance pays for covered services

- Includes deductibles, copayments, and coinsurance

- Protects you from catastrophic medical expenses

- Varies by plan level and individual versus family coverage

Financial Assistance for Marketplace Plans

Many people qualify for financial help that makes Marketplace coverage more affordable.

Financial Assistance for Families

Many families qualify for financial assistance that makes health insurance more affordable.

Premium Tax Credits

These subsidies reduce your monthly premium costs:

- Available based on income relative to federal poverty level

- Can be applied monthly to lower your premium

- Can be claimed when filing your taxes

- Amount depends on income, family size, and plan costs

- Available for plans purchased through the Marketplace

Cost-Sharing Reductions

These reduce your out-of-pocket costs when you receive care:

- Lower deductibles, copayments, and coinsurance

- Available for Silver plans only

- Based on income eligibility

- Automatically applied when you use healthcare services

- Provide additional savings beyond premium tax credits

Income Guidelines for Assistance

Financial assistance is available at various income levels:

- Premium tax credits available for moderate-income individuals and families

- Cost-sharing reductions available for lower-income enrollees

- Guidelines updated annually based on federal poverty level

- Many working individuals and families qualify for assistance

- We can help determine your eligibility during consultation

Advanced Premium Tax Credits

You can choose to receive credits in advance:

- Applied directly to your monthly premium

- Reduces your out-of-pocket premium costs

- Reconciled when you file your annual tax return

- More affordable option for immediate budget relief

- Can be adjusted if your income changes during the year

Essential Health Benefits in Marketplace Plans

All Marketplace plans must cover ten essential health benefits:

- Ambulatory patient services (outpatient care and doctor visits)

- Emergency services (emergency room care and ambulance services)

- Hospitalization (inpatient care and surgery)

- Maternity and newborn care (pregnancy, childbirth, and newborn care)

- Mental health and substance use disorder services (counseling and treatment)

- Prescription drugs (coverage for medications with formularies)

- Rehabilitative services and devices (physical therapy and medical equipment)

- Laboratory services (diagnostic tests and lab work)

- Preventive services and chronic disease management (screenings and wellness care)

- Pediatric services (child healthcare including dental and vision when applicable)

These benefits ensure comprehensive coverage addressing most healthcare needs.

Pre-Existing Conditions Protection

Marketplace plans provide important protections:

- Cannot deny coverage due to pre-existing conditions

- Cannot charge higher premiums based on health status

- Cannot exclude coverage for pre-existing condition treatment

- No waiting periods for coverage of pre-existing conditions

- Coverage begins immediately upon plan effective date

These protections ensure everyone has access to affordable coverage regardless of health history.

Choosing the Right Marketplace Plan

Selecting the appropriate Marketplace plan requires evaluating several factors:

Assess Your Healthcare Needs

- Current health status and medical conditions

- Prescription medications you take regularly

- Doctors and specialists you prefer to see

- Anticipated healthcare needs for the coming year

- Frequency of doctor visits and medical services

- Importance of specific benefits or services

Evaluate Total Costs

Consider both premium and out-of-pocket expenses:

- Monthly premium amounts after any tax credits

- Annual deductible requirements

- Copayments for services you use regularly

- Out-of-pocket maximum limits

- Prescription drug costs under different plans

- Total estimated annual healthcare expenses

Check Provider Networks

Verify your preferred healthcare providers are included:

- Primary care physicians in your area

- Specialists you currently see or might need

- Hospitals and medical facilities you prefer

- Pharmacies convenient to your location

- Mental health providers if needed

- Out-of-network costs if you need providers outside the network

Compare Plan-Specific Benefits

Look beyond basic coverage to understand:

- Prescription drug formularies and costs

- Mental health and substance abuse benefits

- Preventive care coverage details

- Specialty care access and referral requirements

- Telehealth and virtual care options

- Additional services like vision or dental coverage

Using Your Marketplace Plan Effectively

Maximize your Marketplace plan benefits through smart usage:

Preventive Care Benefits

Take advantage of covered preventive services:

- Annual wellness visits and physical exams

- Recommended health screenings and tests

- Immunizations and vaccinations

- Women’s health services including contraceptive coverage

- Chronic disease management services

- Mental health screenings and assessments

Understanding Your Network

Keep costs down by using network providers:

- Maintain current lists of in-network providers

- Verify network status before scheduling appointments

- Understand referral requirements for specialists

- Know your plan’s rules for emergency and urgent care

- Research in-network options when traveling

Managing Prescription Costs

Control medication expenses through:

- Using your plan’s preferred pharmacy network

- Choosing generic drugs when available

- Understanding your plan’s formulary tiers

- Exploring mail-order pharmacy options

- Reviewing prescription coverage during plan selection

- Asking about patient assistance programs

Appropriate Care Settings

Choose the right setting for your healthcare needs:

- Primary care for routine health maintenance

- Urgent care for immediate non-emergency needs

- Emergency room for serious, life-threatening situations

- Telehealth for minor concerns and follow-up care

- Specialists for complex or ongoing conditions

Marketplace Plan Renewal and Changes

Keep your coverage current and optimized:

Annual Renewal Process

- Review your plan’s performance each year

- Compare renewed coverage with other available options

- Update income information for accurate subsidies

- Make changes during Open Enrollment if desired

- Ensure your plan still meets your needs

Life Event Changes

Update your coverage when life changes:

- Report income changes that affect subsidies

- Add or remove family members as appropriate

- Change plans if you move to a new area

- Update contact and payment information

- Notify the Marketplace of qualifying life events

Plan Optimization

Regularly evaluate your coverage:

- Track your healthcare usage and costs

- Compare actual costs with plan estimates

- Consider switching plans if needs change

- Review provider networks for continued access

- Assess satisfaction with current coverage

FAQS

Frequently Asked Questions About Marketplace Plans

Most U.S. citizens and legal residents are eligible for Marketplace coverage. You cannot have access to affordable employer-sponsored insurance or qualify for government programs like Medicare or Medicaid. Age, health status, and pre-existing conditions do not affect eligibility. We can help determine your eligibility and best coverage options.

Financial assistance depends on your household income relative to the federal poverty level. Many working individuals and families qualify for premium tax credits, and those with lower incomes may also receive cost-sharing reductions. The exact income limits change annually, and eligibility varies by household size. We can help calculate your potential assistance.

You should report significant income changes to the Marketplace as they occur. Income increases might reduce your subsidies, while decreases could increase them. Failing to report changes could result in having to repay advance premium tax credits at tax time. We can help you understand the implications of income changes.

Like other insurance plans, Marketplace plans have provider networks. You'll typically pay less when using in-network providers and more for out-of-network care. Some plans don't cover out-of-network care except in emergencies. Always verify your preferred providers are in-network before enrolling.

All Marketplace plans cover specialist care, though the process varies by plan type. HMO plans typically require referrals from your primary care physician, while PPO plans allow direct access to specialists. EPO plans fall somewhere in between. Specialist visits are subject to your plan's deductibles and cost-sharing rules.

All Marketplace plans include prescription drug coverage, but specific medications and costs vary by plan. Each plan has a formulary (list of covered drugs) organized into tiers with different costs. Generic drugs are typically least expensive, while brand-name and specialty drugs cost more. We can help compare prescription coverage across plans.

If you miss Open Enrollment and don't qualify for a Special Enrollment Period, you'll typically have to wait until the next Open Enrollment to get coverage. This could leave you uninsured for months. Some limited options like short-term health insurance might be available, but these don't provide the same protections as Marketplace plans.

If you move within the same state, you can typically keep your plan if it's available in your new area. If you move to a different state or your plan isn't available in your new location, you'll qualify for a Special Enrollment Period to select new coverage. Moving is a qualifying life event allowing plan changes.

Marketplace plans must cover essential health benefits and cannot deny coverage for pre-existing conditions. Employer plans may offer different benefits or network options. The "best" choice depends on costs, coverage, provider networks, and your specific needs. We can help compare your options if you have access to both.

Marketplace plans provide customer service through both the insurance company and the Marketplace itself. You can get help with coverage questions, finding providers, understanding benefits, and resolving issues. As your local broker, we also provide ongoing support to help you navigate any problems or questions.

Take the Next Step for Your Affordable Marketplace Plan

Finding the right affordable Marketplace plan provides comprehensive healthcare coverage while protecting your budget. Our local team in Queen Creek and San Tan Valley specializes in guiding individuals and families through Marketplace options. We provide:

- Free Marketplace plan consultations and comparisons

- Assistance with financial assistance applications

- Enrollment support and deadline management

- Year-round customer service for Marketplace questions

- Local expertise with Arizona providers and networks

Don’t navigate the Marketplace alone. Contact us today to explore your affordable coverage options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

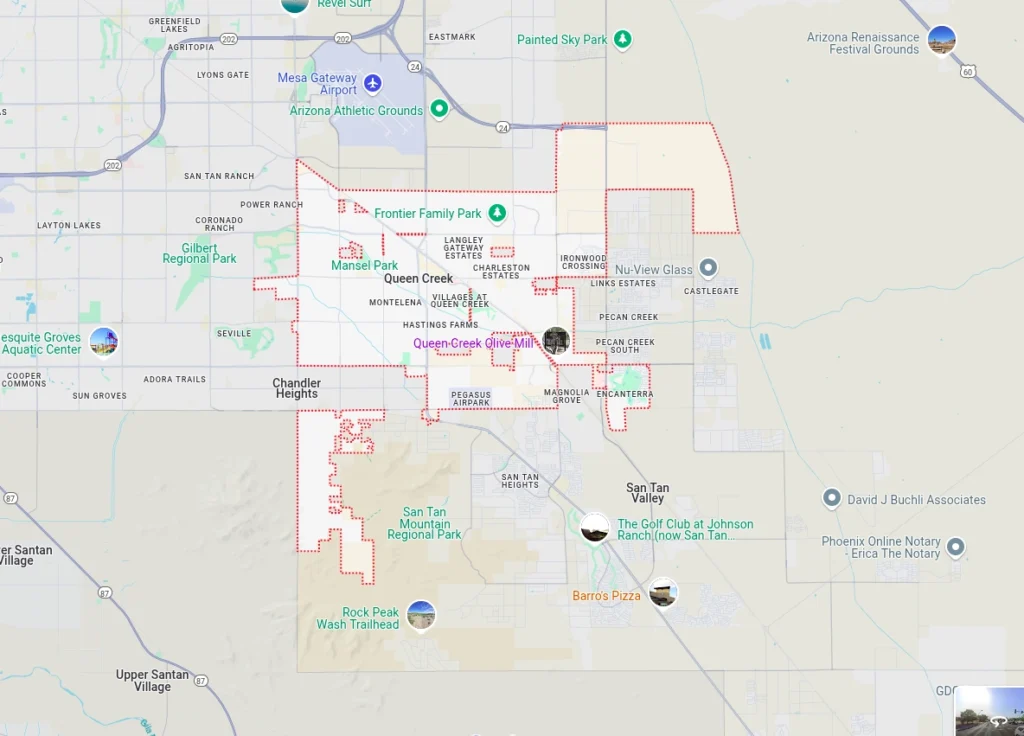

The Health Insurance Jedi proudly serves individuals and families seeking affordable Marketplace plans throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s Marketplace landscape and local provider networks ensures you receive coverage that works in your community. Contact us today to discover how we can help protect your health with affordable Marketplace coverage.