More Information

Reach out for expert insurance support and personalized solutions.

Call Us!

855-822-5334

Our Location

Get Your Free Quote

Find affordable coverage tailored to your needs. See how much you could save today!

Affordable employer health plans provide comprehensive healthcare coverage for your employees while controlling costs for your business. These tailored plans offer essential benefits that help attract and retain talent, improve workplace productivity, and provide tax advantages while protecting your team’s health and financial wellbeing.

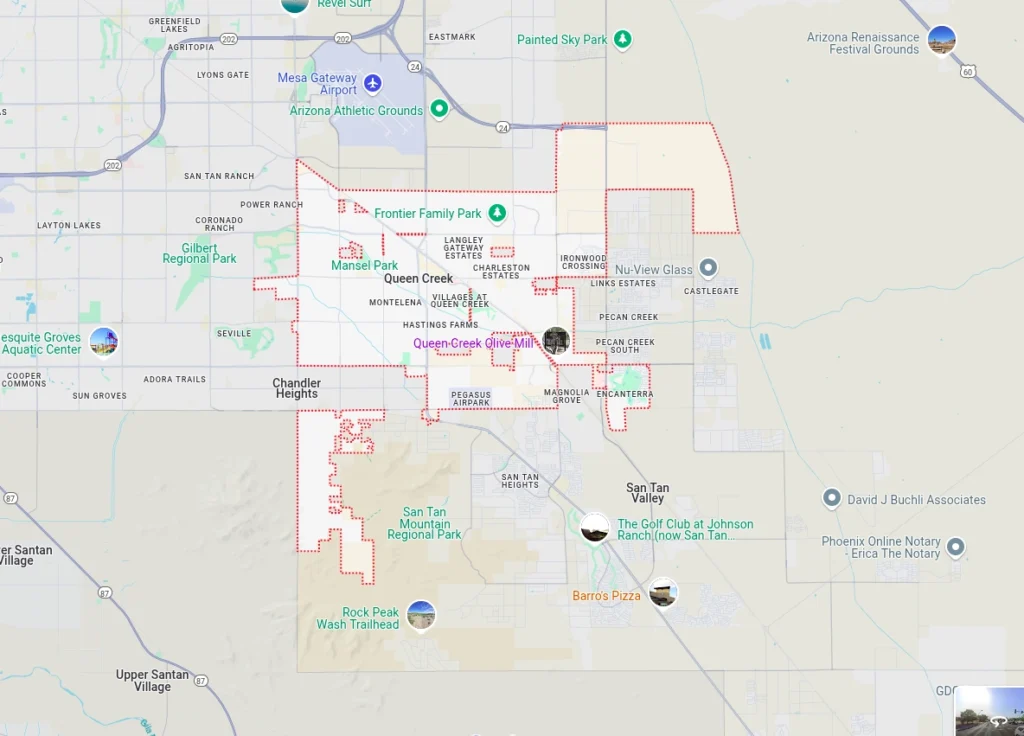

In Queen Creek, San Tan Valley, and throughout Arizona, finding the right affordable employer health plan requires understanding your business needs and workforce demographics while exploring cost-effective coverage options. Our local expertise helps businesses discover employer health coverage that balances quality benefits with budget constraints while meeting compliance requirements.

Why Choose Us for Your Affordable Employer Health Plans

Selecting the right employer health coverage involves navigating complex benefit structures, contribution strategies, and compliance requirements. Our Health Insurance Jedi team in Queen Creek and San Tan Valley simplifies this process with expert guidance and personalized service focused on creating affordable health benefits that work for your business.

1. Employer Health Plan Expertise

We understand that employer health insurance has unique considerations different from individual coverage. Our team helps you evaluate plans based on your business needs, including workforce size, industry requirements, and budget constraints. We explain employer coverage options clearly without confusing jargon, ensuring you understand exactly what each plan offers your business and employees.

2. Local Business Insurance Knowledge

As Arizona business supporters ourselves living in Queen Creek and San Tan Valley, we know the local employer health insurance landscape thoroughly. We can tell you which carriers offer the most cost-effective options for businesses in our area, which plans similar companies choose, and how to navigate Arizona-specific regulations. This local insight ensures your employee benefits truly work in our community.

3. Continuous Employer Support

Our service relationship extends well beyond initial enrollment. As your business grows and changes, your health insurance needs evolve too. We provide ongoing support for employee additions and changes, annual renewals, claims issues, and helping you optimize your benefits package throughout the year.

4. Customized Affordable Solutions

Employer health insurance through our agency gives you flexibility to design coverage that fits your business budget and employee needs. Whether you're a small startup offering coverage for the first time or an established company looking to reduce costs, we help you find affordable plans that address your specific business requirements.

5. Streamlined Employer Enrollment

Our efficient application and enrollment process reduces administrative burden for your HR team. We handle the technical details while ensuring your employees receive clear information about their benefits, making the entire experience smooth and professional.

6. Round-the-Clock Employer Assistance

Business health insurance questions don't follow office hours. Our support team remains available whenever you need help understanding coverage changes, addressing employee benefits questions, or managing urgent insurance matters.

Fast & Easy Process

Our streamlined application process minimizes paperwork and confusion. We handle the technical details while keeping you informed at every step, ensuring quick policy setup without unnecessary delays.

24/7 Supports

Access our support team whenever you need assistance. Whether you have questions about coverage, need help with claims, or want to understand your benefits better, we're here to help around the clock.

Understanding Affordable Employer Health Plans

Affordable employer health plans are group insurance policies that provide healthcare coverage for employees while managing costs through group purchasing power. These plans offer comprehensive benefits while leveraging tax advantages and cost-control strategies to make quality coverage accessible for businesses of all sizes.

- Affordable Plans

- Local Expertise

- Personal Guidance

Key Features of Affordable Employer Plans

- Group purchasing power: Lower rates through collective risk pools

- Tax advantages: Potential deductions for premium contributions

- Contribution flexibility: Various employer contribution options

- Plan design choices: Multiple coverage levels and structures

- Administrative support: Enrollment and benefits management

- Compliance guidance: ACA and other regulatory requirements

Types of Affordable Employer Plan Options

Different plan structures offer various cost-saving advantages:

Traditional Group Health Insurance

- Fully-insured arrangements with predictable premiums

- Carrier assumes all claims risk

- Multiple plan options for employee choice

- Standard provider networks and benefit designs

- Simplified administration and compliance

- Good choice for most small to mid-sized businesses

Level-Funded Health Plans

- Hybrid approach combining self-funding benefits with predictable costs

- Monthly payments similar to traditional insurance

- Potential for premium refunds when claims are low

- Detailed claims reporting for cost management

- Lower costs for younger, healthier groups

- Ideal for small businesses seeking cost control

ICHRA (Individual Coverage Health Reimbursement Arrangement)

- Tax-free reimbursement for individual health insurance

- Flexible benefit amounts for different employee classes

- Employees choose their own Marketplace or private plans

- Predictable costs for employers

- Less administrative complexity than traditional group plans

- Suitable for businesses wanting maximum flexibility

Small Group Health Options Program (SHOP)

- Marketplace-based coverage for small employers

- Potential tax credits for eligible small businesses

- Multiple plan options and employee choice models

- Standardized benefits and coverage levels

- Competitive pricing through marketplace structure

- Good fit for very small employers seeking affordability

Arizona Employer Health Insurance Market

Arizona offers diverse employer health insurance options with specific requirements and opportunities.

Plan Availability and Requirements

Group Size Considerations Employer coverage options vary by:

- Number of eligible employees

- Full-time equivalent calculations

- Owner and family participation rules

- Participation rate requirements

- Contribution minimums from employers

- Industry classification and rating factors

Enrollment Periods Employer plans typically offer:

- Initial enrollment upon plan establishment

- Annual open enrollment for plan changes

- Special enrollment for new hires

- Qualifying life events for mid-year changes

- Anniversary date renewals

- Limited need for waiting on marketplace periods

Cost-Control Strategies

Contribution Approaches Employers can manage costs through:

- Percentage-based premium contributions

- Fixed dollar amount contributions

- Tiered contributions for different coverage levels

- Defined contribution models

- Employee incentives for plan selection

- Wellness program integration

Plan Design Optimization Cost-effective plan design includes:

- Appropriate deductible and copay structures

- Network optimization for local providers

- Prescription drug management programs

- Preventive care emphasis

- Telehealth and virtual care integration

- Value-based benefit designs

Understanding Employer Health Plan Costs

Affordable employer health plans involve strategic cost structures that benefit both businesses and employees:

Premium Cost Factors

Employer plan premiums depend on:

- Group size and employee demographics

- Industry classification and risk factors

- Geographic location and provider networks

- Plan design and covered benefits

- Employer contribution strategy

- Claims history for larger groups

Employer Contribution Options

Businesses have flexibility in premium sharing:

- Traditional percentage-based contributions

- Fixed dollar amount contributions

- Tiered contributions by employee class

- Defined contribution approaches

- Employee wellness incentives

- Premium-only cafeteria plans

Tax Advantages

Employer plans offer significant tax benefits:

- Business tax deduction for premium contributions

- Reduced payroll taxes through Section 125 plans

- Tax-free benefit for employees

- HSA integration for additional tax savings

- Potential small business healthcare tax credits

- Business expense write-offs

Long-Term Cost Management

Sustainable cost control includes:

- Multi-year rate guarantees

- Level-funding with potential refunds

- Wellness program integration

- Employee education and engagement

- Strategic plan design adjustments

- Alternative funding approaches

Affordable Plan Benefits and Coverage

Employer health plans typically include comprehensive benefits while allowing cost customization:

Core Medical Benefits

Most employer plans cover:

- Preventive care services at no cost

- Doctor visits and specialist care

- Hospital admissions and surgical procedures

- Emergency and urgent care services

- Prescription drug coverage

- Mental health and substance abuse treatment

Supplemental Coverage Options

Enhance affordability through:

- Dental and vision coverage add-ons

- Life and disability insurance

- Accident and critical illness protection

- Hospital indemnity plans

- Employee assistance programs

- Wellness program integration

Tailored Plan Designs

Cost-effective customization includes:

- High-deductible options with HSA compatibility

- Multiple plan choices for diverse workforces

- Narrow network options for premium savings

- Reference-based pricing models

- Value formularies for prescription savings

- Virtual care integration for convenience

Employee Cost-Sharing Options

Balance affordability through:

- Appropriate deductible levels

- Copayment and coinsurance structures

- Out-of-pocket maximum protection

- Premium sharing through payroll deduction

- Health Savings Account contributions

- Flexible Spending Account options

Choosing the Right Affordable Employer Plan

Selecting appropriate employer health insurance requires evaluating your business needs and workforce demographics:

Assess Your Business Needs

Consider your organizational priorities:

- Overall benefits budget

- Contribution strategy preferences

- Administrative capacity and resources

- Industry standards and competitors

- Employee recruitment and retention goals

- Long-term growth projections

Evaluate Your Workforce

Understand employee demographics:

- Age distribution and health profiles

- Family coverage requirements

- Income levels and affordability concerns

- Geographic distribution

- Provider preferences and relationships

- Medical and prescription utilization patterns

Compare Plan Structures

Evaluate different approaches:

- Traditional fully-insured group plans

- Level-funded or self-funded options

- Health reimbursement arrangements

- Multiple carrier options

- Different network types

- Prescription drug program variations

Consider Alternative Approaches

Explore innovative solutions:

- Professional Employer Organization (PEO) options

- Association Health Plans where available

- Direct primary care integration

- Reference-based pricing models

- Digital health and telemedicine emphasis

- Integrated wellness approaches

Implementing Affordable Employer Health Plans

Successfully launching employer health coverage requires careful planning and execution:

Initial Setup Process

Establishing new coverage includes:

- Carrier selection and plan design finalization

- Employer contribution strategy documentation

- Section 125 plan establishment

- Employee census gathering and submission

- Initial employee education sessions

- Enrollment period planning and execution

Employee Communication

Effective benefit communication involves:

- Clear explanation of plan options and costs

- Educational materials and resources

- Group meetings and individual consultations

- Online enrollment tools and support

- Benefit summaries and highlight documents

- Ongoing communication strategies

Administrative Setup

Plan administration requires:

- Payroll system integration for premium deductions

- Eligibility tracking systems

- New hire and termination procedures

- COBRA administration arrangements

- Claims resolution processes

- Provider directory access

Compliance Documentation

Required documentation includes:

- Summary Plan Descriptions (SPDs)

- Summary of Benefits and Coverage (SBCs)

- Required notices and disclosures

- ERISA and ACA compliance documentation

- Annual reporting requirements

- Record keeping systems

ACA Compliance for Employers

Affordable Care Act requirements affect employer health coverage decisions:

Applicable Large Employer Requirements

Employers with 50+ full-time equivalents must:

- Offer minimum essential coverage to full-time employees

- Ensure coverage is affordable based on employee income

- Provide minimum value coverage

- Complete annual reporting requirements

- Understand potential penalty implications

- Monitor full-time equivalent calculations

Small Employer Considerations

Businesses with fewer than 50 full-time equivalents should:

- Understand exemptions from employer mandate

- Explore potential tax credit eligibility

- Consider SHOP Marketplace options

- Review ACA benefit and rating requirements

- Understand community rating implications

- Evaluate alternative coverage approaches

Required Reporting

Employer reporting includes:

- Forms 1094-C and 1095-C for applicable large employers

- Employee coverage documentation

- Affordability safe harbor documentation

- Full-time employee determination records

- Variable hour employee tracking

- Measurement period documentation

Maximizing Employer Plan Value

Get the most from your affordable employer health coverage:

Employee Education and Engagement

Maximize plan value through:

- Comprehensive benefits orientation

- Regular educational sessions

- Understanding of preventive care benefits

- HSA or FSA utilization support

- Provider network optimization

- Prescription drug program guidance

Wellness Integration

Enhance health outcomes with:

- Preventive care incentives

- Biometric screening programs

- Health risk assessments

- Wellness challenges and activities

- Mental health and stress management resources

- Disease management programs

Technology Utilization

Leverage available tools:

- Online enrollment platforms

- Benefits administration systems

- Employee self-service portals

- Mobile benefits applications

- Telehealth platforms and services

- Digital decision support tools

Annual Plan Optimization

Regularly evaluate and adjust:

- Utilization and claims analysis

- Employee satisfaction assessment

- Market comparison and benchmarking

- Plan design refinement

- Contribution strategy adjustments

- Alternative funding evaluation

FAQS

Frequently Asked Questions About Affordable Employer Health Plans

Most carriers require at least one W-2 employee who isn't the owner or owner's spouse to qualify for group coverage. Some carriers have higher minimum requirements. Participation requirements typically range from 50-75% of eligible employees, but this varies by carrier and state regulations.

Fully-insured plans involve paying premiums to an insurance carrier that assumes all risk for claims. Level-funded plans combine self-funding with stop-loss protection, offering monthly payments like traditional insurance but with the potential for premium refunds if claims are lower than expected. Level-funding can offer cost savings for healthier groups.

While there's no legal minimum contribution requirement, most carriers require employers to contribute a percentage of employee premiums (typically 50%). Contribution strategies vary widely from minimal contributions to full premium coverage. We help design contribution approaches that balance affordability with employee value.

Yes, employers can create distinct classes of employees based on non-discriminatory criteria like full-time/part-time status, geographic location, or job category. Benefits can vary between classes as long as the distinctions follow permitted guidelines and comply with non-discrimination requirements.

If you don't meet carrier participation requirements, you might face limited enrollment opportunities, higher premiums, or potential plan cancellation. Most carriers offer exceptions during annual guaranteed issue periods. We help develop strategies to maximize participation through appropriate plan design and contribution approaches.

The ACA employer mandate only applies to businesses with 50 or more full-time equivalent employees. Smaller businesses are not required to offer coverage but may benefit from doing so through tax advantages, employee recruitment and retention, and potential tax credits for eligible small employers.

Employees with other qualifying coverage (like through a spouse's plan or Medicare) can waive your group coverage. These employees typically don't count against your participation requirements if they provide proof of other coverage. Clear waiver documentation should be maintained.

Employer premium contributions are generally tax-deductible business expenses. Employee contributions can be made pre-tax through Section 125 plans, reducing both employer and employee payroll taxes. Additional tax advantages include potential small business tax credits and reduced overall tax liability.

Most employers can change plans annually at renewal. Mid-year changes are possible in certain circumstances, such as significant business changes or carrier/plan terminations. We help evaluate whether your current plan remains competitive and appropriate at each renewal cycle.

This depends on your workforce size, diversity, and needs. Multiple plans provide choice but add complexity. Single plans simplify administration but may not meet all employee needs. We help design the optimal approach based on your specific workforce demographics and business objectives.

Take the Next Step for Your Affordable Employer Health Plan

Finding the right affordable employer health plan provides essential benefits for your employees while supporting your business objectives. Our local team in Queen Creek and San Tan Valley specializes in guiding employers through health insurance options. We provide:

- Free employer health plan consultations and comparisons

- Assistance with contribution strategy development

- Employee education and enrollment support

- Year-round employer insurance customer service

- Local expertise with Arizona group health regulations

Don’t let healthcare costs limit your ability to provide quality benefits. Contact us today to explore your affordable employer health plan options.

Call us at ☎️ +1 (855) 822-5334 or schedule a free consultation online.

Proudly Assisting

Our Service Area

The Health Insurance Jedi proudly serves businesses seeking affordable employer health plans throughout:

- Queen Creek

- San Tan Valley

- Gilbert

- Chandler

- Apache Junction

- Florence

- Mesa

Our deep knowledge of Arizona’s employer health insurance landscape and local business community ensures your organization receives coverage that works for your business and employees. Contact us today to discover how we can help protect your team with affordable employer health insurance.